Analysis of Litecoin Address Growth and Investor Activity

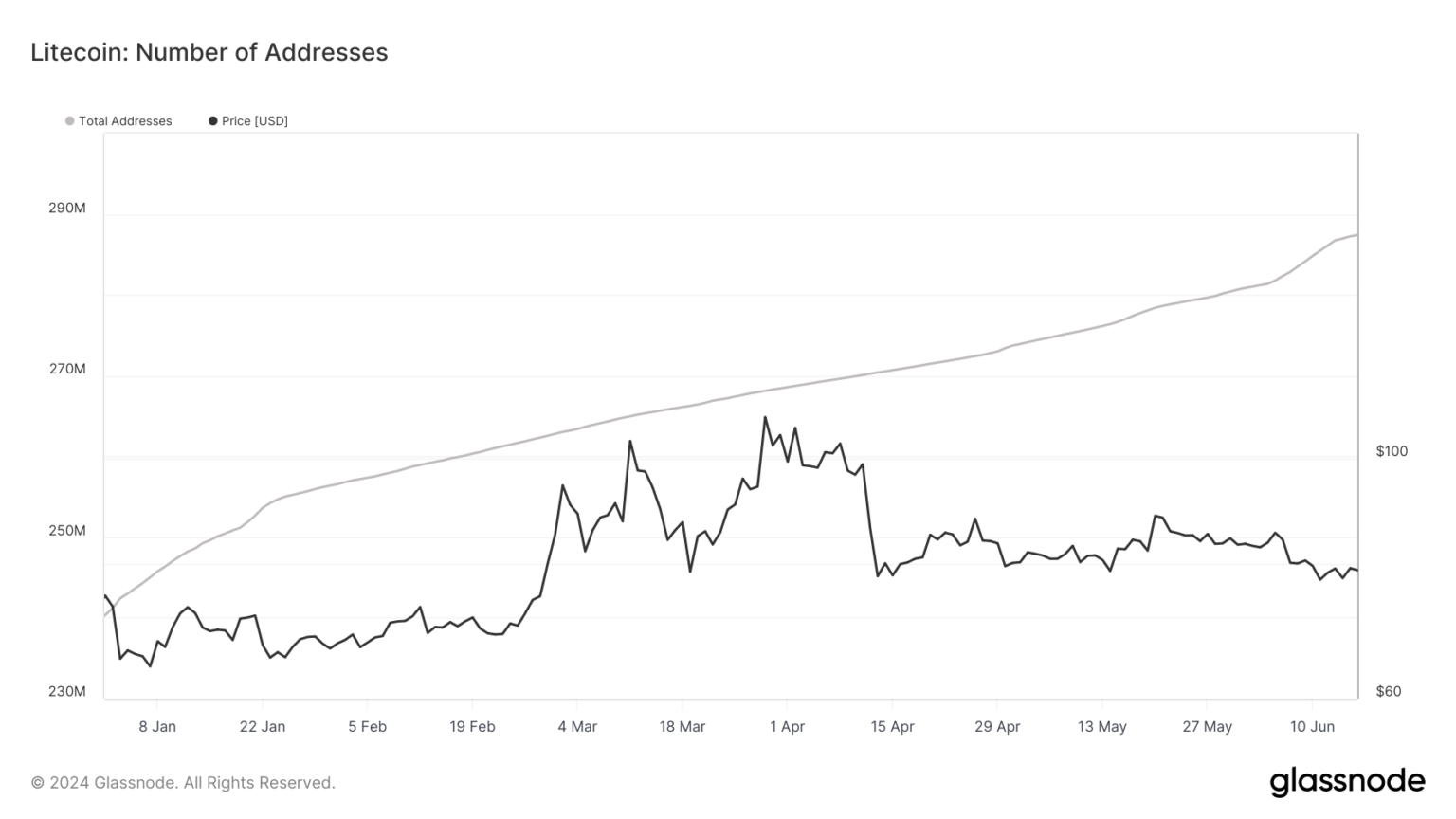

The blockchain activity of Litecoin demonstrated robust fundamentals between June 1 and June 16. Notably, there was a noticeable surge in the number of Litecoin addresses during this period, indicating heightened user participation and confidence among long-term investors.

Examination of Litecoin Address Growth

The data from June 1 to June 16 highlighted a significant increase in the total number of Litecoin addresses. By June 16, there were 287.42 million unique addresses compared to 283.80 million on June 1, showcasing a 1.28% rise. This consistent climb underscores the growing interest and reliance on the Litecoin network.

Source: Glassnode

Source: Glassnode

A notable surge in address creation was observed between June 3 and June 4, with an increase from 284.43 million addresses to 284.9 million, indicating a rise of 511,527 addresses. This uptick hints at a significant inflow of new addresses or users, potentially linked to specific events or increased network activity.

Similarly, between June 12 and June 13, another substantial shift occurred. On June 13, there were 286.7 million addresses, up by 650,128 from the previous day's 286.11 million. This marked the second-largest increase in the dataset, suggesting another phase of heightened activity.

From June 15 to 16, there was a rise of 165,306 addresses, increasing from 287.25 million to 287.41 million. Although smaller than earlier spikes, this increment indicates sustained interest and engagement in the network.

Market Sentiment and HODLer Activity

The continual growth in the number of addresses reflects positive market sentiment, portraying increased interaction and trust in the Litecoin network. This sentiment is further reinforced by the Hodler Net Position Change indicator, monitoring the net movement of long-term investors' Litecoin holdings.

Offering insights into active market holdings, this indicator reveals whether HODLers are accumulating or selling their Litecoin assets. Complementing this data, recent figures from CoinMarketCap indicate a value of approximately $71.08 for Litecoin (LTC), showing a 0.91% increase from the previous day amidst a bearish trend over the past week.

The recent market performance of Litecoin, influenced by founder Charlie Lee's affirmations regarding the cryptocurrency's resurgence and potential to outpace Bitcoin in BitPay cryptocurrency payments, underscores the optimistic market outlook and growth trajectory of Litecoin.