Balancer - an automated market-maker with certain features that make it function as a self-balancing portfolio and price detector. The resource turns the concept of the index fund upside down: instead of paying a commission for changing the balance, you collect a commission from traders.

Contents:

Description of the Balancer project

Balancer is based on a specific surface that acts as a cost to exchange any pair of tokens in the balancer pool.

Any holder of 2 or more ERC20 tokens can be the liquidity providers, for example:

- managers, who want to have a control without having to deal with complex and / or expensive procedures;

- investors, whose ERC20 tokens are unnecessarily in their wallet and would like to make them work, so that they can earn commissions easily.

Traders can benefit from a diverse set of pools, each of them has different methods.

Platform economics

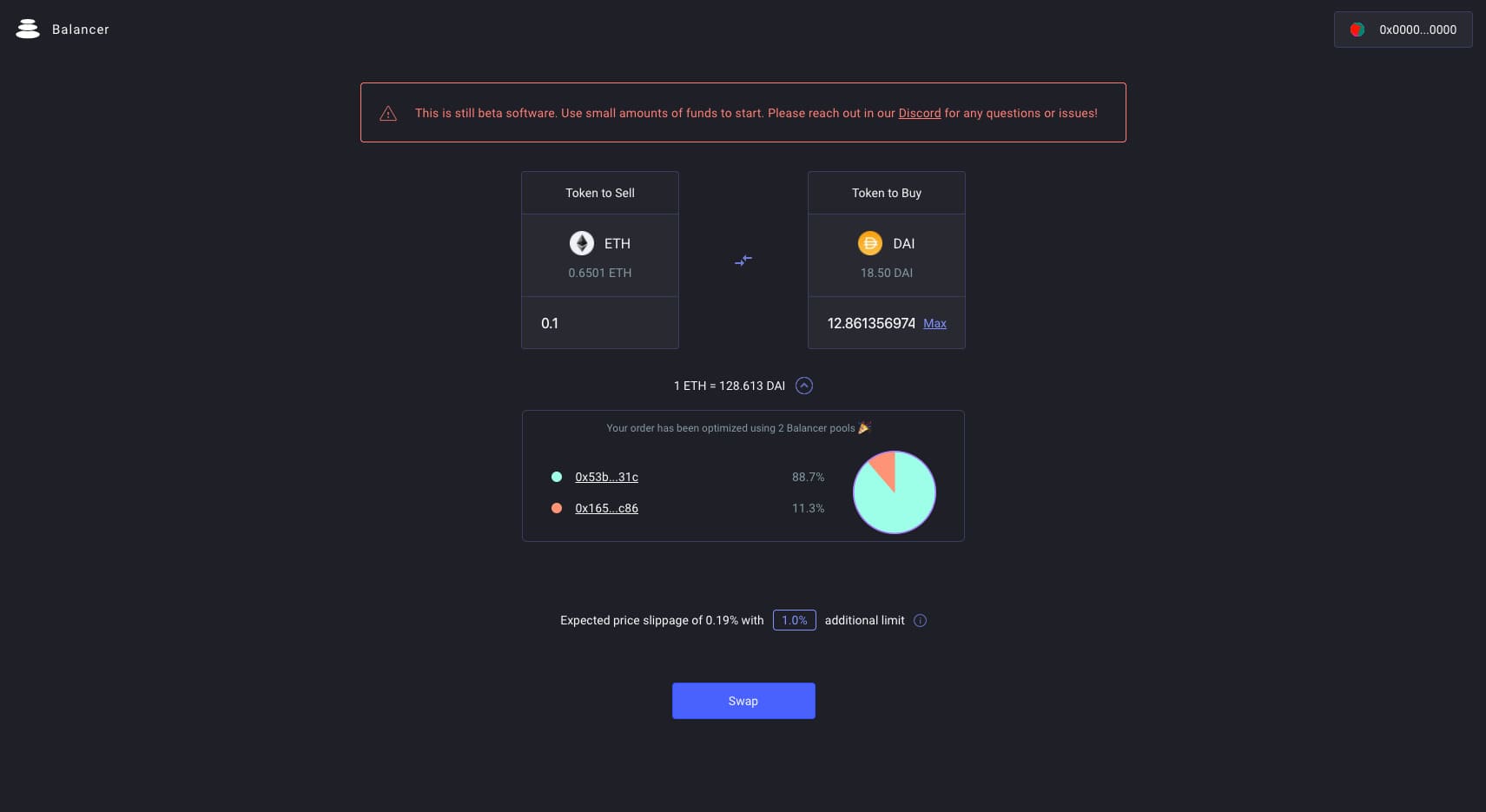

The main blocks of the protocol are Balancer Pools. Pools are smart contracts, integrated with the Balancer Protocol that contain a value in 2 or more ERC20 tokens. They can be considered as a portfolio of market-makers since each token, entering the pool, has a different weight of value and can be sold against any other of its tokens.

Two main features make Balancer Pools special:

| Price | The company guarantees that, even if the relative prices per unit of its tokens change, they constantly maintain a constant distribution of the desired value by tokens. |

| Fee | Each transaction that occurs in the platform pool brings a commission to the pool owner. |

Future versions of the platform may have some experiments with protocol tokens and liquidity analysis. Any protocol updates in this regard will be discussed with the user community on the project’s Twitter. The balancing protocol limits pools in the following ways:

- maximum number of tokens: no more than 8 different tokens can be in the pool;

- swap commission: commission can be selected in the range from 0.0001% to 10%;

- ERC20 compliance: pool tokens must comply with ERC20.

There are several additional ratios and balance restrictions that you can find by looking at the company's White paper. The main innovation of the protocol is a multidimensional function, used to determine prices between any two tokens in any pool. The balancing protocol allows market participants to buy tokens from the pool actively and charge a fee for this. Developers are working on a detailed Road Map. Release is planned at the end of 2020.