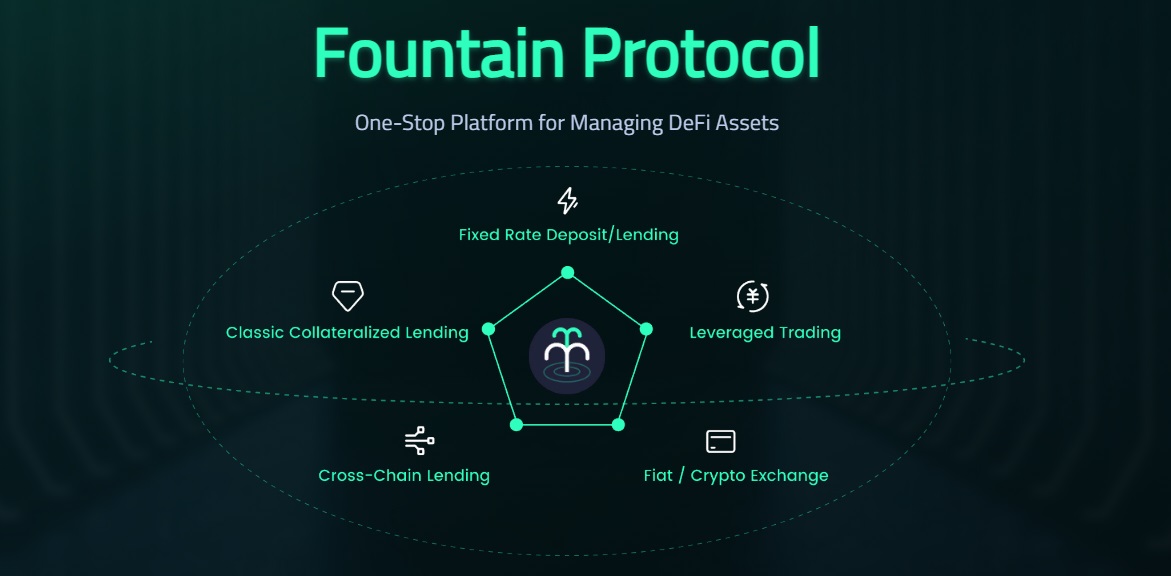

Fountain Protocol — the first cross-chain lending platform, powered by Oasis. The protocol allows users to get highly efficient DeFi asset management from a single source. Taking advantage of the extremely efficient and low-cost Oasis network, Fountain Protocol establishes a multi-profile protocol with a pool of funds as the core and multiple application scenarios.

About Fountain Protocol

Fountain Protocol implements multi-chain deployment to keep up with the global deployment trend. Since the high fees of Ethereum have been an obstacle to the future development of the blockchain, many high-performance public chains have emerged, these public chains have become an important underlying infrastructure for the blockchain world. As a lending protocol, Fountain Protocol can be used as a vehicle for long and short positions. Through the act of delivering, borrowing and selling assets, using the FountainProtocol, clients have access to an easily managed, capital-efficient and decentralized means for long and short cryptocurrencies.

The user contributes their preferred asset, accepted by the protocol. Users will be able to earn interest, based on market demand, for assets to borrow.

To provide a token to the Fountain protocol, all the user needs to do is:

| 1. | Click on the MARKETS tab in the menu and click "SUPPLY". Select an asset type from the drop-down menu in the SUPPLY panel. |

| 2. | Enter the amount of the token to be granted or click Max to deposit the entire wallet balance of that token. |

| 3. | Click the "Submit" button to initiate a transaction and deposit tokens. |

| 4. | After confirming the transaction, the deposit is successfully registered and begins to earn interest. |

| 5. | When providing a Fountain Protocol asset, users will receive fTokens in return. These tokens are percentage versions of the underlying asset. |

User deposits provide pools of liquidity, available on the platform to borrowers, as well as the ability to act as collateral. Users who have provided collateral assets can borrow tokens of their choice, but interest is charged that must be paid to release the total provided balance.

More about defi app

A user's borrowing limit - an expression of the value of the assets they can borrow, based on the value of the assets they have provided and the combined values of credit to the value of those assets. Once this borrowing limit is reached, the liquidity of the account reaches zero. If the value of user collateral falls even further, or if they fail to keep up with the interest, accrued on their loan balances, then their collateral will become vulnerable to liquidation.