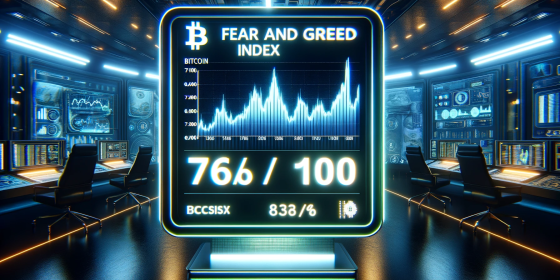

Bitcoin Fear and Greed Index has reached a historic high, nearly in two years. On January 9, 2024, this indicator stood at 76 out of 100, indicating extremely optimistic sentiments among market participants. This happened after the price of Bitcoin reached $47,000, the highest level since April 2022.

According to data as of 09:15 Moscow time on January 9, 2024, the price of Bitcoin was $46,825, which is 7.3% higher than the previous day's level. The market capitalization reached $917.5 billion, and daily trading volumes doubled, reaching $42.8 billion.

The Bitcoin Fear and Greed Index operates on a scale from 0 to 100, where 0 signifies extreme fear and panic, and 100 indicates high greed and euphoria. This indicator is calculated based on various factors that influence the emotional state of market participants. Changes in the price of Bitcoin, trading volumes, and price volatility play an important role in its calculation.

Special attention is also given to the analysis of data and sentiments expressed on social media. The index analyzes discussions and reactions related to Bitcoin to gauge the overall market sentiment. Therefore, the Bitcoin Fear & Greed Index is not an absolute market indicator but serves as a useful and effective tool for assessing the market situation and the sentiments of its participants.