In the world of financial investments, fear and greed play a significant role in shaping market sentiments and investor behavior. The Fear and Greed Index is a tool that helps analyze these sentiments in the market. It was developed by CNN Money in 2012 and has since become a widely used indicator.

Table of Contents:

- Understanding the Fear and Greed Index

- Components of the Index

- How to Analyze the Fear and Greed Index

Understanding the Fear and Greed Index

The Fear and Greed Index is a tool that helps investors analyze the potential behavior of the market based on the sentiments of its participants. This index was first introduced by CNN Money in 2012.

The Fear and Greed Index represents a scale ranging from 0 to 100, where 0 indicates maximum fear, and 100 indicates maximum greed. A value of 50 on the scale signals neutral sentiments in the market.

The original "Fear and Greed" index was created to assess the state of the stock market. However, the company Alternative.me adapted it for the cryptocurrency market.

Components of the Index

The Fear and Greed Index analyzes several indicators, each contributing a certain percentage to the overall index. Let's look at them:

- Volatility (25%) – This indicator reflects the average Bitcoin price volatility, the most capitalized cryptocurrency, over 30 and 90 days. This information helps understand the level of certainty among market participants (whether there are active buying, selling, or the market is stagnant).

- Market Momentum and Volume (25%) – The index compares Bitcoin trading volume and market activity over the last 30 and 90 days. The result helps assess the activity of buyers and sellers to determine whether positive or negative sentiments prevail.

- Social Media Mentions (15%) – To analyze this, the index uses hashtags on Twitter. An increase in mentions of a cryptocurrency in social media indicates heightened interest in the coins, which often indicates increased greed.

- Bitcoin Dominance (10%) – An increase in this indicator indicates an influx of new investors and possible market capital reallocation.

- Google Trends Analysis (10%) – Information about search queries obtained through Google Trends also allows analyzing market participants' sentiments. For example, an increase in queries related to crypto scams may indicate growing fear in the market.

- Survey Results (15%) – This parameter is temporarily not used in calculating the Fear and Greed Index.

How to Analyze the Fear and Greed Index

To understand the index, we use logic: the more people fear cryptocurrencies, the fewer buyers there will be, as investors rarely acquire assets they doubt. However, extreme values of the fear index may indicate a potentially good entry point into the market for long-term investors.

On the other hand, when people exhibit maximum greed, it may indicate that the cryptocurrency market is overbought. In such situations, there is a risk of price declines.

Here's the standard scale for interpreting the Fear and Greed Index:

| Fear and Greed Index | Description | Color |

|---|---|---|

| 0–24 | Extreme Fear | Orange |

| 25–49 | Fear | Yellow |

| 50–74 | Greed | Light Green |

| 75–100 | Extreme Greed | Green |

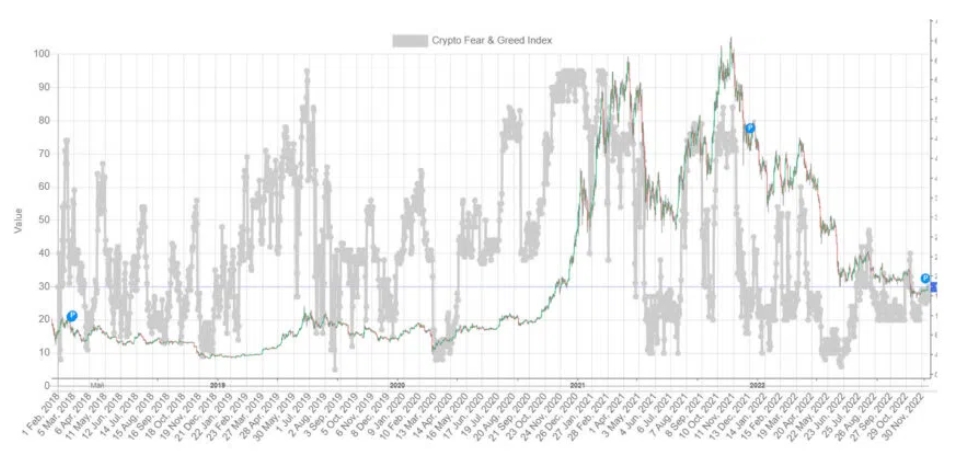

Observing the dynamics of the index and its correlation with the Bitcoin price chart helps us understand how signals work in the market. The time when the BTC price reaches its peak values often coincides with periods of maximum greed among investors, while price bottoms often correspond to extreme fear in the market.