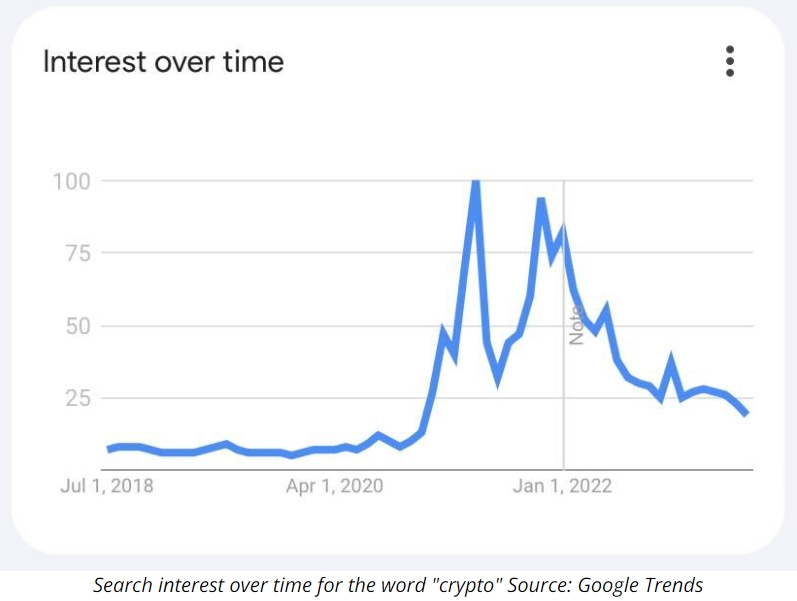

Online interest in crypto has experienced a significant decline since its peak in May 2021, with a score of only 17 out of 100.

Search interest in cryptocurrencies and related terms has experienced a significant decline, reminiscent of levels observed in late 2020, following a lack of optimism in the sector over the past two months.

Based on Google Trends data, the term "crypto" currently has a score of 17, significantly lower than its reference point of 100 in May 2021. Bitcoin and Ethereum have experienced a similar decline in popularity.

However, the search interest for these terms has been steadily decreasing since May 2022, which was about a month after a significant collapse occurred within the Terra Luna ecosystem. There was a minor increase in interest observed in early November when the cryptocurrency exchange FTX experienced a collapse.

The decline in interest is occurring concurrently with Bitcoin maintaining a relatively stable value of approximately $28,000 for a consecutive period of 10 weeks. This price behavior, characterized as "lackadaisical" by Mike Novogratz, the CEO of Galaxy Digital, is believed to be influenced by a current absence of significant institutional enthusiasm in the market.

Guy Turner, popularly recognized as the "Coin Bureau Guy," recently shared his thoughts on Twitter on June 4th. In his post, he put forward the idea that the decline in interest aligns with reduced trading volumes observed on exchanges. According to him, these volumes hit a 32-month low in the previous month.

The Crypto Fear & Greed Index provided by Alternative also reflects a similar narrative, with market sentiment consistently remaining at its current score of 53 for approximately a month, placing it in the "Neutral" zone.

Interest has not waned across all areas of crypto, though. In 2023, search volumes for terms like "decentralized finance" and "DeFi" have actually witnessed an increase. Similarly, searches for "memecoin" reached their pinnacle in early May.

Nigeria presently leads the charts with the highest number of searches related to cryptocurrencies, while several South American countries rank low in terms of search volume in this domain.

Meanwhile, there is a remarkable surge in search interest for artificial intelligence, which some consider to be the newest trend in the technology industry.