Bitcoin's price has been declining since October 2, when it hit a local high of $28,580. Many are speculating about the cryptocurrency's future moves as a result of the bears' success in driving the price down to the $26,500 range.

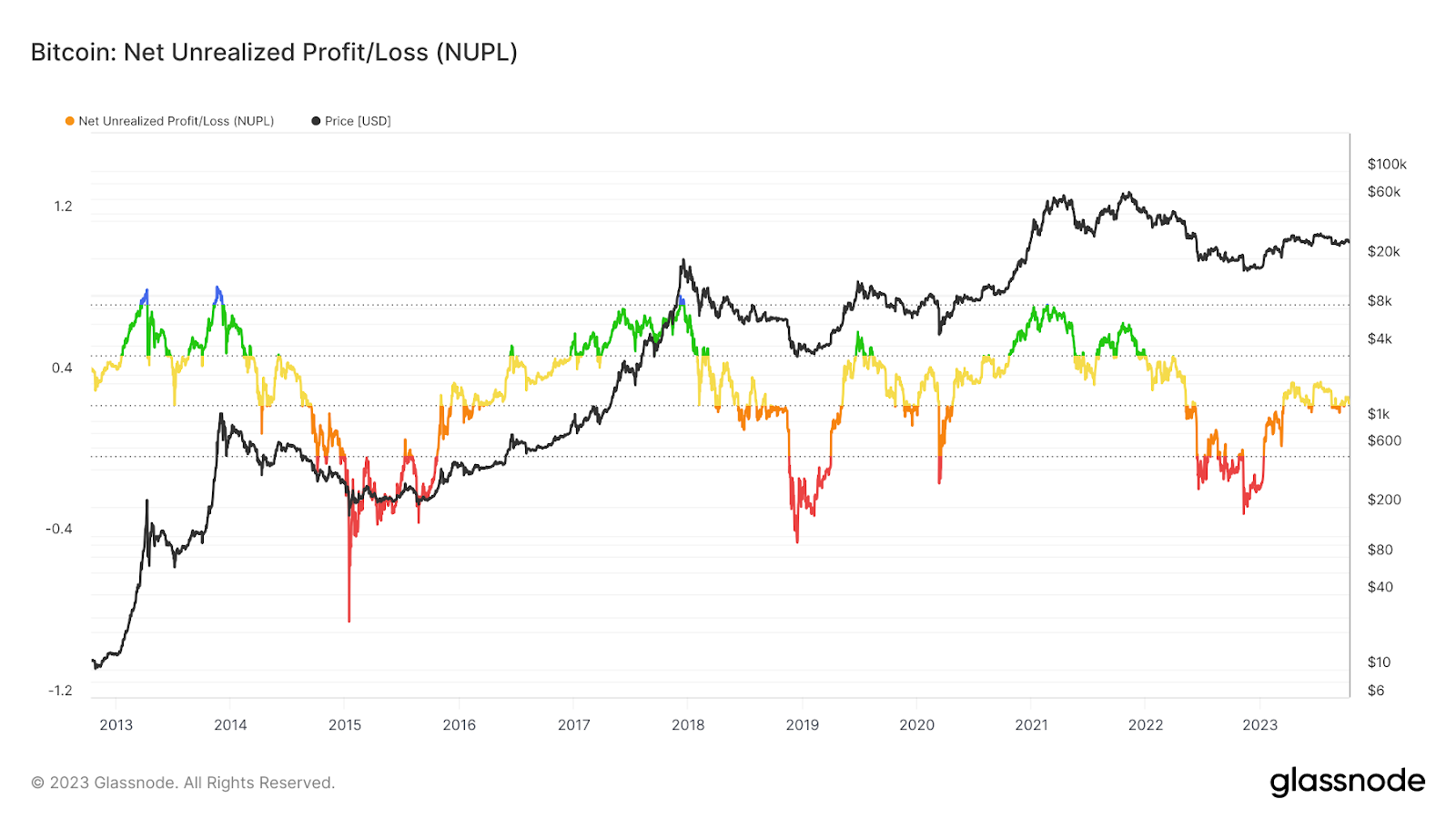

The Net Unrealized Profit/Loss (NUPL) on-chain metric is a crucial metric in this context. The difference between relative unrealized profit and loss is calculated by NUPL. It makes use of five horizontal areas, from red (capitulation) to blue (euphoria and greed), to represent various market psychological states.

Bitcoin's NUPL is currently resting at 0.26, in the yellow, somewhat neutral area of optimism. The orange zone of fear, which triggers below 0.25, is not far away, though. Since early 2023, optimism hasn't been this high, which represents a change from mid-January's lowest capitulation levels. However, the possibility of a deeper correction looms, which could drive NUPL back into a state of anxiety.

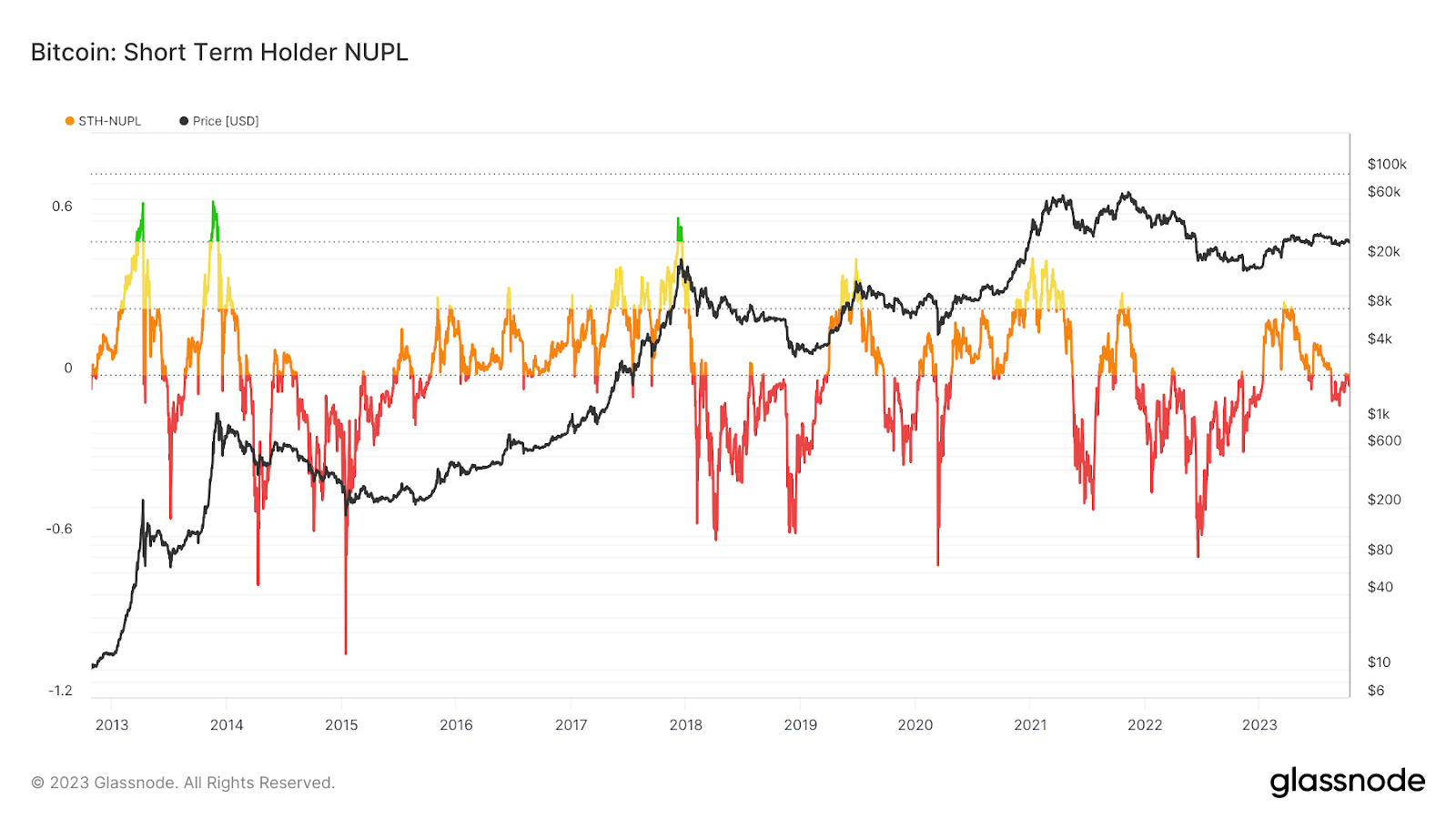

The same indicator for short-term holders (STH), when viewed in this manner, shows that new investors are still capitulating. STH NUPL, which only takes into account UTXOs older than 155 days, shows that most new investors are currently underwater as a result of capitulation that has been occurring since mid-August.

Notably, the Profit/Loss Momentum indicator for STH recently changed to green, which might indicate that profit/loss momentum is about to pick up. Two outcomes are possible from this: the last profit-taking before a significant correction or a resurgence of strength, with the latter being preferable from the standpoint of the macromarket.

The Bitcoin Risk Index was unveiled by @Negentropic, another on-chain analyst. It implies that Bitcoin is currently in the low-risk blue zone and that further significant declines are unlikely. This interpretation is supported by the recent inability of Bitcoin's detractors to lower the price below $26,000. The market may soon experience a bullish rebound if Bitcoin holds this level and validates the signals from NUPL.

Short-term holders would remain in the red if the $26,000 support was lost because it might trigger a deeper correction and a return to the fear zone.

The Bitcoin market continues to oscillate between optimism and fear, with a number of on-chain indicators providing information on the potential future movements of the cryptocurrency.