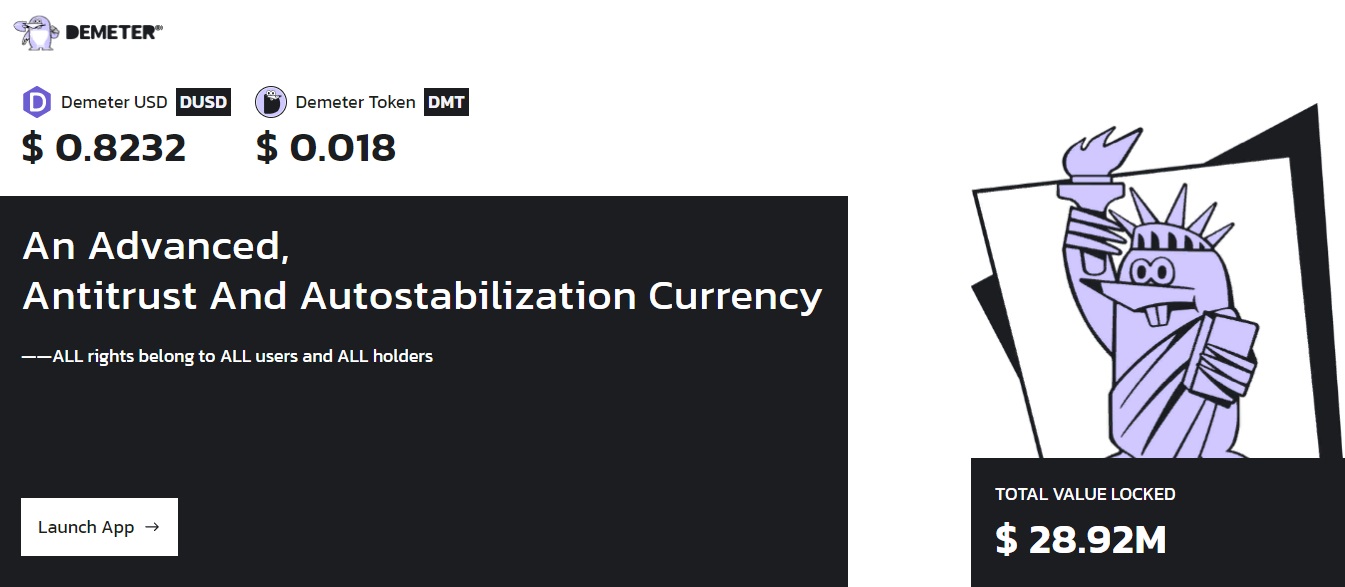

Demeter — a multi-chain decentralized foreign exchange market protocol. By combining lending and secured stablecoin generation, Demeter provides users with a more reliable DUSD stablecoin and safer lending services at a low cost.

About the decentralized Demeter project

Demeter uses a dual token system: the first - DMT, the governance token, and the second - decentralized stablecoin DUSD. By creating a DAO revenue pool and a DAO treasury, DMT holders can participate in platform governance and share their profits as the platform evolves. The decentralized collateralized lending system works seamlessly by supporting multi-asset lending (BTC / ETH / USDT / LP assets, etc.) and generating DUSD through collateral.

This crypto project has brought significant innovations to optimize the interest rate model as well as the collateral ratio in the DeFi loan agreement. In particular, Demeter has created a new credit rating model (DCRM). Based on this model, Demeter presents a wider range of types of crypto assets such as LP assets, collateralized assets, NFT-fi assets, etc. This ensures a high degree of interoperability of lending models between assets, while providing security and maximum user experience with control over interest rates and volume.

DMT - a minable protocol control token that is used for the following purposes:

| 1 | Participate in the management vote. |

| 2 | Participate in the distribution of rewards from the DAO revenue pool. |

| 3 | Participate in the distribution of the DAO treasury. |

Demeter borrowing and minting stablecoins take place at the expense of over-collateralization. Borrowers deposit cryptocurrency or synthetic assets with Demeter and each asset has a collateral ratio, which is the ratio of loan to value. Users can obtain a "line of credit" by providing these assets. If the borrower's available credit limit falls below zero, his collateral will be liquidated to pay off the debt.

More about the dapp site

TRFM (Target Rate Feedback Mechanism) will be used by Demeter to maintain the target price. When the DUSD price falls below $ 1, the collateral ratio for the CDP (Collateralized Debt Position) decreases. DUSD will be provided at a dynamic interest rate with an annual excess reserve rate, corresponding to the stability fee, with the inflationary share, going entirely to the DAO revenue pool and DAO treasury without any subjective malicious increase.

In addition, Demeter has created a mechanism for the overcollateralization rate, where a certain percentage (0% -100%) of the surplus collateral income, along with a portion of the governance tokens, will go to the DAO treasury. In this way, ensuring that the actual annual over-provisioning rate is in a manageable state.

You can get more information about the project through the introductory document. It contains the necessary data for work. From social networks, the community leads:

There are already over 40,000 participants. Subscribe to find out about the news. The smart contract audit is available here.