Major participants in the cryptocurrency industry evade answering crucial questions about transparency and resort to using the term "decentralization" to obscure the details of their operations.

Contents:

- Opacity and secrecy: Research findings on cryptocurrency companies and their business practices

- Transparency challenges in the cryptocurrency industry: Revelations after the FTX crisis

Opacity and secrecy: Research findings on cryptocurrency companies and their business practices

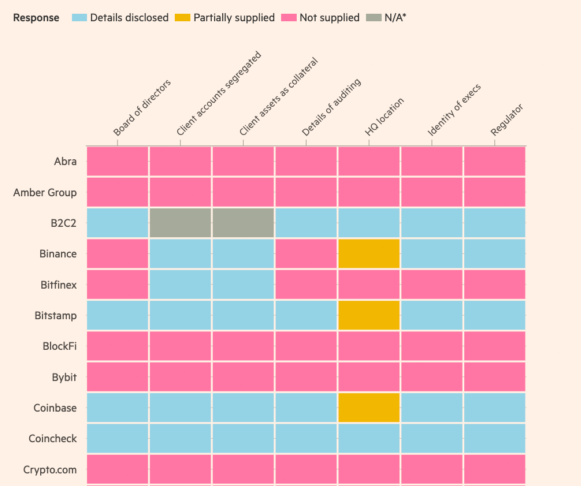

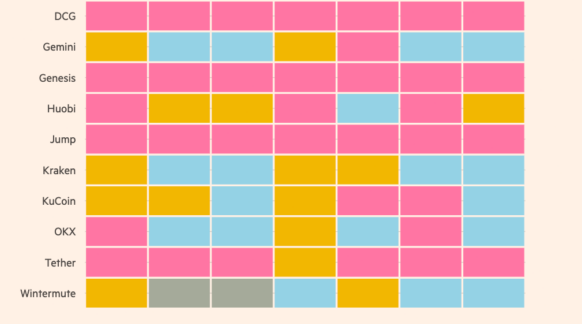

In a recent study conducted by the Financial Times, some leading cryptocurrency companies are avoiding disclosure of their business practices. According to the publication, 21 companies specializing in Web3 were surveyed. However, eight of them refused to provide even basic information.

Questions were raised about the company's main office location, legal basis of its operations, composition of the board of directors, and the conduct of audits. Doubts were also expressed regarding certain business practices, such as the segregation of investment funds, provision of loans based on client assets, as well as trading and custodial operations.

Crypto companies that were queried:

1. BlockFi 2. Crypto.com 3. Genesis 4. Jump

Companies often face accusations that they use the term "decentralization" to avoid regulation applicable to specific jurisdictions. While some companies already have their headquarters, others still need to clarify this situation.

Transparency Challenges in the Cryptocurrency Industry: Revelations after the FTX Crisis

Following the financial crisis that occurred with FTX last year, cryptocurrency companies have been facing demands for greater transparency. Despite exchanges starting to provide evidence of claimed reserves, some have encountered issues due to the lack of audits or failure to provide confirmations of their obligations.

After the departure of FTX, one of the largest companies in the cryptocurrency sphere, the spotlight and attention turned to the cryptocurrency exchange Binance. As a result, it attracts intense scrutiny not only from regulatory bodies but also from the media, who constantly question its activities.

Shortly after FTX's bankruptcy, auditing firm Mazars exercised caution and withdrew its audit of Binance's reserves, as well as discontinued providing services to other cryptocurrency exchanges, explaining that they did not want to mislead the public with their reports. They only released a report on agreed-upon procedures (AUP), which is not a full audit report.

Subsequently, Binance announced that even the leading "Big Four" auditing firms refuse to audit the exchange's reserves. These firms include:

- PricewaterhouseCoopers

- Deloitte

- KPMG

- EY

The situation became further complicated due to concerns raised by the U.S. Securities and Exchange Commission (SEC) regarding the legality of conducting audits on cryptocurrency exchanges.

Tether, the issuer company of the stablecoin USDT, has always faced criticism for the lack of proper auditing. In a survey conducted by the Financial Times, Tether, like most other surveyed companies, did not provide complete information about auditing procedures.

As more jurisdictions seek to establish clear norms and rules, ensuring transparency at all levels will become more convenient and effective.

Previously, analysts wrote that Binance is investing in Twitter.