Yield farming is an investment strategy where users lend their crypto assets to DeFi protocols to earn passive income in cryptocurrency. Users provide or borrow cryptocurrency on a DeFi platform and earn tokens in exchange for providing liquidity.

Contents:

- Types of Yield Farming?

- Calculating the Yield of Yield Farming

- Popular Yield Farming Protocols

- Risks of Liquidity Farming

- Conclusion

The world of DeFi is complex, but some users have learned strategies that allow their cryptocurrency to generate as much income as possible.

Yield farmers are farmers who want to increase income. They can use a more complex strategy. For example, these farmers can constantly move their cryptocurrencies between several DeFi platforms to optimize their income.

Quick Facts:

- Yield farming is the process by which token holders maximize rewards on various DeFi platforms;

- Yield farmers provide liquidity for different token pairs and receive rewards for this;

- The most profitable and reliable yield farming protocols include Aave, Curve Finance, Uniswap and many others;

- Liquidity farming can be risky due to price volatility, smart contract manipulations, and much more.

Types of Yield Farming?

Liquidity farming allows investors to earn income by providing cryptocurrencies or tokens to decentralized applications (Dapps). Dapps come in various forms - DEX, crypto wallets, decentralized social networks, marketplaces, and much more.

Yield farmers typically use decentralized exchanges (DEX) for lending, borrowing, or staking coins to earn interest and speculate on price fluctuations.

Types of liquidity farming:

| Parameter | Description |

|---|---|

| Liquidity Provider | Users deposit two coins on DEX to provide trading liquidity. In return, they receive LP tokens. They earn fees from token exchanges and can stake LP tokens to earn more income. |

| Lending | Holders of cryptocurrencies lend their funds to borrowers through smart contracts and earn interest on the loan. |

| Borrowing | Farmers use one token as collateral to borrow another. They farm income with borrowed coins while retaining their original assets, which may increase in value over time. |

| Staking | Users stake tokens in POS blockchains and earn interest for contributing their tokens to the network's security. |

Profitability in DeFi is ensured by a smart contract - a fragment of code that automates financial agreements between two or more parties.

Calculating the Yield of Yield Farming

The expected yield is usually stated in annual terms. The projected earnings are calculated for the entire year.

The two commonly used indicators are: Annual Percentage Rate (APR) and Annual Percentage Yield (APY). The annual percentage rate does not take into account the accrual of compound interest - reinvestment of profits to obtain greater profit, - but APY takes into account.

Keep in mind that these two types of interest are just forecasts and estimates. Even short-term benefits are difficult to predict accurately. Why? Income farming is a highly competitive, rapidly evolving industry with rapidly changing interest rates.

If a liquidity farming strategy is successful for some time, other farmers will use it too, and eventually it will stop yielding significant profit.

Since APR and APY are outdated market indicators, DeFi will have to build its own profit calculations. Weekly or even daily expected yields may make more sense due to the rapid pace of change in DeFi.

Popular Yield Farming Protocols

There are several popular protocols listed below.

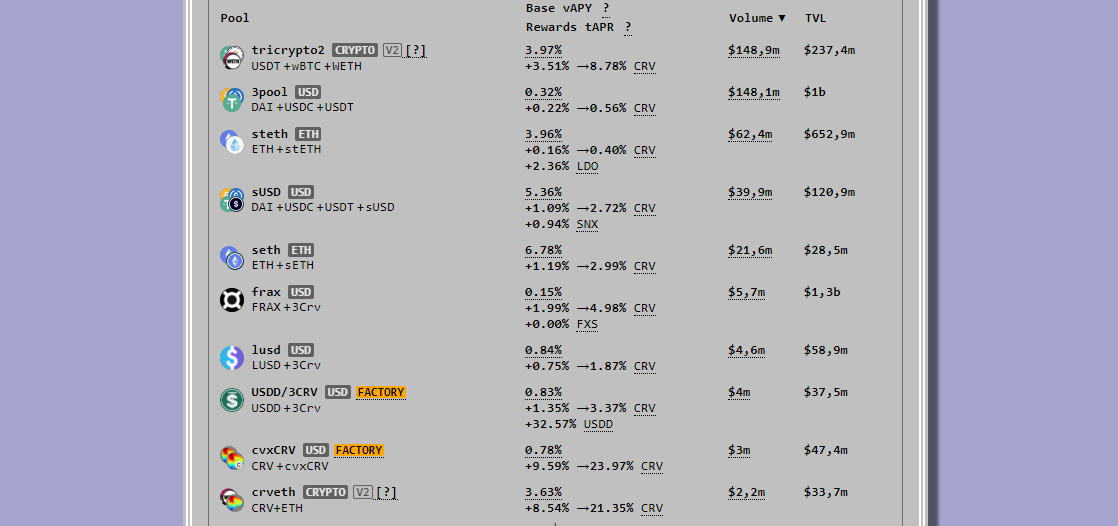

Curve Finance

Curve is one of the largest DeFi platforms in terms of total locked value. The platform has nearly $4.9 billion. Thanks to its own market-making algorithm, the Curve Finance platform uses locked funds more than any other DeFi platform - a profitable strategy for both exchanges and liquidity providers.

Curve offers a large list of stablecoin pools with a good annual percentage rate that are pegged to fiat money. It also supports high interest rates ranging from 1.9% (for liquid tokens) to 32%. As long as the tokens do not lose their peg, stablecoin pools are quite safe. Irreparable losses can be completely avoided, because their value will not change sharply compared to each other. Curve, like all DEXs, carries the risk of temporary losses and smart contract failure.

This platform also has its own token CRV, which is used to manage Curve DAO.

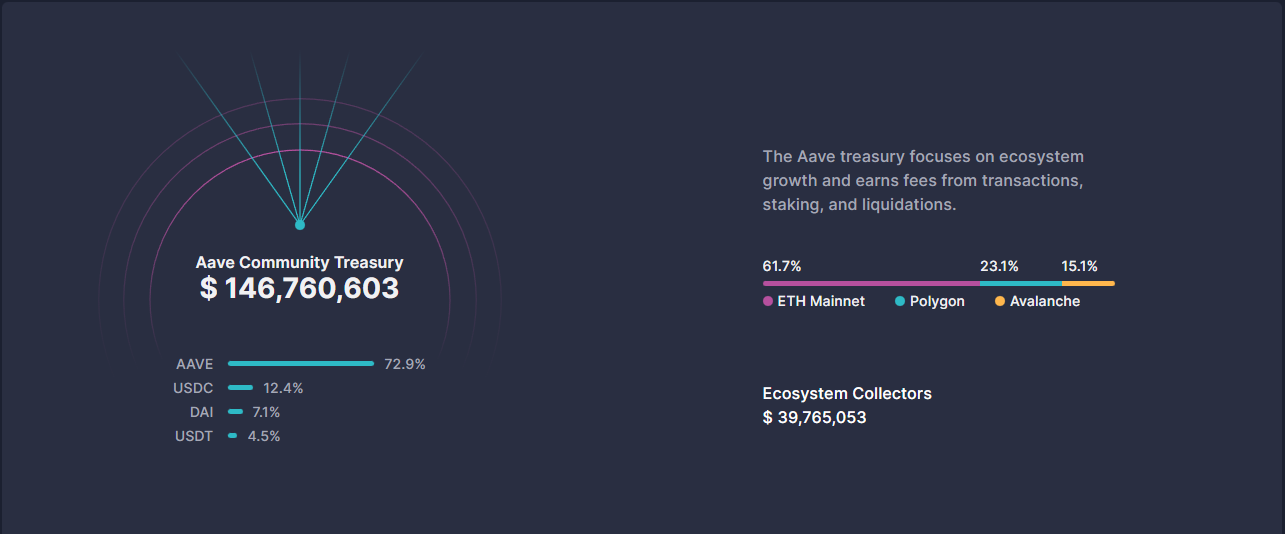

Aave

Aave is one of the most widely used platforms for yield farming stablecoins with a TVL of more than $5.9 billion and a market capitalization of over $900 million.

Aave also has its own token AAVE. This token encourages users to use the protocol by providing benefits such as payment savings and voting rights in governance.

Liquidity pools usually work together when it comes to yield farming.

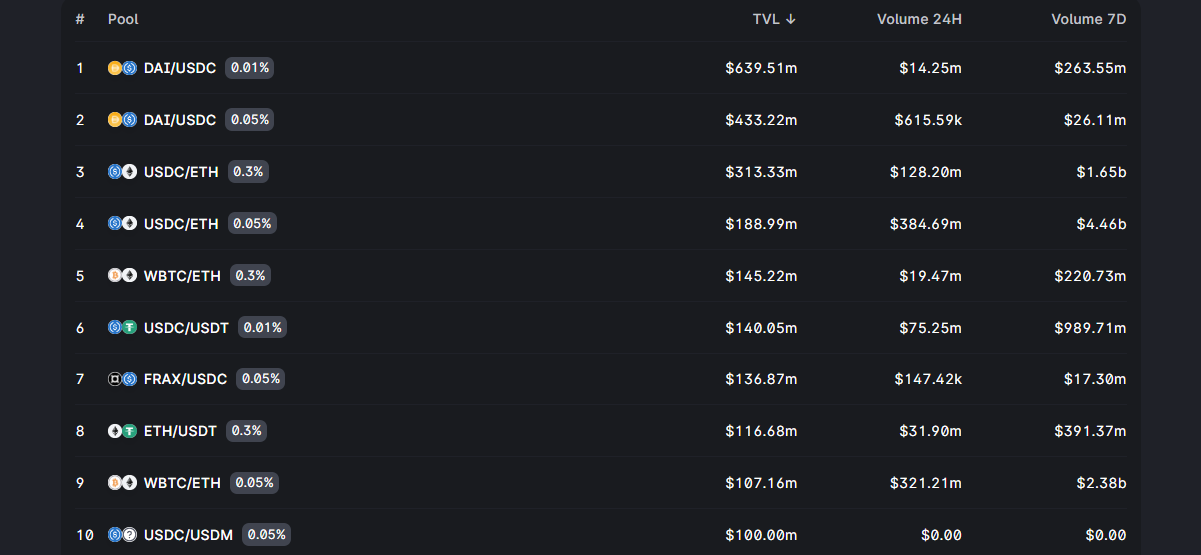

Uniswap

Uniswap is a DEX exchange that allows the exchange of a large number of tokens. Liquidity providers invest an equivalent of two tokens to create a market (liquidity pool). Traders can then trade against the liquidity pool. In exchange for providing liquidity, liquidity providers receive a commission for transactions that occur in their pool.

Thanks to its impeccable nature, Uniswap has become one of the most popular platforms for trustless token exchange. Uniswap also has its own governance token, UNI.

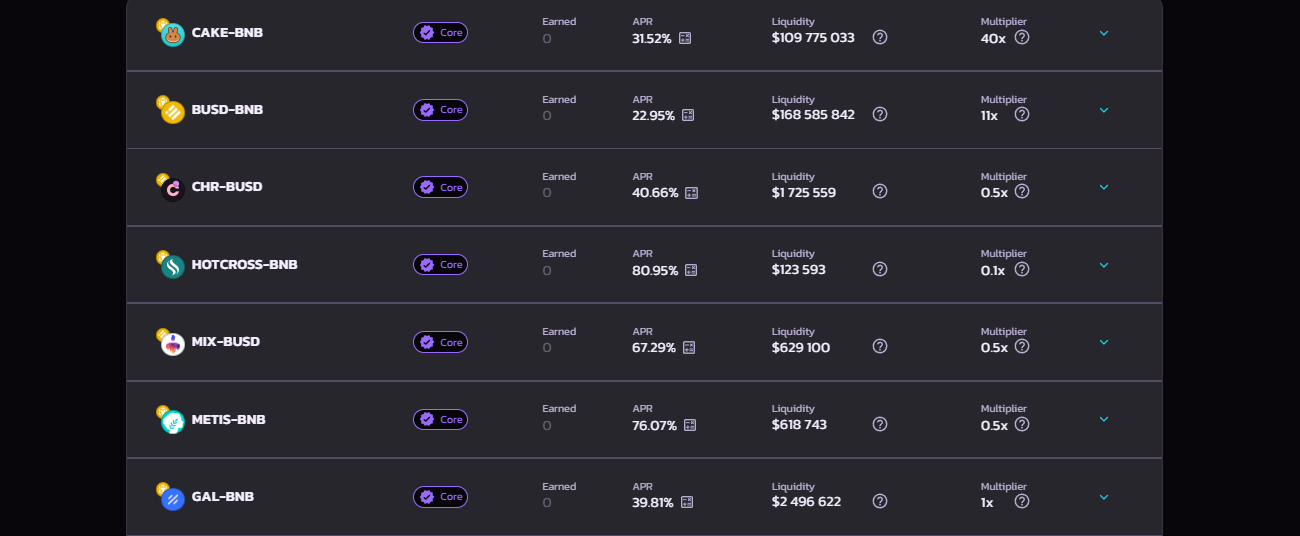

PancakeSwap

PancakeSwap operates similarly to Uniswap, however, PancakeSwap operates on the Binance Smart Chain (BSC), not the Ethereum network. It also includes several additional features focused on gamification.

PancakeSwap is subject to the same risks as Uniswap, such as impermanent loss due to large price fluctuations and smart contract failure. Many tokens in PancakeSwap pools have insignificant market capitalization, exposing them to the risk of impermanent loss.

PancakeSwap has its own token called CAKE, which can be staked on the platform and also used to vote on proposals for platform improvements.

Liquidity Farming Risks

Yield Farming is a complex process that exposes both borrowers and lenders to financial risk. When markets are volatile, users face increased risk of impermanent loss and price slippage. Below are some risks associated with such farming:

Rug pulls

Rug Pulls are a form of fraud where a cryptocurrency developer collects money from investors for a project and then abandons it without returning funds to the investors. According to a CipherTrace research report, about 99% of major fraud in the second half of 2020 were attributed to Rug Pulls and other scams to which farmers are particularly vulnerable.

Regulatory Risk

Cryptocurrency regulation remains shrouded in uncertainty. The Securities and Exchange Commission has declared some digital assets as securities, placing them under its jurisdiction and allowing them to be regulated. State regulators have already issued cease and desist orders for centralized crypto lending sites like BlockFi, Celsius, and others. DeFi lending and borrowing ecosystems could suffer if the SEC declares them securities. Although DeFi is designed to be immune to any central authorities, including government decrees.

Volatility

While tokens are locked, their value can fall or rise, which is a huge risk for farmers' income, especially when there is a bearish cycle in the cryptocurrency markets.

Smart Contract Hacks

Most dangers associated with liquidity farming are related to the smart contracts on which they are based. The security of these contracts is improving through better code verification and third-party audits, but hacks in DeFi are still common.

DeFi users should conduct research and exercise due diligence before using any platform.

Conclusion

Is Yield Farming profitable? Yes. However, it depends on how much money and effort you are willing to invest in the yield farm. While some high-risk strategies promise significant profit, they generally require a full understanding of DeFi platforms, protocols, and complex investment chains to be most effective.

If you are looking for a way to earn passive income without investing a lot of money, try placing some of your cryptocurrencies in a time-tested and reliable platform's liquidity pool and see how much you earn. After you have formed a knowledge base and gained confidence, you can move on to other investments or even buy tokens directly.