- Ethereum Whales Cease Accumulating ETH

- Significant Outflows from ETH Spot ETF

- ETH Price Trend: Slight Increase Amid Bearish Trend

Ethereum, one of the world's largest cryptocurrencies, is currently experiencing significant changes in ownership patterns among major investors. These signals are drawing attention from the crypto community, especially since these trends began months ago and continue to this day.

Ethereum Whales Cease Accumulating ETH

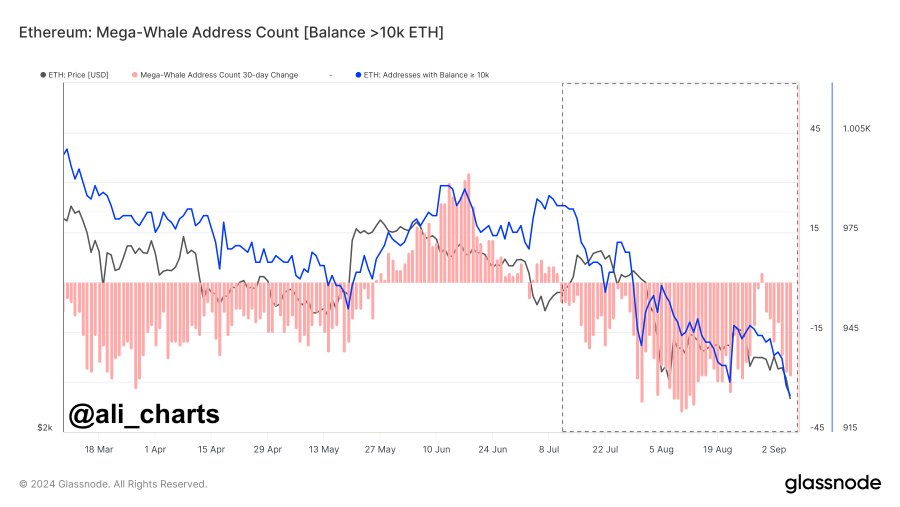

The first signal of a significant change in the Ethereum ownership pattern came from popular on-chain analyst Ali Martinez. In his tweet, he noted that Ethereum whales began to stop accumulating ETH in early July.

Previously, these whales were known to actively buy more ETH to increase their portfolios; however, this trend seems to have reversed.

"Ethereum whales stopped accumulating ETH in early July. Since then, they have sold or redistributed their ETH holdings," Ali Martinez wrote on Twitter.

This change is significant because whales typically have a major influence on cryptocurrency price movements. When they start selling or redistributing their ETH, the market can experience greater selling pressure, potentially pushing the price lower.

Significant Outflows from ETH Spot ETF

Besides whale activity, attention is also focused on other developments that could impact the Ethereum market.

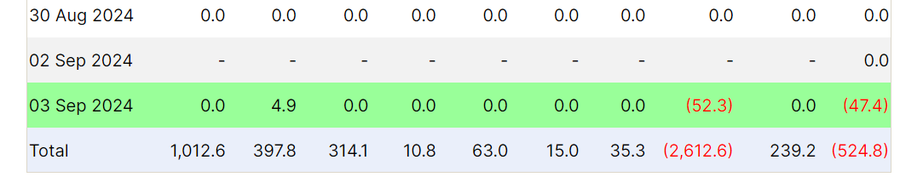

Crypto Rover, a crypto influencer, reported that the Ethereum spot ETF recorded significant outflows on September 3, 2024. According to the report, there was an outflow of $47.40 million in one day.

This indicates that institutional investors may be repositioning their portfolios or anticipating further volatility in the Ethereum market. Large outflows from ETFs could signal a lack of confidence among large investors in the short-term potential of ETH, especially given the distribution patterns observed among whales.

ETH Price Trend: Slight Increase Amid Bearish Trend

However, in the last 24 hours, the price of ETH has shown a slight increase of 1.06%, currently trading around $2,307.13.

Overall, the Ethereum market continues to show a multi-day bearish trend. This means that despite the short-term price increase, the broader market structure remains weak.

The small price increase could be related to short-term sentiment or reactions to external factors, but it is not sufficient to reverse the broader bearish trend.

The actions of whales and the significant outflows from the Ethereum spot ETF could have long-term effects on the ETH market. Whales play a crucial role in creating liquidity in the market, and when they start selling, it can trigger more selling from smaller investors, ultimately putting pressure on the price.

Furthermore, outflows from ETFs indicate growing concerns among institutional investors. This could lead to further declines in institutional demand for ETH, ultimately putting more pressure on Ethereum prices.

Changes in the behavior of major investors and significant outflows from ETFs could significantly alter the Ethereum market. Paying attention to these trends is crucial for understanding the future price dynamics of the cryptocurrency.