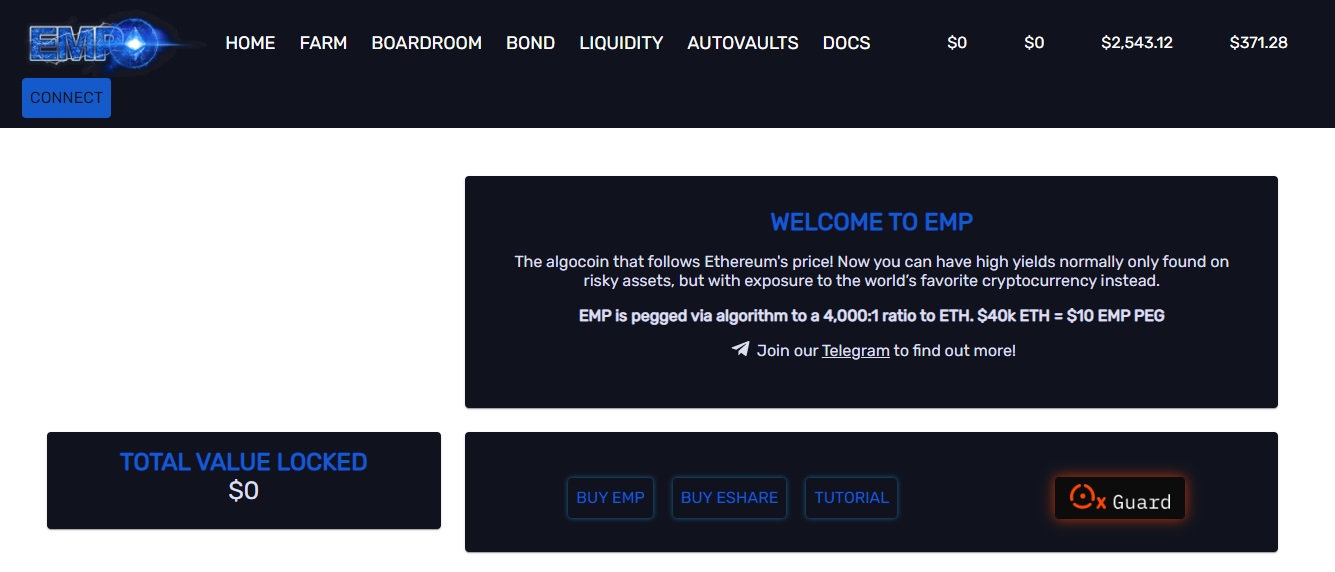

With the EMP MONEY project, you can get high returns that you can usually only get from risky assets, but instead you can use the world's favorite cryptocurrency.

About the EMP MONEY project

The $EMP algorithmic token serves as the backbone of a rapidly growing ecosystem, focused on providing liquidity and new use cases on the BSC network. The underlying mechanism of the protocol dynamically adjusts the supply of $EMP, raising or lowering its price relative to the price of $ETH.

Inspired by tomb.finance, which was originally inspired by Basis as well as its predecessors (EDollar and soup), emp.money is a multi-token protocol that consists of the following three tokens:

| 1 | EMP ($EMP). |

| 2 | MP Shares ($ESHARE). |

| 3 | EMP bonds ($EBOND). |

Unlike previous algorithmic tokens, $EMP is not pegged to a stablecoin – instead, it is pegged to $ETH. Due to the high cost of the ETH coin, the team decided to peg EMP to ETH at a ratio of 4000:1. One of the main drawbacks of past algorithmic tokens was the lack of use cases, leaving no good reason for anyone to want to use or hold them. To successfully support tethering in the long term, the EMP team will focus on innovation around enhanced functionality and use cases.

The annual interest rate will vary, depending on its value in US dollars. If $ETH rises in the price of $USD, $EMP goes with it. Likewise, if $ETH falls against the USD, $EMP will be worth less in USD, but this will not affect the peg. The only thing that can change the price of $EMP in terms of its value of $ETH - buying and selling it.

More about the coin defi site

Bonds - unique tokens that can help to stabilize the price of EMP around the peg (4000 EMP = 1 ETH) by reducing the circulating supply of EMP if TWAP (Time Weighted Average Price) falls below the peg (4000 EMP = 1 ETH).

Each new epoch during periods of contraction, EBONDs are issued at a rate of 3% of the current EMP circulating supply, with a maximum debt amount of 45%. This means that if the bonds reach 45% of the EMP circulating supply, the bond issuance is terminated.