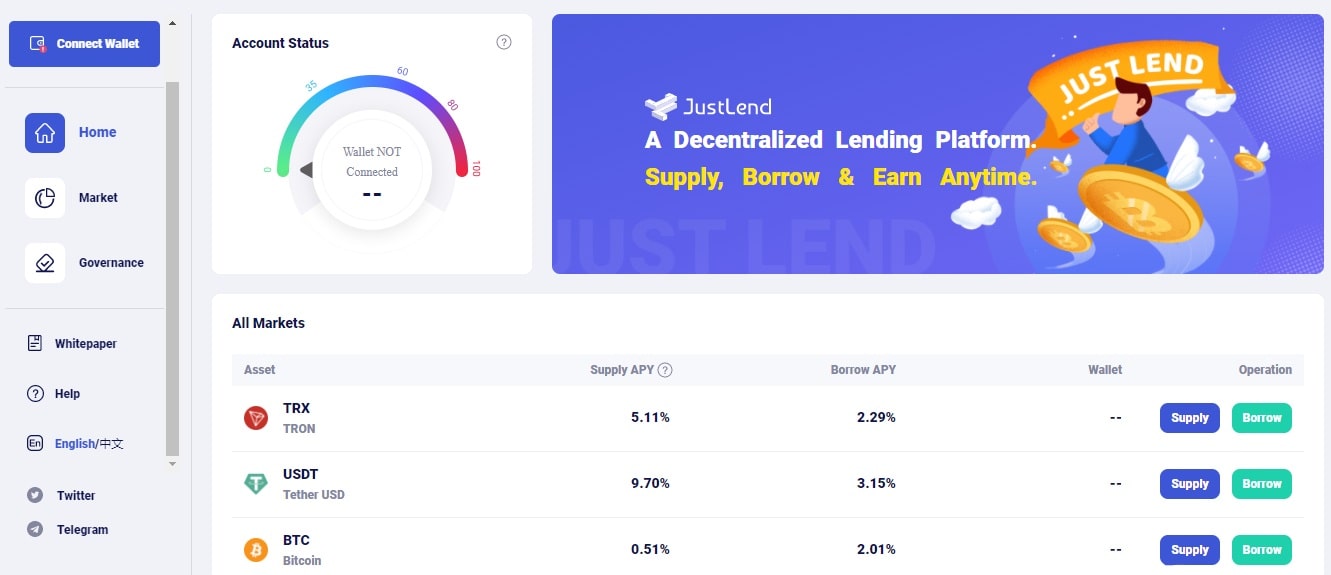

JustLend — the money market protocol on the TRON base, aimed at creating fundal pools, which are determined by the algorithm, based on the demand and suggestion of TRON assets. Within the framework of the Protocol, there are two roles - suppliers and borrowers. Both of them directly interact with the protocol to earn or pay a floating interest rate.

Contents:

Description of the Justlend project

On this platform, each monetary market corresponds to the unique asset TRON, such as TRX, TRC20 StableCoin or other TRC20-based tokens, and includes an open and transparent book of accounting for all transactions and historical interest rates. On peer-to-peer platforms, where borrowers are compared with creditors, the user's asset is thugged to another directly. The JustLend protocol combines the proposal of each user, which increases liquidity and provides the best monetary balance.

Assets, supplied to the market, are indicated as JToken (TRC-20 token balance). Token holders can purchase the appropriate JToken, delivering and observing the relevant rules to earn interest.

Main scenarios of use:

| 1 | Users can deliver tokens on Justlend and receive interest with low risk. |

| 2 | Dapps, institutes and stock exchange assets can be appreciated on Just Lend. |

If borrowers want to borrow an asset on Just Lend, they need to purchase JTokens as a collateral by making tokens and borrow any available asset. Just Lend asks borrowers to indicate a borrowed asset without any other requirements, such as the expiration date. Borrowing is carried out in real time, and its interest rate will be automatically adjusted, depending on the demand and supply of the market.

Additional information

The site has a WhitePaper document. With it, you can get acquainted in more detail with the project and its rules of use. Also, the project information is on the platform page.

There are next social networks:

Subscribe to stay up to date with all news and updates. The audit of the smart contract is not available.