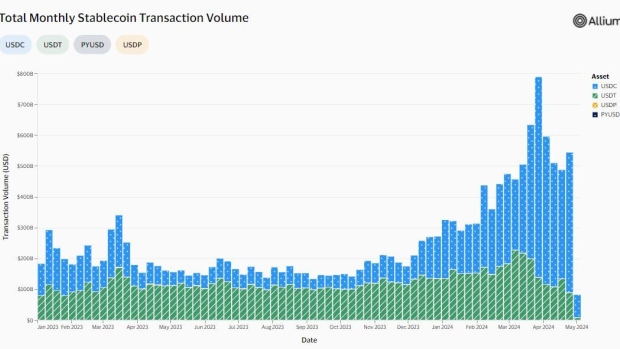

According to data from Visa Inc., USDC issued by Circle has surpassed Tether's USDT in transaction volume since the beginning of 2024. This significant shift in the stablecoin market is reinforced by the latest figures showing an annual increase in USDC market share.

In just the past week, USDC recorded an impressive transaction volume of US$456 billion, far exceeding USDT's US$89 billion in the same period. Furthermore, USDC now accounts for 50 percent of the total stablecoin transactions this year.

Shift in Market Dominance: USDC Circle

Coin Edition reports that the surge in USDC usage is particularly interesting given USDT's historical dominance as the primary stablecoin. Traditionally, USDT has been the preferred stablecoin, maintaining a market dominance of 68 percent compared to 20 percent for USDC, according to DefiLlama data.

However, the latest statistics from Visa indicate a potential shift in preferences among users of these stable value tokens.

Despite clear data, Visa, which partnered with Circle in 2020, has not provided an explanation for this surge in USDC transactions. Bloomberg, covering this story, notes that the reasons behind this surge are not immediately clear, suggesting that deeper market dynamics may be at play.

The lack of explanation from Visa leaves room for speculation about what may be driving the increased adoption of USDC.

Geographical Preferences Impact Adoption

Noelle Acheson, author of the Crypto Is Macro Now newsletter, offers perspective on this trend. She suggests that geographical preferences for different stablecoins may influence their adoption rates.

"USDT is more held outside the US as a dollar-based store of value, while USDC is used in the US as a transaction currency," Acheson revealed.

These differences may contribute to the observed shift in transaction volume between the two stablecoins.

Complexity of Stablecoin Transaction Analysis

Stablecoins like USDC and USDT, tied to the US dollar, play a crucial role in facilitating trade and cross-border remittances within the crypto ecosystem.

Visa's head of crypto, Cuy Sheffield, points out that analyzing transactions involving stablecoins can be complex. He explains that stablecoins can be used in various use cases, with transactions initiated manually by end-users or programmatically through bots.

This complexity can sometimes obscure the true nature of stablecoin usage.

Discussions about USDC are also influenced by external financial events. In December 2023, the disclosure of Circle's significant exposure to Silicon Valley Bank led to a drastic decline in the total value of circulating USDC, from US$56 billion to US$23 billion.

However, recent data shows a recovery, with the total value of circulating USDC rebounding to US$32.8 billion.