Amidst the emergence of various theories, the CEO of Binance has firmly stated that there is no clandestine trading activity involving BTC or BNB taking place behind the scenes.

Binance CEO Changpeng "CZ" Zhao has denied allegations that Binance has been engaging in covert Bitcoin sales in order to artificially maintain the stability of its BNB token's price.

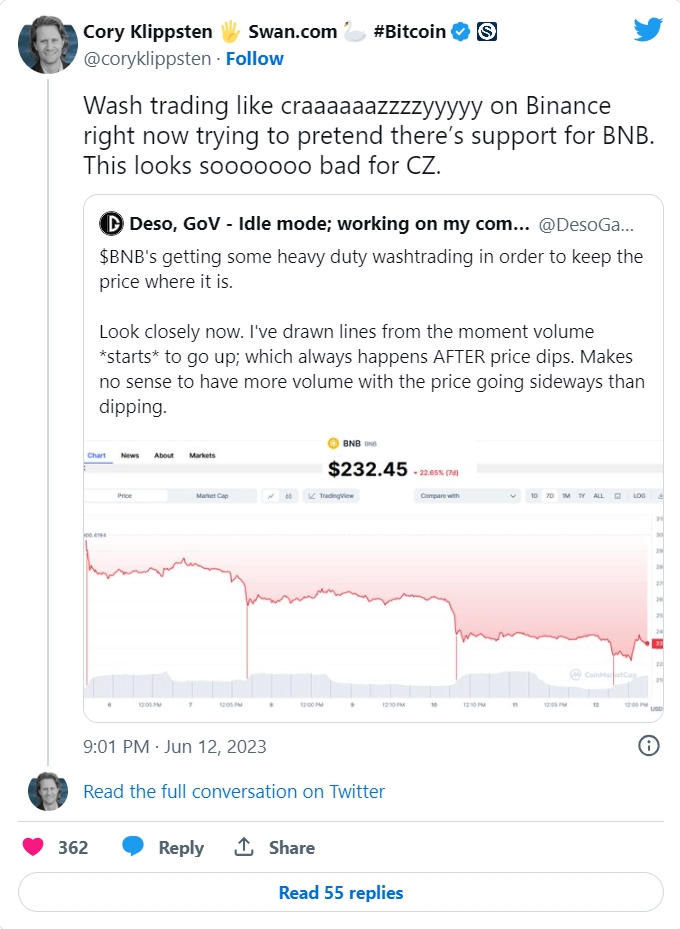

Numerous market commentators, such as analyst Dylan LeClair and Swan Bitcoin CEO Cory Klippsten, have raised rumors alleging that Binance is engaging in deliberate market manipulation to artificially boost the price of BNB.

In a tweet on June 13th, CZ clarified that Binance had not disposed of any of its BNB holdings, and additionally revealed that the cryptocurrency exchange still possessed a significant amount of FTX Tokens. FTX Tokens were the native tokens of the now-defunct FTX crypto exchange.

CZ's statement was a clear reaction to a post made on June 14 by Skew, a technical analysis platform. Skew had accused Binance of engaging in market manipulation by executing a sequence of trades involving BTC, BNB, and Tether:

In the same discussion, Bitcoin analyst LeClair asserted that the BNB market is evidently artificial, as it trades with significantly lower realized volume compared to BTC. Please rewrite the text in English.

In a tweet on June 13, Klippsten made an accusation of "wash trading" against Binance and suggested that the exchange was attempting to create the illusion of support for BNB:

Wash trading can be described as a form of market manipulation in which a trader engages in the sale of an asset and subsequently purchases it shortly thereafter. The primary objective behind this tactic is to artificially inflate the asset's demand or create an illusion of increased activity within the marketplace.

According to Joe Consorti, an analyst at The Bitcoin Layer, the price movement of BNB has been described as "abnormal," particularly noting the strong defense of the $220 level. He speculates that this level could potentially be significant for liquidating a loan collateralized by BNB.

In a reply to CZ's statement, Consorti emphasized the importance of Binance releasing an audited statement to provide evidence that Binance does not possess any liabilities backed by BNB. This action would effectively put an end to the spread of fear, uncertainty, and doubt (FUD).

On June 5, Binance.US was sued by the United States Securities and Exchange Commission (SEC) on allegations of violating securities laws and participating in wash trading. The lawsuit also claims that Binance.US's undisclosed "market making" trading firm, Sigma Chain, owned by CZ, was involved in these activities.

CZ and Binance.US have refuted any allegations of misconduct and have asserted their intent to vigorously defend themselves against the charges brought against them in the U.S. District Court in Washington, D.C.