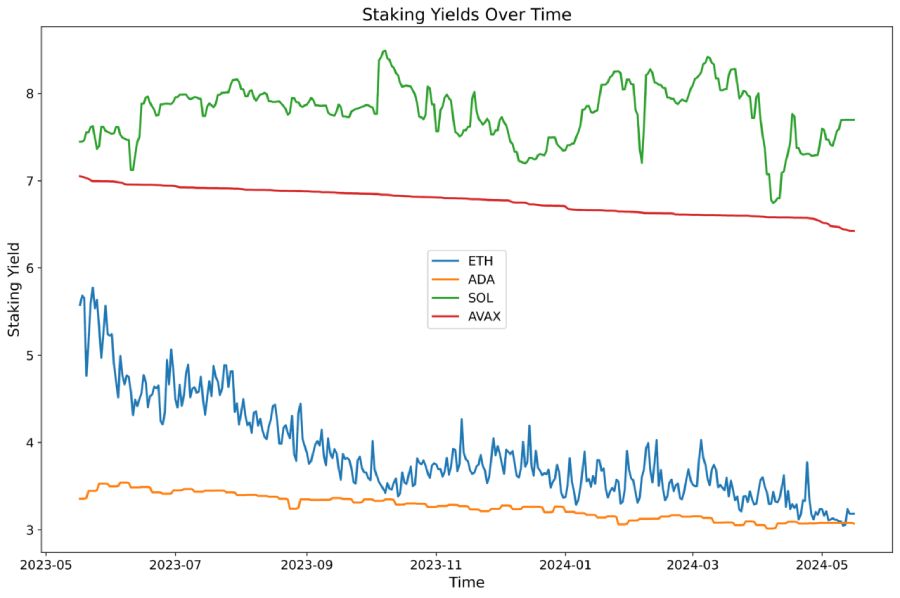

According to CCData, cryptocurrency staking yields have significantly decreased over the past year. From May 2023 to May 2024, staking yields for the following crypto assets declined by:

Main Reasons and Consequences

The decline in yields is due to the reduction in the number of coins allocated for validator rewards, aimed at preventing a significant increase in circulating supply and combating inflation. The rewards will continue to decrease until they match the total transaction fees collected.

Solana Breaks the Trend

Interestingly, Solana deviated from this trend, with its staking yield increasing from 7.5% to 7.7%. However, according to Staking Rewards, the actual staking yield for Solana is 7.48% APY, and the sole provider of liquid staking for SOL, Marinade Finance, pays only 6.54% annually.

These changes in staking yields highlight important trends in supply management and inflation control, significantly impacting market participants.