In recent times, there have been several discussions and articles suggesting the demise of decentralized finance (DeFi), primarily triggered by recent challenges in the DeFi space. These issues were caused by a poorly managed risk by a crypto founder and an exploit that led to a significant drop in the price of CRV tokens from Curve Finance.

Two notable pieces, an op-ed in CoinDesk and a report from JPMorgan, suggested that DeFi is either "dead inside" or in a "shrinking or stalling mode." However, these views seem to be far from reality.

DeFi is neither dead nor shrinking. The perception of DeFi that existed during the summer of 2020 has indeed changed, and for the better. That period was characterized by excessive bribery, liquidity, and discussions about yield. The hype around "yield farming" eventually subsided, and several decentralized platforms emerged as leaders, many of which adopted professional services for expansion.

However, the sector isn't flawless. There's an imbalance of power, with too much control in the hands of a few, a situation that mirrors traditional systems. DeFi has been financialized to an extreme degree, which can be problematic when programmers start acting as financiers.

Despite these challenges, it's important to remember that we're still in the experimental phase with this technology. We're learning how to use it, and mistakes are bound to happen.

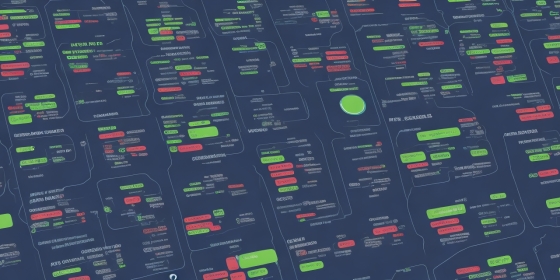

Over the past few years, we've built robust systems that operate outside traditional corporate structures, banking systems, or geographical boundaries. These systems have proven secure enough to attract the attention of financial and corporate giants like Mastercard, Visa, Coca Cola, Anheuser Busch, Nike, Starbucks, BNY Mellon, BlackRock, and Fidelity. These entities are investing resources to leverage this technology for increased efficiency.

While the ultimate dream for many is complete decentralization of all financial systems, the reality may not align with this vision, at least not in our lifetime. The challenge lies in finding the balance between self-executing code and the humans who create it.

The journey towards decentralization took a significant step with the DAO Summer of 2021. It became commonplace for anyone to join a decentralized autonomous organization via a Discord link, work for newly minted tokens, and have a say in the organization. However, when founders and investors decide to vote, we revert to a corporate hierarchy.

Despite the challenges, DeFi continues to grow and will face more hurdles as it interacts with the real world and individuals who haven't ventured into the crypto world.

On one end of the spectrum, we have those who wish to maintain the traditional economic, financial, and corporate system where the Federal Reserve controls the money supply, banks manage the money, and the government regulates our investments. In this system, major publicly held companies control our data, and there's little we can do about it.

On the other end, we have the Degens - traders, builders, and protocol creators who want a world run on computer-generated money and where everything is decided based on token count.

The reality will likely be somewhere in between. There are trillions of dollars in real estate, private and public companies, and debt instruments that need to be accounted for, traded, and borrowed against. These won't transition to on-chain overnight, but the world is moving in that direction.

As more assets are denoted on-chain, DeFi will be ready to offer loans, liquidity, and transparency. The growth of DeFi has shifted the center and swung the pendulum. It's likely that the transparency, efficiency, disintermediation, and self-custody that DeFi offers will become the norm across the entire financial system. Otherwise, traditional banks risk being outcompeted by the innovative lending, borrowing, and insurance solutions that DeFi offers.

The experiments may not be perfect, but they're necessary for progress. While the situation with Curve is unsettling, the move towards decentralization means we need to let the market work and allow protocols, teams, and systems to make the necessary adjustments.

Far from being dead or dying, DeFi is just beginning to shine.