The Origin Ether app places Ethereum (Ether) into Curve, Convex, stETH, rETH, and sfrxETH for deposits.

Origin Ether, a recently launched yield farming application, has achieved an impressive milestone within just two weeks. Data provided by DefiLlama, a blockchain analytics platform, reveals that the app has managed to accumulate more than $12 million in total value locked (TVL). TVL serves as a metric that gauges the monetary worth of assets contained within the smart contracts of an application.

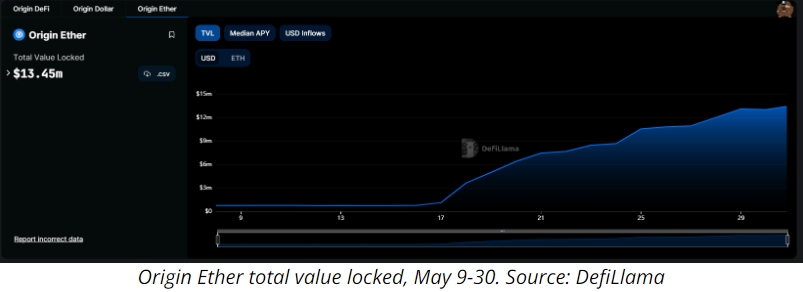

According to a spokesperson from the development team, the application was released on May 16. Prior to the launch, data from DefiLlama indicates that the app had already accumulated $793,000 in locked funds within its contracts. These funds may have been contributed by team members or other early partners.

After its public launch on May 16, deposits into Origin Ether (OETH) quickly increased, resulting in a Total Value Locked (TVL) exceeding $13 million by May 30. This represents a remarkable growth of around $12.6 million within a span of 14 days.

Origin Ether generates yield from Ether by depositing it into various liquid staking and decentralized finance (DeFi) protocols, as stated in the official documentation of the app. The platform employs an algorithmic market operations strategy on Curve and Convex to optimize returns. Prior to being deposited into Curve and Convex, a portion of the ETH is converted into liquid staking derivatives such as Lido Staked Ether (stETH), Rocket Pool Ether (rETH), and Frax Staked Ether (sfrxETH). This approach enables users to earn additional farming rewards from these providers.

Liquid staking protocols for Ether offer ETH holders the opportunity to stake their coins by partnering with a network of providers, receiving tokens that represent their deposits in return. These protocols have gained significant traction with the transition of Ethereum to a proof-of-stake consensus mechanism, which now allows for withdrawals.

On May 1, DefiLlama announced that liquid staking protocols had emerged as the leading category in DeFi, surpassing the Total Value Locked (TVL) of decentralized exchanges. By May 30, LayerZero, a cross-chain bridging protocol, had formed a partnership with the Tenet network to enhance the adoption of liquid staking within the Cosmos ecosystem.