CryptoQuant, a reputed cryptocurrency analysis company, recently provided insights into the present condition of the Bitcoin market.

In the last couple of years, the Bitcoin market has witnessed a substantial surge, impacting the prices of various other cryptocurrencies as well. This period has shown more promise compared to the downturn experienced in 2021 and 2022.

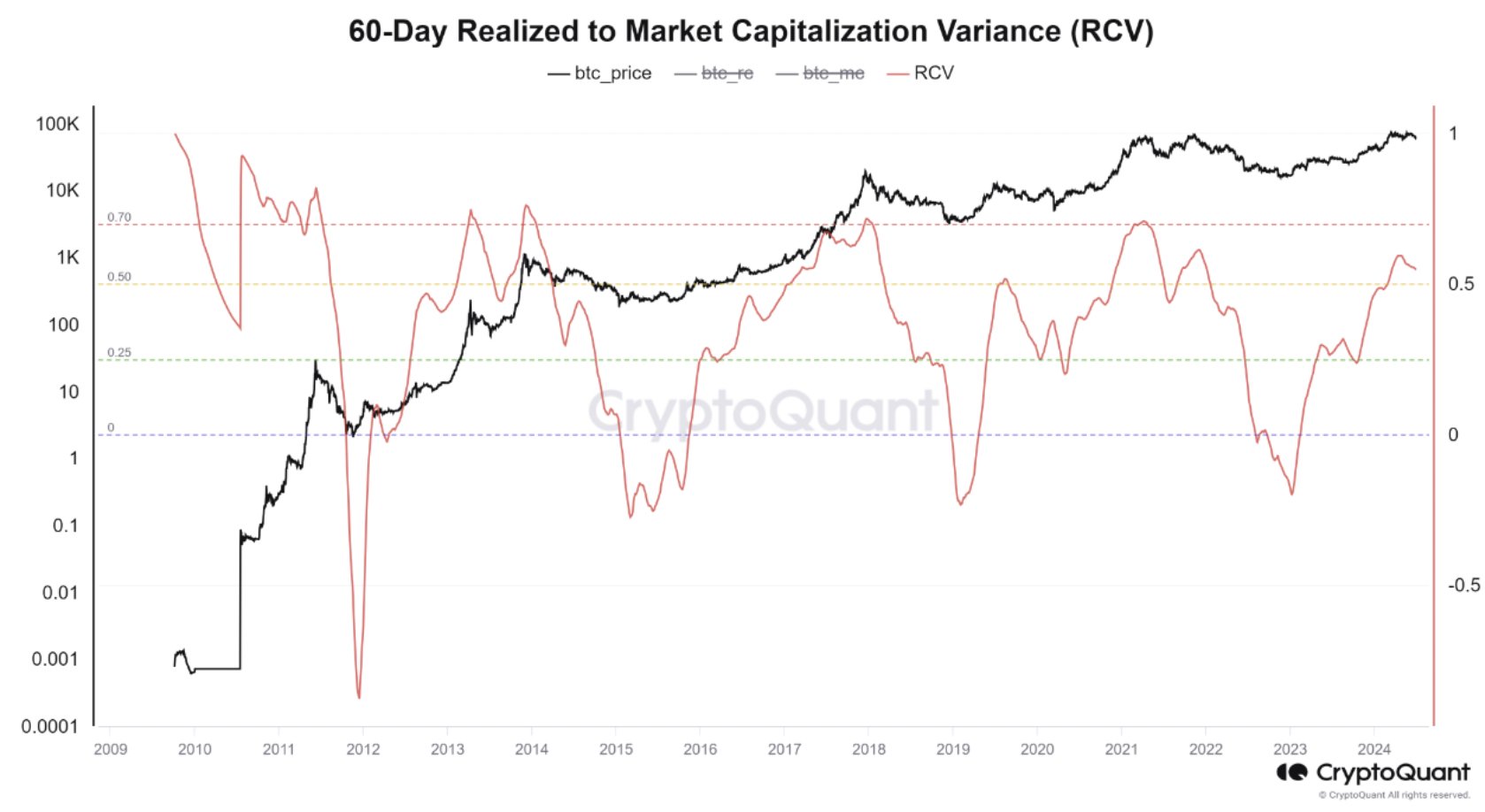

To assess the current status of the Bitcoin market, analysts at CryptoQuant turned to a highly effective modern tool known as the 60-Day Realized to Market Value Variance (RCV) metric. This metric gauges the two-month alteration in Bitcoin's cap relative to its market cap, proving to be highly valuable for making long-term decisions and investments following the Dollar-Cost Averaging (DCA) methodology.

According to the RCV metric, Bitcoin has entered the risk zone. Nonetheless, there remains potential for the market to ascend, possibly reaching 0.70. While foretelling the future with absolute certainty is unattainable, analysts propose that a surge in demand around the 0.50 mark in the metric could mirror the behavior observed in 2017, leading to a potential establishment of a new long-term peak for Bitcoin.

Please note that this information does not constitute investment advice.