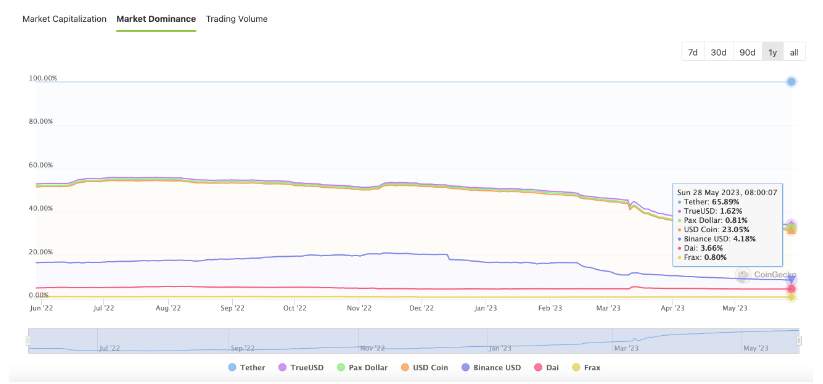

In the last year, there has been a significant shift in market dynamics, with Circle's USD Coin witnessing a decrease in its market share from 34.88% to 23.05%. Conversely, Tether's USDT has experienced a notable increase in popularity and market presence.

Data from CoinGecko indicates that the landscape of stablecoins tied to the US dollar has witnessed fluctuations in market dominance over the past year. While the majority of these stablecoins have experienced a decline, Tether, on the other hand, has managed to regain its previous record-high position.

Over the course of the previous year, there has been a noticeable decrease in market share for Circle's USD Coin, which has dropped from 34.88% to 23.05% as of the current writing. Similarly, Binance USD's market participation has experienced a significant decline, plummeting from 11.68% to 4.18% during the same period. Additionally, Dai's share of the cryptocurrency market stood at 3.66%, representing a decrease from 4.05% recorded in May 2022.

Meanwhile, Tether's USDT is making significant strides, as its market dominance has surged to 65.89% compared to 47.04% a year ago. The stablecoin's market capitalization has skyrocketed to $83.1 billion, whereas USDC's market cap has dwindled from its peak of $55 billion to a mere $29 billion.

During a recent interview with Bloomberg, Circle CEO Jeremy Allaire attributed the declining market capitalization of the stablecoin to the intensified regulatory actions targeting cryptocurrencies in the United States. It seems that the current regulatory environment in the United States is favoring Tether's growth and success.

In March, the banking crisis in the United States resulted in the depegging of USDC, as approximately $3.3 billion worth of reserves became inaccessible at Silicon Valley Bank, one of the three crypto-friendly banks that were forced to shut down due to regulatory measures. Despite Circle's reassurances, the market swiftly reacted to this news, causing USDC to lose its peg to the US dollar.

As the connection between the cryptocurrency space and traditional finance continues to strengthen, stablecoins have gained significant popularity. A recently published report by the European Systemic Risk Board emphasized the necessity for greater transparency in the digital assets market, particularly regarding the reserves backing stablecoins.

Tether has faced significant criticism due to its lack of transparency in recent years. The crypto company, owned by Hong Kong-based iFinex, was fined $18.5 million in 2021 by the New York Attorney General's Office for allegedly providing misleading information about the fiat currency reserves backing its stablecoin. As part of the settlement, Tether was required to enhance its financial transparency.

In response to the negative allegations, Tether's leadership has taken to Twitter to defend the company. Furthermore, in the wake of Silicon Valley Bank's collapse, the company is actively working to reduce its reliance on the banking system. According to its latest audit report, Tether withdrew more than $4.5 billion from banks during the first quarter of 2023, resulting in a significant decrease in counterparty risk amidst the ongoing global economic uncertainty.

In addition, the company significantly increased its holdings of U.S. Treasury bills, reaching a new record of over $53 billion, which now accounts for 64% of its reserves. The report states that when combined with other assets, USDT is backed by 85% in cash, cash equivalents, and short-term deposits.

A similar strategic decision has been implemented by Circle, the stablecoin operator. It is reported that Circle has adjusted its reserves in order to minimize risk in light of the prevailing macroeconomic uncertainty. As part of this adjustment, Circle no longer holds Treasurys that mature beyond early June.

Earlier we wrote that the capitalization of USDC stablecoins fell by 12%.