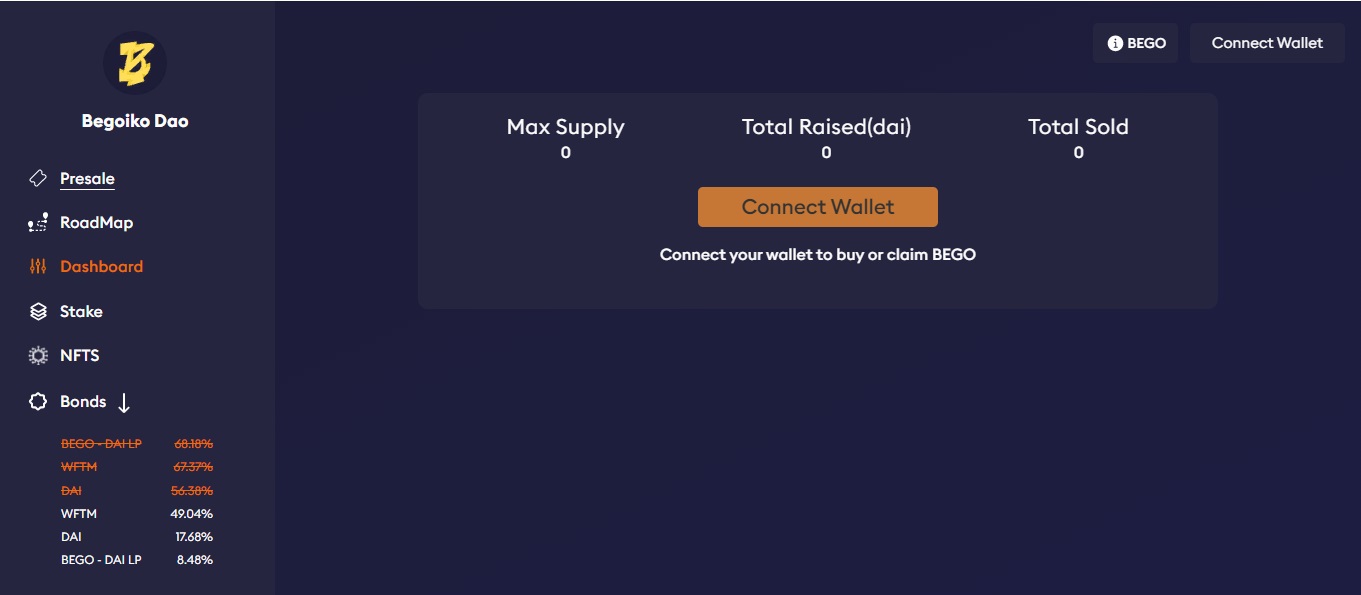

Begoiko DAO — the first decentralized reserve currency protocol, available on the Fantom Opera network, based on the BEGO token. Developers aim to create value for users by developing a range of use cases in the BEGODAO ecosystem. Each BEGO token is backed by a basket of assets (e.g. DAI, BEGO-DAI LP token, WFTM, etc.) in the BEGOIKOAO treasury, giving it an intrinsic value below which it cannot fall. A portion of the treasury proceeds will help to buy and burn BEGO tokens on the market, complete the development of the NFT market, acquire NTF premium assets and lend stable assets to holders of their own NFTs.

About Begoiko DAO

The goal of BegoDao — to build a socially controlled currency system, where the behavior of the BEGO token is controlled at a high level by the DAO. The developers believe that in the long term, this system can help to optimize stability and consistency so that BEGO can function as a global unit of account and medium-of-exchange currency. In the short term, the creators intend to optimize the system for growth and wealth creation.

BEGO and other assets can help to support BEGO (to increase intrinsic value). As a result, the value of BEGO tokens is at least equal to the total value of assets, held in the treasury, excluding future earnings from BEGOIKODAO’s unique profit strategies, NFT marketplace and lending/borrowing, so the value of the token is steadily increasing every day.

BEGO guarantees the market that there is always liquidity to facilitate the buying and selling transaction. BEGO is not obligated to pay high farm fees to incentive liquidity providers.

Staking and mining in DeFi

Market participants have two main strategies: staking and mining. Stakers stake their BEGO tokens in exchange for additional BEGO tokens, while miners provide DAI, WFTM or LP tokens in exchange for discounted BEGO tokens after a fixed vesting period.

Staking features:

| 1 | The main benefit for stakers comes from increased supply. |

| 2 | The protocol mints new BEGO tokens from the treasury, most of which is distributed among the stakers. |

| 3 | Thus, profits for stakers will come from their auto-adding balances, although price risk remains an important factor. That is, if the increase in the balance of tokens outpaces the potential drop in price (due to inflation), the stakers will profit. |

The main advantage for miners - price stability. Miners contribute upfront capital and are promised a fixed income at a set point in time; this income is in BEGO tokens and the profit of the bondholder will depend on the price of BEGO when the bond (minted by BEGO) matures. Miners benefit from the growth or static price of the TEM token.