In recent months, Coinbase has been steadily increasing the interest rates for USDC, beginning at 2% and gradually reaching the recently set rate of 6%.

Coinbase Raises USDC APY to 6%

MV Capital's Chief Investment Officer and partner, Tom Dunleavy, has shared a screenshot of an email from Coinbase, revealing that the enhanced 6% interest rate applies exclusively to the initial $250,000 worth of USDC. Any subsequent holdings would revert to a 5% interest rate.

Numerous users have reported disparities in the interest rates displayed on their dashboards. While some users have seen rates as low as 0.58%, others have maintained rates as high as 5% APY. Dunleavy suggested that these differences might be related to the amounts held in Coinbase and underscored the distinctions compared to other staking pools.

The US Securities and Exchange Commission (SEC) has recently taken legal action against Coinbase, accusing the platform of multiple securities offering violations. Notably, while the SEC has categorized the platform's staking service as an unregistered securities offering, the charges filed do not explicitly address the precise implications of Coinbase's USDC reward program.

As a result, the regulatory compliance status of Coinbase's ongoing USDC rewards program in relation to federal securities law remains uncertain.

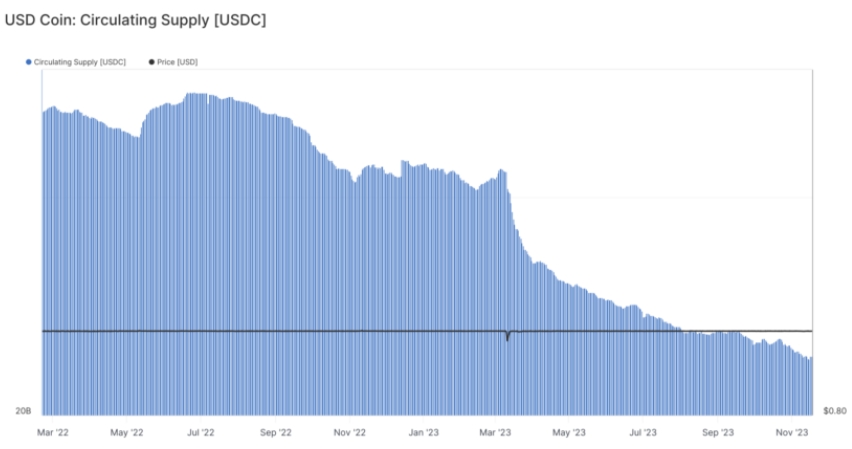

Circulating Supply Is in Free Fall

The supply of USDC has experienced a significant decline over the past year, dropping to less than 25 billion, marking its lowest level since 2021. In just the last month, the USDC supply has decreased by almost $1 billion, reaching $24.39 billion as of the most recent update.

This pattern began earlier in the year when USDC encountered difficulties related to its exposure to the US banking crisis. The issuer, Circle, disclosed that it had reserves of USDC at Silicon Valley Bank, which later experienced a financial collapse.

As a result of this revelation, USDC temporarily lost its peg and dropped to as low as $0.87 before subsequently rebounding. Despite improvements in market conditions, the market share of USDC continues to show a downward trajectory.