Unlike limited blockchains like Bitcoin, which uses the Proof-of-Work (PoW) mechanism, Polkadot blockchain enables cross-chain transactions of any assets or data. This allows for easy processing of a high number of transactions per second and requires less infrastructure for its operation.

Polkadot utilizes a mechanism called Nominated Proof-of-Stake (NPoS), which is based on the interaction between "parachains" - network participants that connect to and secure the blockchain. Validators have the ability to validate both the relay chain and the parachains, making them a flexible and scalable solution for the blockchain.

The native token of the Polkadot blockchain is called DOT. This token can be used within the Polkadot network for various purposes such as trading, staking (locking to earn rewards), network governance voting, and payment of transaction fees.

Contents:

- What is the role and principle of Polkadot?

- Why stake Polkadot?

- How to invest in Polkadot (DOT) tokens?

- Rewards for staking DOT

- What are the risks of staking Polkadot?

What is the role and principle of Polkadot?

Polkadot was created in 2016 as a Layer 0 protocol and is a multi-chain blockchain network. This project was founded by Gavin Wood, co-founder of Ethereum.

The project aims to develop a decentralized, secure, and fair Internet known as Web 3.0 or Web3. This is achieved by facilitating interaction between previously incompatible and independent blockchain networks.

In the Polkadot staking system, DOT tokens are used for nominating validators who, in turn, receive rewards. Polkadot operates as an NPoS blockchain, where nodes validate transactions and secure the network. The NPoS mechanism involves a complex process where nominators select validators allowed to participate in the consensus protocol. The more participants and nodes distributed throughout the network, the more decentralized the network becomes, reducing the likelihood of successful blockchain attacks by malicious actors.

DOT token holders have the opportunity to interact with the Polkadot staking system in various ways, depending on their accessibility, knowledge level, and budget. If stakers cannot meet the minimum required amount for individual nomination (which may vary), they can join a nomination pool and proportionally distribute all the benefits and penalties.

Additionally, stakers have the ability to nominate validators. They often choose validators based on their reliability in verifying the legitimacy of transactions in the network. On the other hand, stakers can create and operate nomination pools if they are confident in their ability to identify competent and trustworthy validators, while charging a commission. Other participants can join such pools and contribute their cryptocurrency for staking.

At the top of the hierarchy are the validators, who are individuals and organizations with extensive experience and technical skills. They deploy nodes, which are servers running specialized software. This software enables validators to submit transaction blocks and verify them against the rules, making decisions on approval or rejection.

It is important to note that there are strict criteria that need to be met before becoming a validator in the Polkadot network. The requirements for validators are very high as they require specialized expertise and they will be responsible for a key node in the network.

Stakers who stake with a validator receive additional Polkadot tokens as a reward if the validator correctly verifies a transaction. However, if validators approve fraudulent transactions or attempt to cheat the system, they and their nominators will face slashing, resulting in a loss of a certain percentage of their staked DOT. Slashed DOT tokens will be added to the Polkadot treasury.

Why stake Polkadot?

Staking DOT is a mechanism that ensures network security, decentralization, and provides rewards. Participants who stake DOT contribute to the stability, development, and security of the network, receiving DOT tokens in return. DOT stakers can earn 10-22% annual returns in DOT tokens.

Staking participants have the opportunity to use their staked tokens to generate passive income and potential growth within the ecosystem. Stakers in the Polkadot network can actively participate in network governance, which further enhances the value of their tokens.

How to stake Polkadot (DOT)?

DOT token holders have the opportunity to participate in network governance by staking their tokens and earning rewards in DOT.

There are several common methods for staking DOT, such as using a hardware wallet, the Polkadot.js (UI) network interface, or the Polkadot mobile application.

To stake DOT, you can use the Polkadot.js user interface.

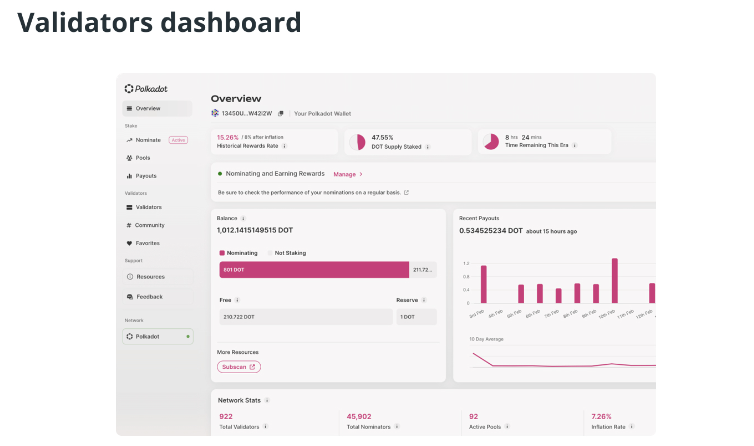

Staking participants can utilize the Polkadot.js user interface to participate as validators or nominators. Nominators have the ability to nominate up to 16 potential validators on the Polkadot platform. In the Polkadot network, validators play a key role in node governance and ensuring network security and reliability.

Validators and nominators receive rewards, with the amount of rewards for nominators depending on the performance of validators. Generally, the higher the performance of a validator, the greater the rewards received by both validators and nominators.

Let's look at the steps required to nominate a validator using the Polkadot.js user interface or the Polkadot mobile application:

- Create a Polkadot account.

- Go to "Network > Accounts > Accounts page."

- Click "+ Nominator."

- Select the controller account.

- Enter the amount to stake.

- Select the desired validator.

You have two options: either stake directly or join a nomination pool.

Assessing your own capabilities is one of the simplest ways to stake DOT. Users can stake directly as a nominator or join a nomination pool. The official Polkadot website provides a dedicated page that explains this process in detail.

Using a cryptocurrency exchange

This approach has become popular as it offers a relatively simple way to stake DOT through a pool on a cryptocurrency exchange. Users can purchase DOT tokens on their chosen exchange, then click the "staking" button to start participating in staking.

Staking participants can acquire DOT tokens using both fiat currency and cryptocurrency. After acquiring the tokens, they can either leave them in their exchange account or transfer them directly to a Polkadot wallet if they already have one. By staking DOT tokens on the Polkadot platform, stakers have the opportunity to earn significant rewards with minimal effort.

Examples of exchanges for Polkadot staking include Kraken, Binance, Coinbase, KuCoin, and Crypto.com.

Staking using an exchange can be a convenient alternative, but it also comes with its set of considerations:

| Name | Description |

|---|---|

| Lack of control over private keys | Users do not have control over their private keys, which requires trust in the exchange and its security. |

| Reduced staking rewards | Exchanges take a percentage of the rewards, resulting in lower earnings for users compared to self-staking. |

| Increased risk of hacks | The growing popularity of the exchange can lead to centralization and increased risk of hacking attacks and other malicious activities. |

Using a Wallet

Staking DOT using a wallet is more complex compared to using an exchange. When using a wallet, the chosen validator becomes the intermediary between the staker and receiving rewards.

Before starting staking, users need to choose up to 16 validators. Therefore, stakers must carefully evaluate their validators before using a wallet. It is important to consider the security, reliability, and reputation of the staking provider when selecting a validator or staking service.

To start staking DOT using a wallet, the staker first needs to acquire DOT tokens from an exchange and deposit them into the DOT wallet. There are several available wallet options for storing DOT, including:

- Ledger

- Polkadot.js

- Talisman

- Fearless

- Subwallet

- Nova

- Polkawallet

Users should choose their wallet based on the amount of DOT they plan to use and the purposes for which they intend to use their wallet.

Hardware wallets, also known as cold wallets, offer the most secure alternative as they store and process private keys in an offline environment. However, they often require more advanced knowledge and come with additional costs. Ledger is the only hardware wallet compatible with DOT.

Additionally, users have the option to choose a software wallet, which is convenient and free. While software wallets are easy to use, their security is not as high as hardware wallets. As a result, software wallets are likely more suitable for storing smaller amounts of DOT or for users with limited experience.

Staking Rewards for DOT

Delegators and stakers in Polkadot receive daily rewards in the form of DOT tokens, which depend on the number of blocks their stake in the network was able to create. Compared to other blockchains that utilize proof-of-stake and staking, Polkadot is likely to provide higher returns.

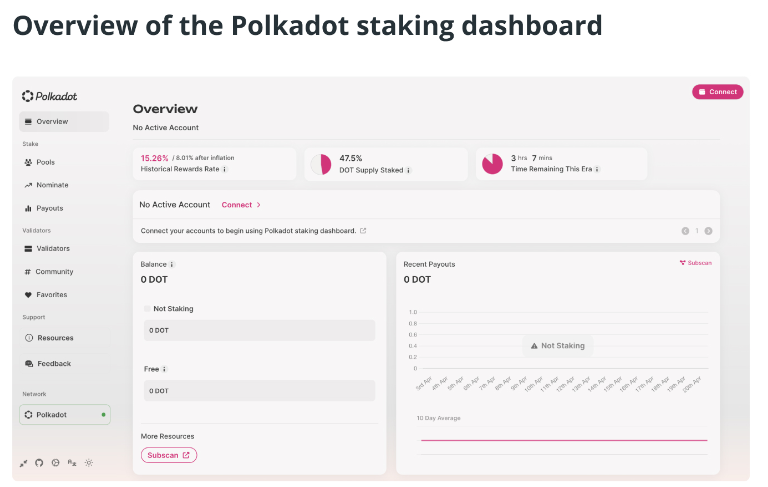

According to data from the cryptographic data aggregator Staking Rewards, the annual reward rate for Polkadot holders can vary depending on the wallet used, exchange, and validators. The maximum annual reward rate available to holders is 22%. The Polkadot dashboard provides a chain of data to display current rewards.

Similarly, staking DOT tokens can yield different rewards depending on the chosen method. Nominators, who do not run their own nodes but instead stake on validators, can earn a maximum annual reward rate of 14.1%. Meanwhile, node operator validators, who have additional responsibilities in maintaining the network, can earn up to 14.8% annual returns.

What are the risks of staking Polkadot?

Like any other investment, staking funds in Polkadot comes with certain risks. Currently, Polkadot offers a high annual rate, but it can vary depending on the current market conditions. Most staking platforms periodically review their reward interest rates based on market interest changes.

Despite the high security of the Polkadot staking system, there are certain risks associated with validator nominations. For example, in the event of a violation of terms and conditions, Polkadot may apply a punishment (slash) to the validator's stake, resulting in stakers losing a portion of their DOT stake.

Due to significant slashing, nominators need to exercise caution when selecting validators. They should choose validators who have proven reliability and a track record. Additionally, DOT has a 28-day unbonding period, which means stakers must wait at least 28 days before they can retrieve their tokens. This can be a drawback, especially in an extremely volatile market.

In the event that the chosen validator is unresponsive throughout the session, their bond will be forcefully terminated, and they may be excluded from the next session. Furthermore, during the unbonding period, the validator will not receive rewards.

When users stake DOT in a software wallet, its security relies on the security protocols provided by the wallet provider. It is beyond Polkadot's direct control and may be vulnerable to hacking or other external threats.