On June 10, the classification of certain cryptocurrencies as securities by the United States Securities and Exchange Commission had a significant impact on the crypto market, resulting in Algorand and Flow reaching unprecedented lows.

In recent legal actions, the securities regulator in the United States has identified a range of cryptocurrencies, such as Algorand, as securities.

Crypto exchanges Binance and Coinbase were sued by the Securities and Exchange Commission (SEC) last week, resulting in the classification of 16 additional cryptocurrencies as securities. Among the newly labeled securities were FLOW and Internet Computer.

While ALGO was specifically mentioned in the SEC's case against Binance, it was initially identified in the regulator's lawsuit against Bittrex in April.

In the past week, Internet Computer (ICP) has also experienced a decline of approximately 25%, currently trading around $3.65. This places it just 25 cents above its previous all-time low of $3.40, which was recorded in December 2022.

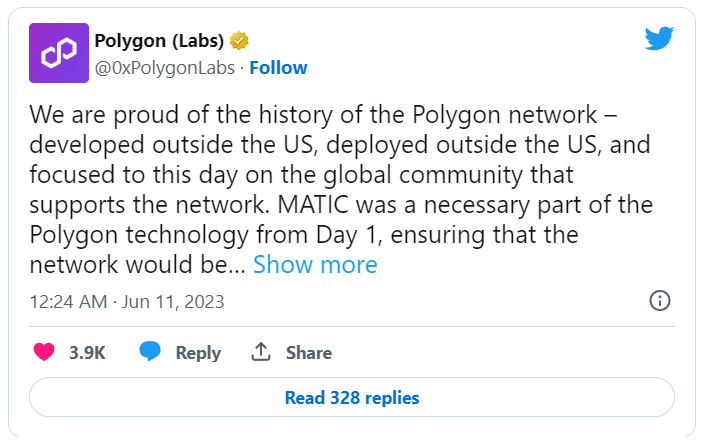

Polygon Labs made a tweet on June 10 in response to the SEC's characterization of MATIC, although they did not directly mention the regulator. The tweet emphasized that Polygon was created and implemented outside of the United States, and that MATIC was accessible worldwide without any specific targeting of the U.S. market.

On June 10, the Solana Foundation expressed its disagreement with the SEC's classification of SOL as a security through a tweet posted on Twitter.

Input Output Global (IOG), the development company behind Cardano, acknowledged the SEC's definition of ADA on June 7. They claimed that there were multiple factual inaccuracies made by the regulator in relation to Cardano.