From June 10 to 14, 2024, $600 million was withdrawn from crypto funds, as indicated in the weekly report by CoinShares.

Analysts noted that this is the largest outflow of funds in the past six weeks, with the last significant capital movement observed on March 22, 2024.

The main reason for the asset withdrawal, according to experts, is the meeting of the Federal Open Market Committee (FOMC) of the US Federal Reserve, which took place on June 12. After the regulator's decision to leave the interest rate unchanged, the price of Bitcoin fell below $67,000.

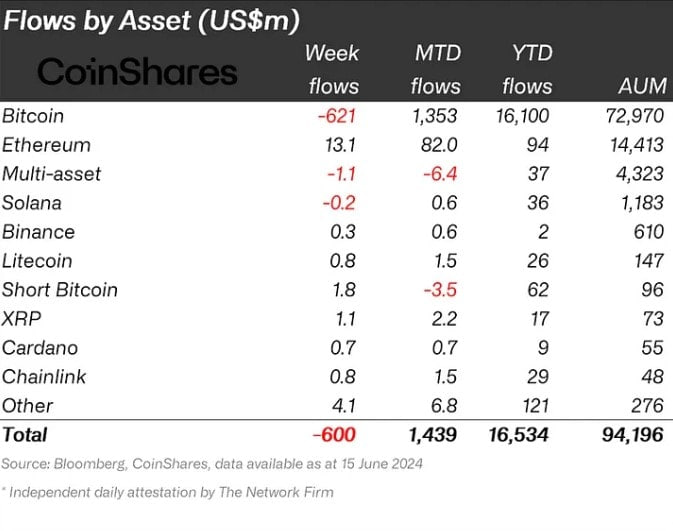

The main outflow of capital was in bitcoin products — $621 million. Meanwhile, projects related to Ethereum attracted $13.1 million.

Altcoins also demonstrated capital inflows. Investors showed interest in products based on Lido DAO (LDO) and Ripple (XRP), which attracted $2 million and $1 million respectively.

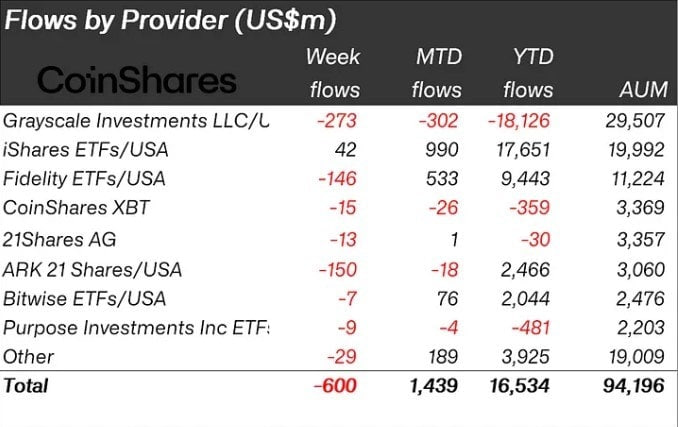

Another significant factor in the negative dynamics was the GBTC fund from Grayscale, which lost $273 million.

Most other exchange-traded funds also showed negative results. For example, $150 million was withdrawn from bitcoin ETFs of Ark Invest and 21 Shares, and $146 million from Fidelity Investments. Only one crypto fund, iShares from BlackRock, recorded a positive capital inflow — $42 million.

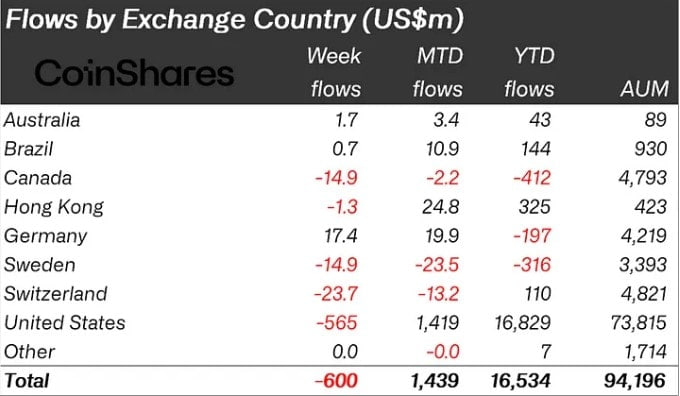

The report notes that the total assets under management (AuM) decreased from over $100 billion to $94 billion over the week. Regionally, the main outflow of investments occurred in the United States — $565 million. Negative sentiment was also observed among investors from Canada, Switzerland, and Sweden — $15 million, $24 million, and $15 million respectively.

Germany, on the other hand, recorded a capital inflow of $17.4 million. Australia and Brazil finished the week with positive results — $1.7 million and $0.7 million.

It is worth noting that in May 2024, projects in the Web3 and blockchain sectors attracted over $1 billion in investments.