The price of Yearn.finance (YFI) has experienced a rapid 45% decline in just a few hours, dropping from $14,500 to $8,300. This significant drop in value has garnered the attention of the cryptocurrency market, as Yearn.finance is considered one of the major players in the DeFi ecosystem. The substantial selloff has led to speculation about potential underlying issues or suspicious activities within the Yearn.finance platform.

Yearn.finance (YFI) Tumbles 45%

In a surprising development on November 18th, Yearn.finance (YFI) experienced a rapid 45% drop within a matter of hours, erasing a substantial portion of its recent gains. This sudden decline coincided with investors liquidating their YFI holdings amid the broader crypto market's recent selloff.

During the month of November, YFI's price had surged by over 160%, reaching a peak of $15,591. However, within the span of just 24 hours, its price plummeted from $15,591 to $8,421. This sharp drop resulted in over $250 million in market capitalization evaporating within hours, going from $525 million to $275 million. While the market capitalization is showing signs of recovery, the abrupt fall has left investors wary.

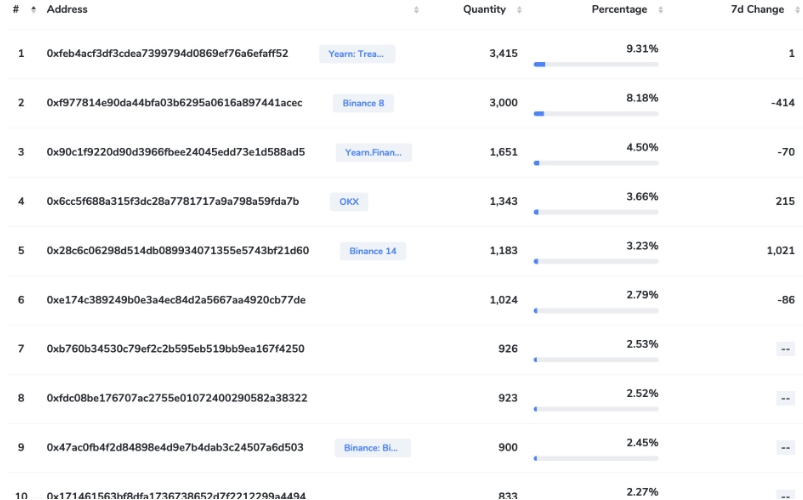

Some individuals suspect that this could be an exit scam orchestrated by insiders, given that nearly half of the total YFI supply is held in just 10 wallets, some of which are associated with cryptocurrency exchanges.

According to data from Coinglass, YFI has witnessed over $5 million in liquidations within the past 24 hours. At its peak, YFI contract positions had soared to $162 million, but presently, positions on major platforms have decreased. Additionally, there has been a notable surge in YFI open interest (OI), suggesting that traders are actively engaging in short positions on YFI.

Altcoins Continue to Pull Back

Major alternative cryptocurrencies continue to face downward pressure as part of the wider market downturn, while Bitcoin is gradually reasserting its dominance. The overall market capitalization has seen a drop of nearly $25 billion over the past two days. Analysts anticipate further retracements before renewed capital flows into alternative cryptocurrencies.

Ethereum (ETH), Ripple (XRP), Solana (SOL), Cardano (ADA), and other prominent altcoins have experienced a nearly 3% decline in the past 24 hours. DeFi tokens are particularly affected, exacerbating the decline in the global market capitalization.