Analysis of XRP Price Decline Due to Market Forces

The price of XRP plunged by over 12% on July 5, reaching $0.381, hitting a three-month low. This drop is a result of significant sell-offs in the Bitcoin market and the response from the U.S. Securities and Exchange Commission (SEC) towards Ripple. Similar negative trends are observed across the cryptocurrency market.

Factors Influencing XRP's Decline

The recent decline in XRP's price is linked to reports indicating that the German government is selling off hundreds of millions of dollars' worth of Bitcoin seized from various illegal activities while still holding a substantial reserve of $2.4 billion in cryptocurrencies.

Moreover, the return of 140,000 Bitcoins by the defunct Mt. Gox exchange to its creditors has sparked speculations about the potential sell-off of the $8 billion in Bitcoin assets. The sharp decrease in the market values of smaller cryptocurrencies like XRP, Ethereum, and BNB is attributed to their strong correlation with Bitcoin. For example, on July 5, the daily correlation coefficient between XRP and Bitcoin stood at an exceptionally high 0.94, nearing a perfect correlation of 1. This alignment may be due to investors offloading altcoin holdings to offset losses incurred in the Bitcoin market.

Noteworthy Trends in the Futures Market

The drop in XRP's price today was exacerbated by significant liquidations of long positions in the futures market. Within the last 24 hours as of July 5, long positions in the XRP Futures market witnessed liquidations exceeding $7 million, contrasting with only $298,370 in liquidated short positions during the same period.

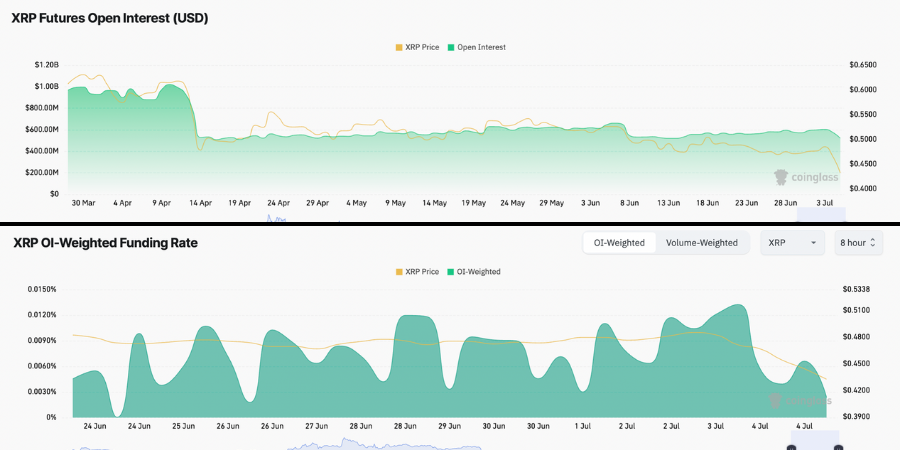

The liquidation of long positions signifies that optimistic investors were compelled to sell their holdings, leading to a downward pressure on the price and hastening the decline. Additionally, the XRP price drop is accompanied by a reduction in open interest and funding rates.

For instance, the total outstanding XRP contracts declined from $577.74 million the previous day to $524.74 million on July 5. Meanwhile, the funding rates for XRP dropped from a weekly 0.13% to 0.05%. These decreases indicate that investors are unwinding their positions and there is a reduced appetite for long positions, reflecting a cautious approach among XRP investors.

This analysis was originally published on COINTURK NEWS: Market Forces Drive XRP Price Down.