Following its failure on October 8 to overcome the $28,000 resistance, Bitcoin just saw a 4.9% correction. However, it's unclear whether this will change the price range Bitcoin is currently trading in according to derivatives data.

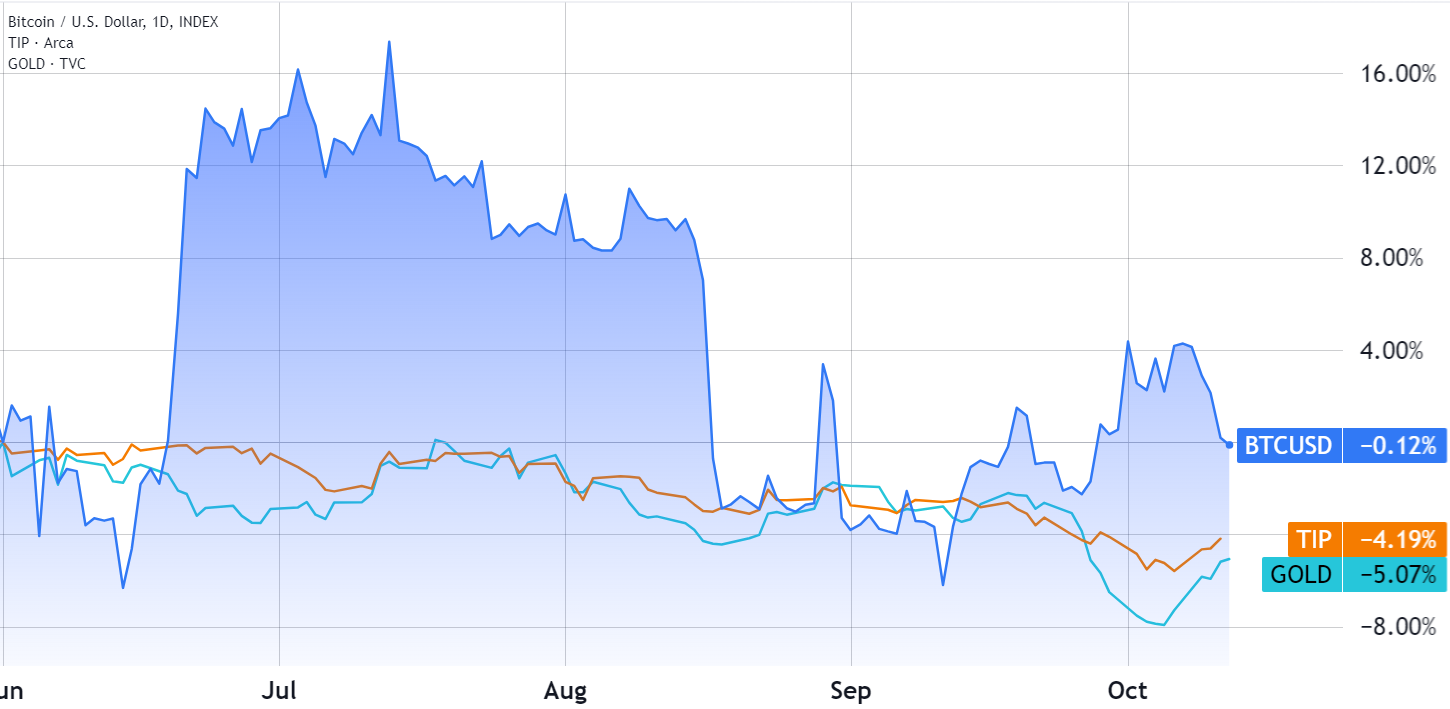

Despite the recent dip, Bitcoin has continued to perform well overall when compared to other assets. It has outperformed both Treasury Inflation-Protected Bonds (TIP), which witnessed a 4.2% decline during the same time period, and gold, which has dropped by 5% since June. The price of one bitcoin is still $27,700.

Given that Bitcoin's previous all-time high was $1.3 trillion in November 2021, investors might have bigger expectations. The usefulness of Bitcoin as an alternative hedge asset has come under scrutiny due to the strengthening of the US dollar and the solid S&P 500 index.

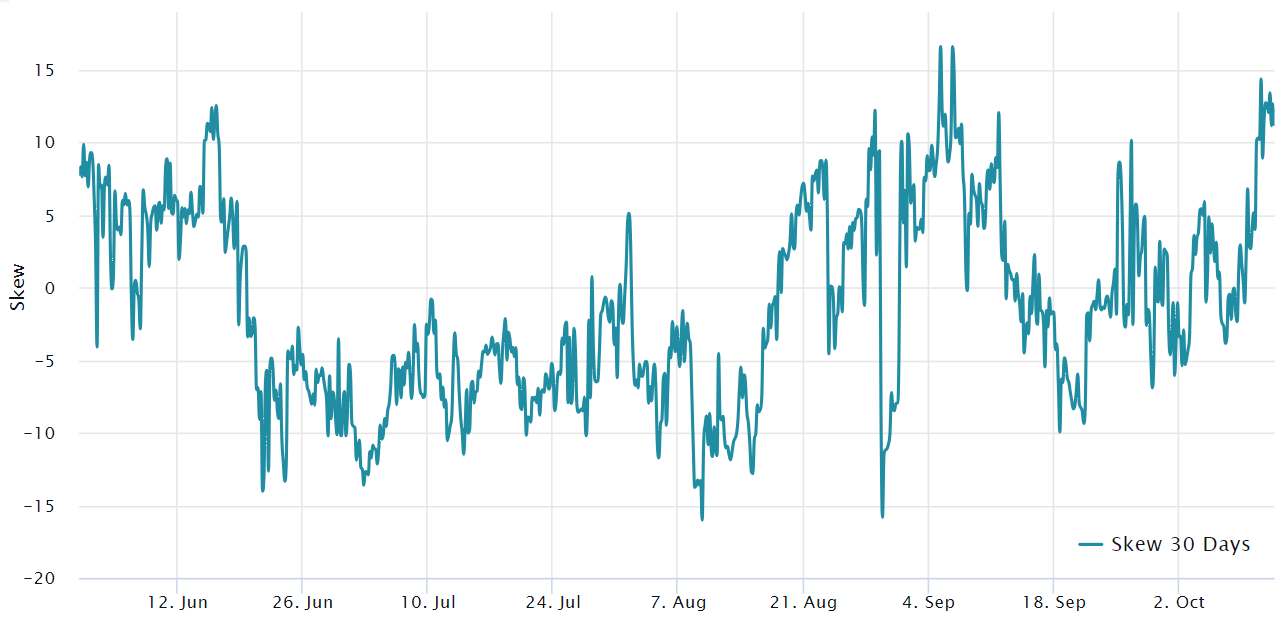

Some gloomy indicators are seen when looking at Bitcoin's derivatives measures. The basis rate, a gauge of future contract premium, is at its lowest point in four months, indicating a decline in demand from buyers of leverage. Additionally, on October 10, the bearish 25% delta skew for Bitcoin options changed, with protective put options trading at a 13% premium above call options.

These indicators point to traders losing faith in Bitcoin's near-term prospects, which may be affected in part by the uncertainty surrounding Bitcoin spot ETF choices and worries about exchange exposure to regulatory difficulties.

In conclusion, even though Bitcoin continues to outperform conventional assets, derivatives metrics point to a market that is becoming increasingly negative, which could have an impact on its near-term price performance.