As of the beginning of November, the volume of stablecoins in the market was just over $126 billion, but by December 7, this figure had increased to $133.76 billion.

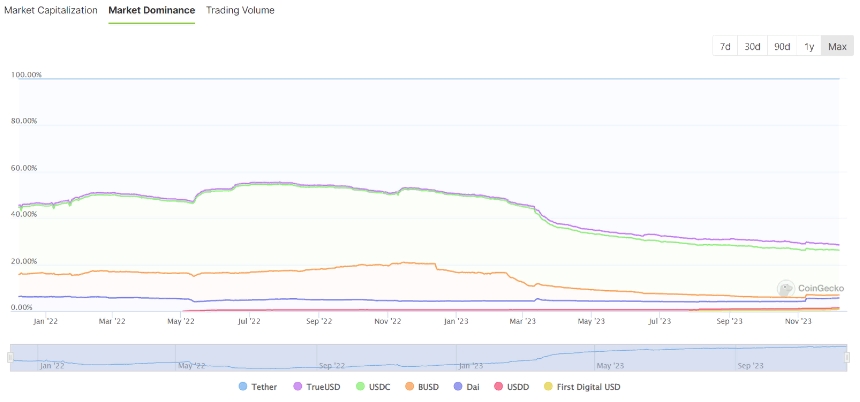

According to CoinGecko data, the capitalization of Tether (USDT) reached $90 billion for the first time in the middle of this week. The share of USDT in the stablecoin market is 71.45%.

The shares of the second and third largest stablecoins, USDC and DAI, decreased to 19.28% and 4.26% respectively.

Over the past month, the supply of Tether (USDT) has increased by 6%, and over the past year, it has grown by more than 35%, starting from $66.24 billion and reaching $90.044 billion. This growth indicates that a significant capital is flowing into the cryptocurrency market, possibly preparing for a new period of growth.

The number of active USDT addresses with balances has increased from 231,000 to 245,800 over the past two months. According to Block Research data, the volume of Tether used in smart contracts has grown from $4 billion to more than $6 billion.

There is also an increase in the supply of USDT on the Tron network. CoinMetrics has recorded an increase in the number of active addresses on this blockchain network from 40,000 to 100,000 since late autumn. USDT on Tron is gaining popularity in Latin America, Asia, and Africa due to its low transaction fees.