Binance Research, the analytical division of the same-named cryptocurrency exchange, released a report on the current state of decentralized finance (DeFi). In it, experts shared information with Incrypted about the development of the derivatives and prediction markets, as well as other aspects of this sector.

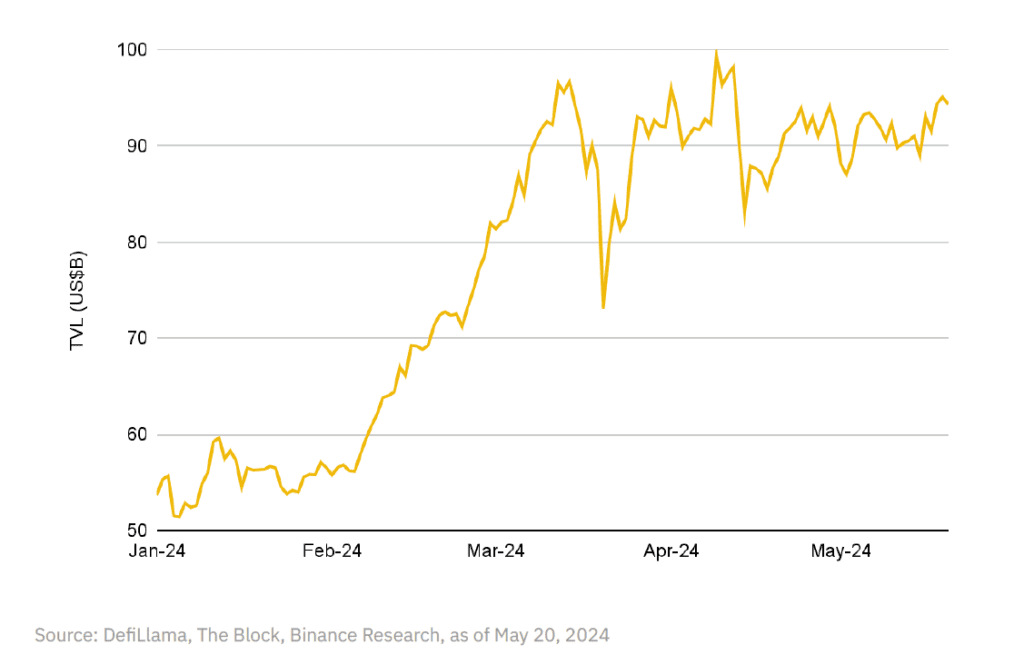

According to analysts, there was an active market rally at the beginning of the year, accompanied by a significant inflow of capital into DeFi. Specifically, in 2024, the total value locked (TVL) in this sector increased by 75.1%, reaching $94.9 billion.

Yield Investment Sector

Experts noted significant growth in the yield segment, where TVL increased by 148.6%, reaching $9.1 billion. Previously, this sector was one of the least developed and least studied areas in DeFi. According to the Binance Research report, the yield market plays a key role in the development of traditional finance (TradFi).

According to experts, the Pendle protocol holds a leading position in the implementation of interest rates in DeFi.

Stablecoin Market

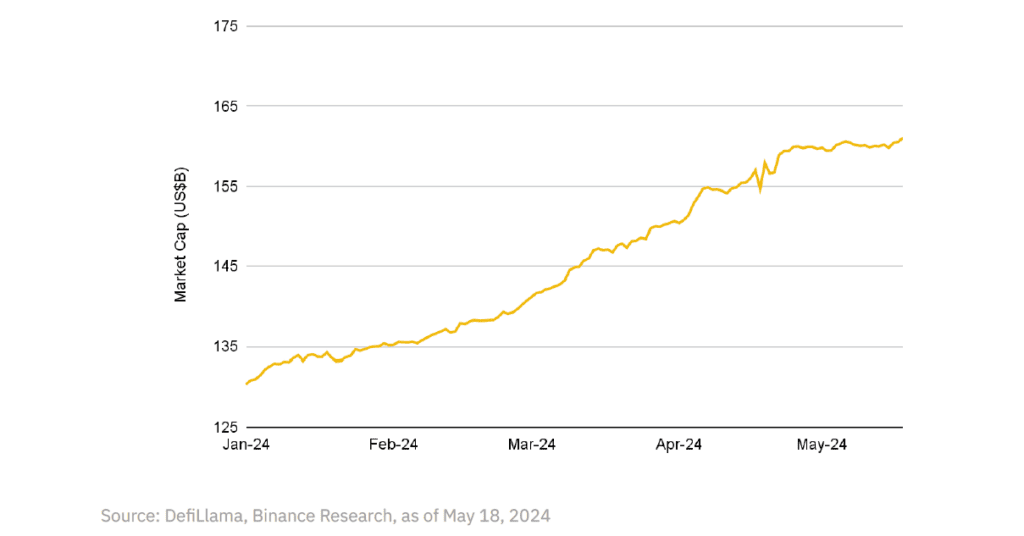

The market capitalization of stablecoins reached $161.1 billion, the highest figure in nearly two years. Experts also noted the "unique delta-neutral strategy of Ethena, which contributed to the project's capitalization growth by 2730% to $2.4 billion."

This growth, according to experts, shows no signs of slowing down, especially under the current high interest rate environment. Tether's record profit of $4.5 billion in the first quarter of this year underscores this trend.

Money Markets

Money markets, which include lending and borrowing, have shown significant growth since the beginning of the year. According to experts, the total value locked in this sector increased by 47.2%, exceeding $32.7 billion.

The Binance Research report mentioned key players in the lending market, such as Aave and Compound Finance. Additionally, modular products like Morpho Blue and MetaMorpho attracted "billions in deposits" due to high demand for more flexible credit solutions.

Prediction Market

The prediction market reached a record TVL of $55.1 million. The metrics of the Polymarket platform grew from $6.1 million in 2023 to $42 million in 2024, driven by activity related to the upcoming US elections.

In January 2024, Polymarket users predicted the probability of Donald Trump winning the presidential election, estimating his chances at 55%, while Joe Biden's chances were estimated at 38%.

Derivatives Market

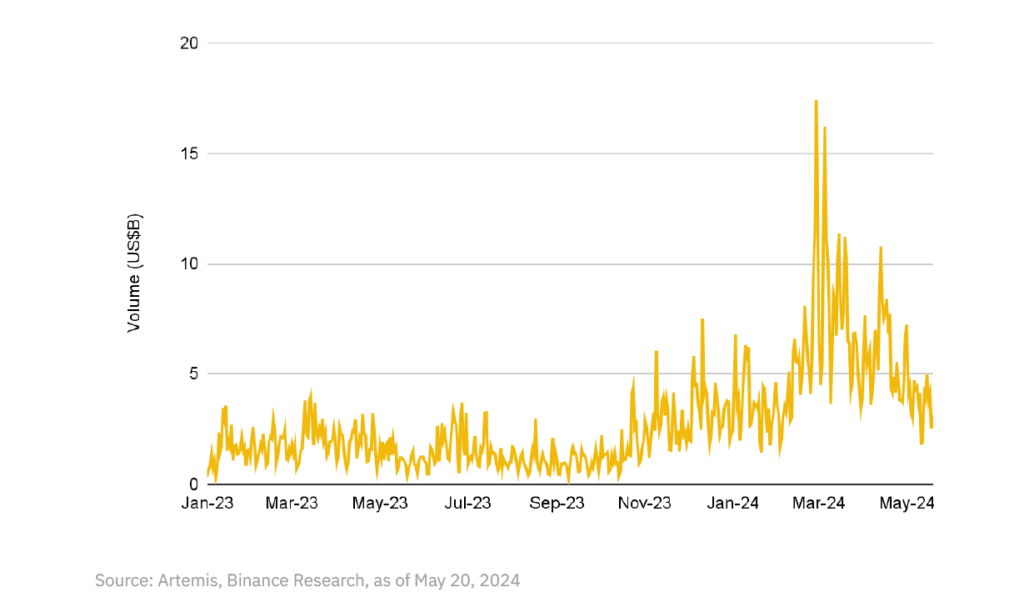

Since the beginning of 2024, the derivatives market in the DeFi sector has increased from $1.8 billion to $5.4 billion. This growth was driven by competition among new participants such as Hyperliquid, Aevo, and RabbitX, as well as the recovery of volumes from well-known players like dYdX and GMX.

It was previously reported that Binance Research experts prepared a report on the state of the cryptocurrency market in March 2024, noting positive dynamics and a market capitalization growth of 16.3%.