Do Kwon became one of the most discussed figures in the cryptocurrency industry following the collapse of his Terra project in 2022. Terraform Labs, founded by Kwon, built one of the largest ecosystems in DeFi, but due to flaws in the design of the TerraUSD (UST) stablecoin and its associated Luna token, the company caused significant financial losses for investors. This incident raised questions about the stability of algorithmic stablecoins and led to investigations by governments and regulators.

Content:

- Career and the Creation of Terraform Labs

- Terra's Problems and the Collapse of the Ecosystem

- Investigations and Legal Cases

- Impact on the Cryptocurrency Industry

- Conclusion

Career and the Creation of Terraform Labs

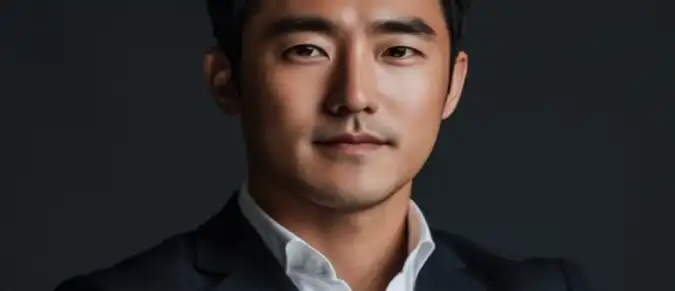

Do Kwon was born in South Korea and pursued his education at Stanford University, where he studied computer science. His first major project, Anyfi, focused on distributed internet technology. However, the most significant milestone in his career came in 2018, when he co-founded Terraform Labs with Daniel Shin. Terraform Labs aimed to create stable digital currencies and decentralized finance (DeFi) applications, becoming a key component of the Terra ecosystem.

Terra became one of the largest ecosystems in the DeFi space, with its stablecoin TerraUSD (UST) being a vital element. UST was designed as an algorithmic stablecoin that aimed to maintain parity with the U.S. dollar without traditional asset backing. The core feature of this solution was its connection to Terra's native token, Luna, which acted as a price stabilizer for UST.

From 2020 to 2021, the project gained immense popularity, with the value of Terra and Luna tokens increasing significantly. Do Kwon emerged as a key figure in the cryptocurrency industry, with his company attracting attention from leading investors and users worldwide.

Terra’s Problems and Ecosystem Collapse

The collapse of the Terra ecosystem was one of the largest incidents in cryptocurrency history. In May 2022, UST lost its peg to the U.S. dollar, leading to a rapid devaluation of the stablecoin. This caused widespread panic among investors, who began selling off their Terra and Luna holdings. As a result, the value of these tokens plummeted nearly to zero, causing significant financial losses for many investors.

The core issue with UST was the instability of its algorithmic model. When the demand for Luna surged, the stabilization mechanism failed to maintain UST's price at one dollar. The model, which relied on supply and demand, proved inadequate in handling the scale of market fluctuations, leading to a domino effect.

Key consequences of the Terra ecosystem’s collapse include:

- Devaluation of Terra and Luna tokens to near-zero levels.

- Loss of trust in algorithmic stablecoins and their sustainability.

- Initiation of investigations into Do Kwon and Terraform Labs by financial regulators.

Investigations and Legal Actions

Following Terra's collapse, Do Kwon and his company faced multiple investigations and legal actions. South Korean authorities launched an investigation into the activities of Terraform Labs and Do Kwon himself, probing whether the collapse was caused by intentional actions or negligence.

In September 2022, an arrest warrant was issued for Do Kwon, accusing him of violating South Korea’s financial laws. Prosecutors alleged that his actions related to the creation and promotion of UST and Luna might have breached securities regulations. As a result, Kwon was placed on the international wanted list, as his whereabouts were unknown for several months.

Do Kwon's legal troubles extend beyond South Korea. Several investors filed class-action lawsuits against Terraform Labs in the U.S., accusing the company of misconduct and misleading claims about UST’s stability. These lawsuits are part of broader efforts to strengthen regulation around stablecoins and their impact on the cryptocurrency market.

Impact on the Cryptocurrency Industry

The collapse of Terra and the legal proceedings against Do Kwon have led to significant shifts in how the cryptocurrency industry and stablecoins are perceived. Following the incident, many regulators began tightening oversight of decentralized projects, while stablecoins became a focal point for financial authorities.

Key impacts in the aftermath:

| Impact | Description |

|---|---|

| Loss of trust in stablecoins | Many investors lost confidence in algorithmic stablecoins due to their instability. |

| Increased regulation | Regulators began drafting new laws to govern the stablecoin and broader cryptocurrency markets. |

| Cryptocurrency market decline | After Terra's collapse, the cryptocurrency market saw a significant downturn, with many projects coming under pressure. |

Terra’s collapse also highlighted the need to reassess risk management mechanisms in DeFi. Many projects have since begun exploring new ways to ensure the stability of their stablecoins. Initiatives for asset-backed stablecoins have emerged, minimizing the risk of value loss.

Conclusion

The story of Do Kwon and Terraform Labs is a striking example of both the highs and lows in the world of cryptocurrency. Terra, once one of the most ambitious projects in the DeFi ecosystem, resulted in widespread losses and sparked discussions around the regulation and improvement of stablecoins. This case underscores the risks associated with new technologies and the need for a thorough evaluation of the sustainability of algorithmic solutions. Do Kwon remains a central figure in the global cryptocurrency industry, and his future moves will be closely monitored.