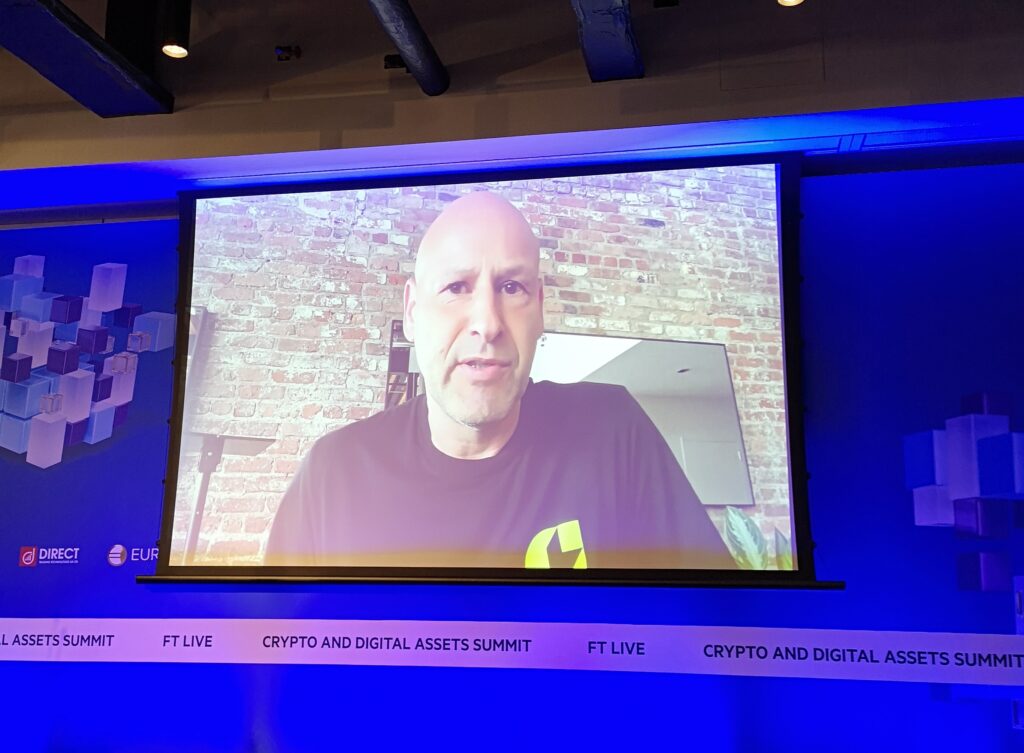

Joseph Lubin, a co-founder of Ethereum and CEO of Consensys, criticized the U.S. Securities and Exchange Commission (SEC) for its approach to regulating cryptocurrency. Lubin expressed his views during the FT Live’s Crypto and Digital Assets summit in London, noting that the SEC seems to prefer strategic enforcement over open dialogue.

The criticism from Lubin followed Consensys’s decision to take legal action against the SEC after receiving a Wells notice, which indicates potential enforcement measures.

SEC’s Position on Ether Security Classification

Lubin observed that the SEC had reclassified Ether as a security without informing relevant stakeholders. He argued that this move appeared to be intentionally unsettling to create doubt and fear within the cryptocurrency industry.

Highlighting the confusion surrounding regulatory stances, Lubin pointed out that the Commodity Futures Trading Commission had previously classified Ether as a commodity.

Lubin suggested that the timing of the SEC's actions might be tied to the upcoming decision on approving Ether spot exchange-traded funds (ETFs). He implied that the SEC's recent enforcement actions could be an attempt to justify rejecting these ETFs.

Moreover, Lubin speculated that the SEC's actions might be driven by concerns over the abundance of capital in the cryptocurrency space, potentially posing a challenge to traditional financial institutions.

Emphasizing the importance of the legal action against the SEC, Lubin warned against labeling wallets like MetaMask as broker-dealers, as it could have far-reaching implications for the tech industry in the U.S.