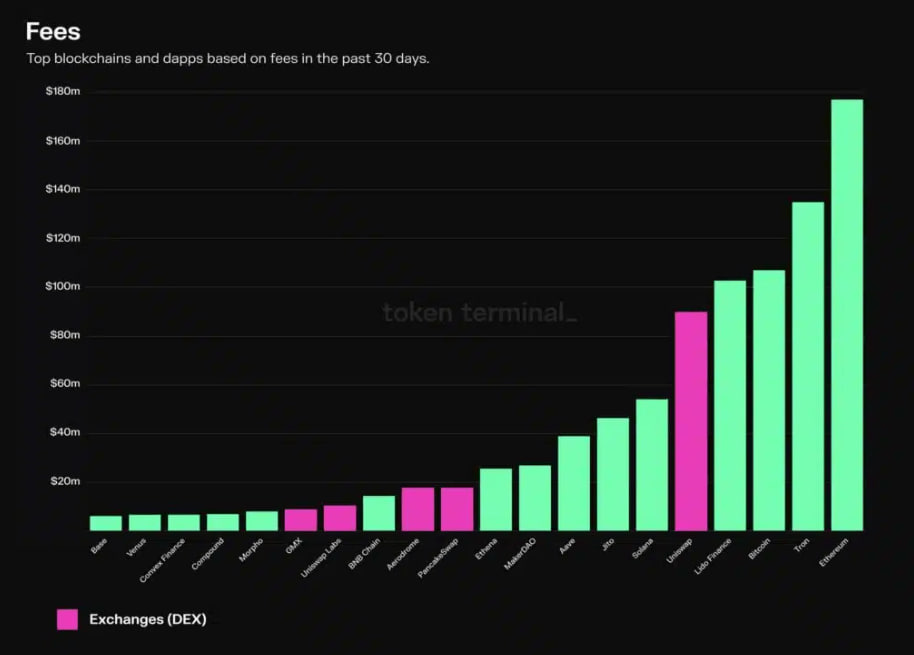

Over the past 30 days, the decentralized exchange Uniswap has collected over $100 million in fees, according to blockchain service Token Terminal. This is the highest figure among all decentralized platforms.

As of June 18, the Uniswap DAO decentralized exchange generated more fees than PancakeSwap, Aerodrome, and GMX combined.

Token Terminal data also shows that the blockchains with the highest fees over the past 30 days are Ethereum, Tron, and Bitcoin.

This is due to the fact that most leading dApps are located on Ethereum, both at the L1 and L2 levels. This blockchain leads all networks, having collected nearly $180 million in 30 days. Tron is in second place with over $130 million, and Bitcoin is third with approximately $105 million.

According to Token Terminal, Ethereum generated the most fees over the past 30 days, around $180 million. Despite the relatively low average transaction fee of ~ $0.03 (compared to ~ $4.5 on Ethereum L1), Base still ranks in the top 20 due to the sharp increase in user activity on L2.