Despite the recent correction in price, Bitcoin's bullish run remains intact as indicated by several on-chain metrics. Bitcoin surged towards an all-time high of $74,000 earlier this month but encountered significant selling pressure, resulting in a 10% drop from its June peak. On June 14, BTC's price experienced a further 1.26% decline, slipping below the $66,000 mark.

Metrics Signifying a Continued Bullish Trend for Bitcoin

In the second quarter of 2024, Bitcoin faced a 5% decline amidst substantial selling pressure following the capitulation of Bitcoin miners triggered by the block reward halving in April 2024. Despite concerns arising from recent price consolidations that the bull market might be waning, on-chain metrics paint a different picture.

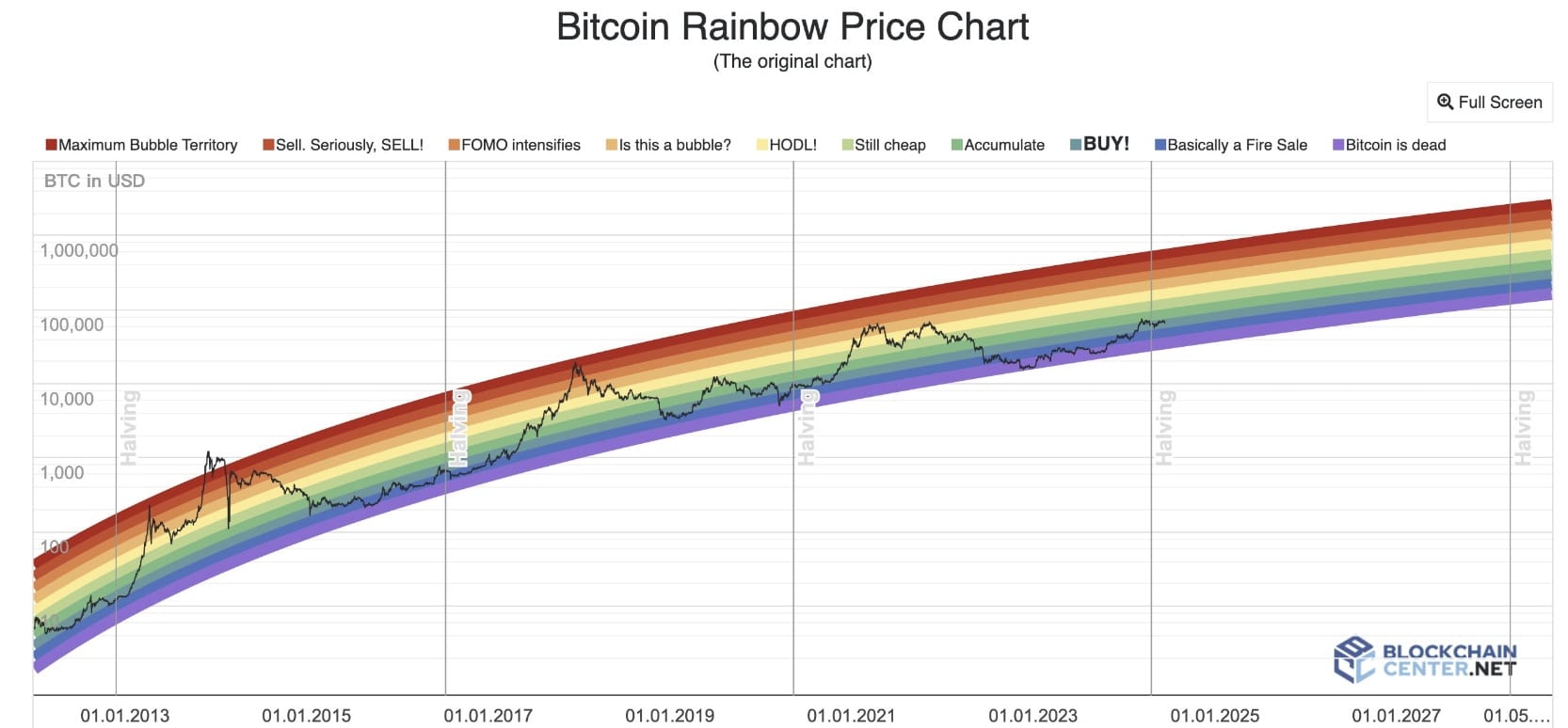

The Bitcoin Price Rainbow Chart, a long-term valuation tool based on a logarithmic growth curve, suggests that the current period presents a favorable opportunity to purchase BTC. This chart assists in predicting the possible price movements of Bitcoin and affirms that the current value remains an attractive option.

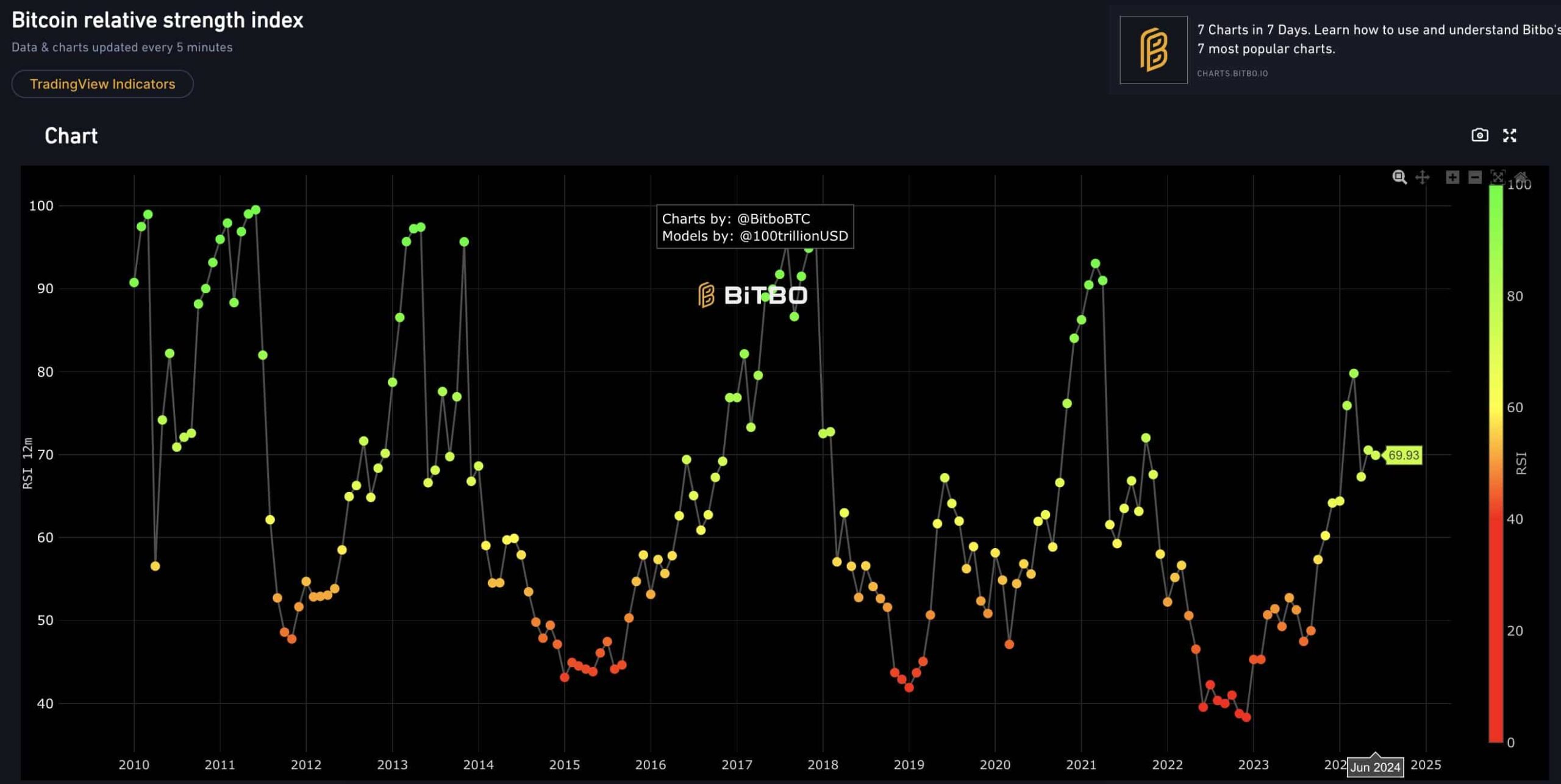

The Relative Strength Index (RSI) for Bitcoin is currently at 69.9. An RSI value above 70 indicates an overvalued asset, while below 30 signifies undervaluation. The existing RSI value indicates that Bitcoin's price has not yet reached its peak and retains further growth potential.

Furthermore, the 200-Week Moving Average heatmap indicates that Bitcoin's current price position remains within the blue zone, suggesting that the peak has not been reached. This scenario implies it is an advantageous time to hold and potentially acquire more BTC.

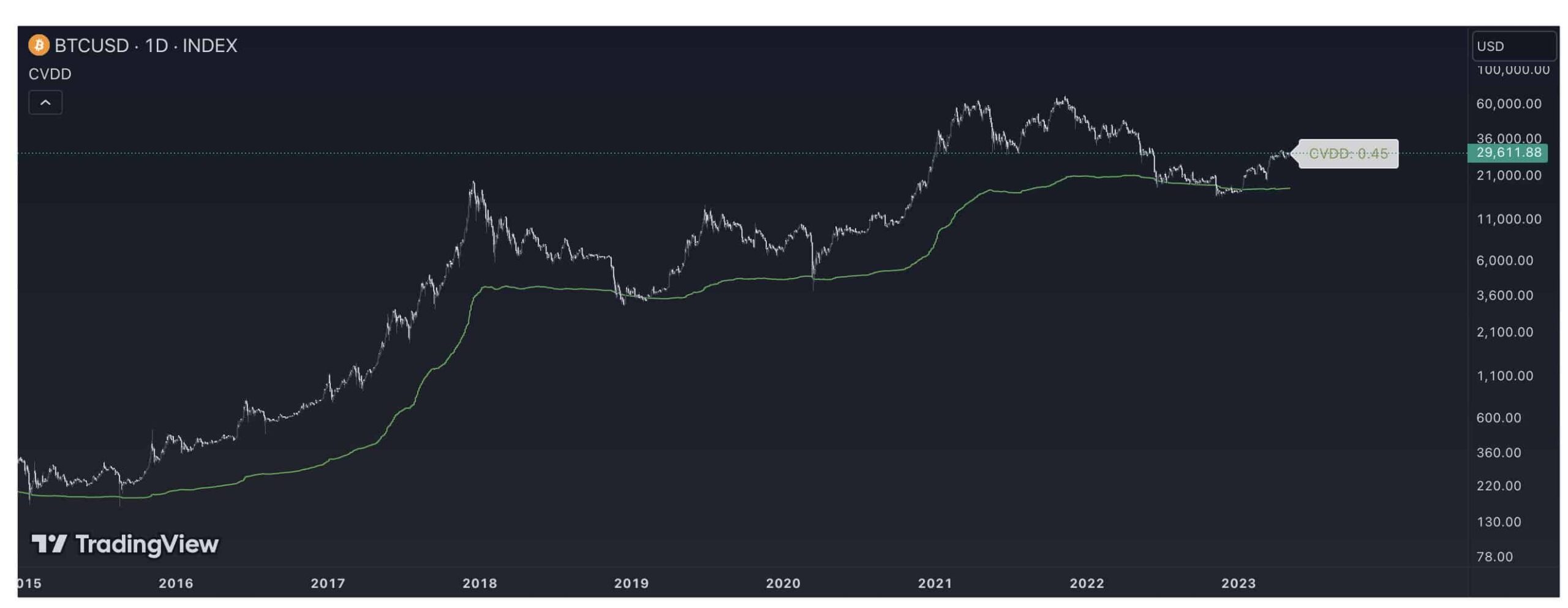

The Cumulative Value Days Destroyed (CVDD) indicator demonstrates that when Bitcoin's price hits the green line, it signals an undervalued asset and a beneficial buying opportunity. The current CVDD value suggests that BTC still has room for growth.

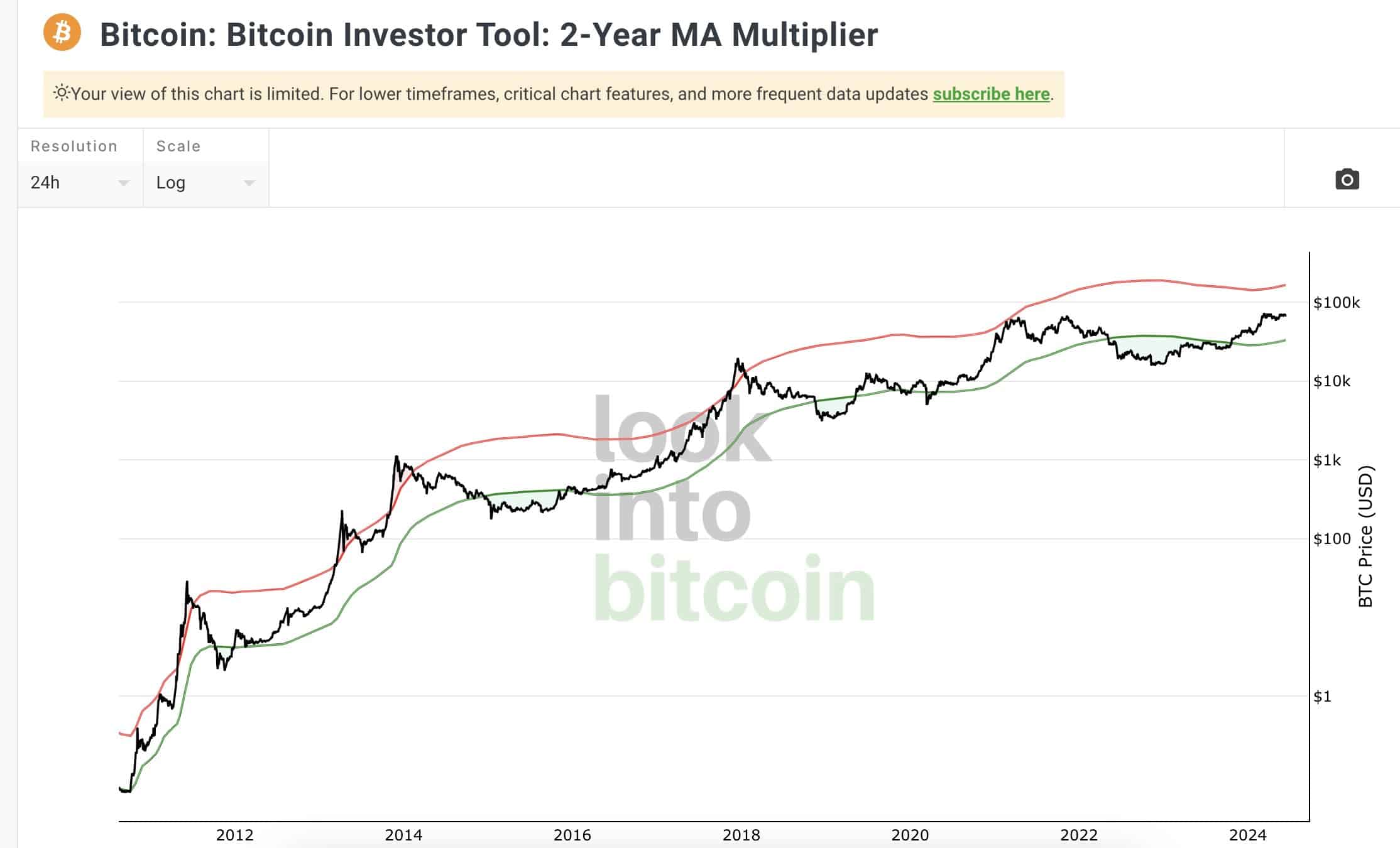

Lastly, the Bitcoin 2-Year Multiplier indicator reveals that BTC is trading within the red and green lines. Until the price touches the red line, there is no confirmation that Bitcoin has peaked, indicating potential for further expansion.

50,000 BTC Sold by Bitcoin Whales

Over the last ten days, Bitcoin whales have divested 50,000 BTC worth $3 billion. According to crypto analyst Ali Martinez, Bitcoin must breach the $66,254 mark soon to evade a drop to $61,000.

CryptQuant CEO Ki Young Ju noted that the average buy-in price for Bitcoin investors hovers around $47,000. In a bullish market scenario, Bitcoin's price typically remains above this level, suggesting that despite a 27% decline, the market is poised to sustain its upward trajectory. Ju recommended maintaining a positive long-term perspective while exercising caution against excessive risk-taking.