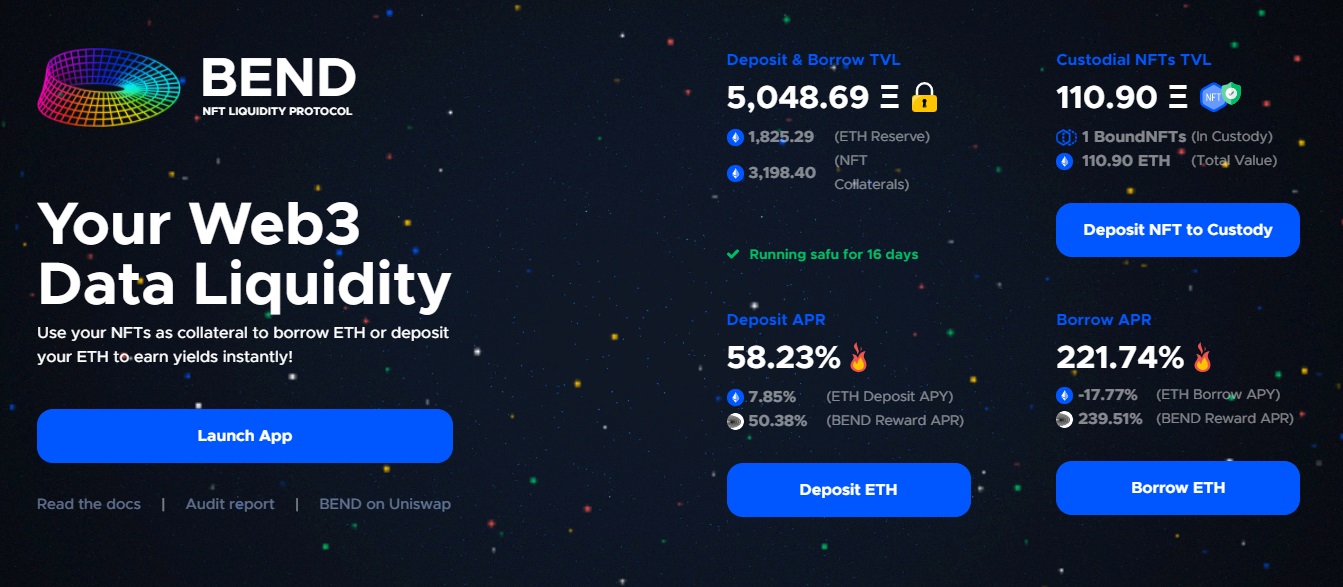

Bend DAO — a decentralized NFT liquidity protocol, based on a peer-to-peer pool. Contributors provide ETH liquidity to the lending pool to earn interest, while borrowers can instantly borrow ETH through the lending pool, using NFTs as collateral.

About Bend DAO

The Bend protocol allows NFT assets to be pooled and converted into ERC721, representing linked NFTs to realize NFT credits. Borrowers (NFT holders) will combine the NFT into one single token (boundNFT) via the Bend protocol to function as a single unit of collateral.

| 1 | Initiate an instant NFT lending contract to borrow ETH from the pool. |

| 2 | Maintain your NFT collateral ratio by redeeming ETH at any time. |

| 3 | Return the NFT when you pay off the NFT loan. |

To avoid losses, caused by market fluctuations, the borrower will have a 48-hour liquidation protection period to repay the loan. Bend will collect and distribute airdrops to boundNFT holders when their NFTs are in the collateral pool. Additionally, borrowers can claim NFT rewards through other protocols while keeping the NFT in a Flashloan-enabled collateral pool.

BoundNFT is non-transferable to avoid the risk of theft. On the other hand, boundNFT has the same digital self-expression that can be used on Web2 social media platforms that support the NFT avatar. The borrower's NFT collateral is locked on the coin defi platform. Once the total debt exceeds the value of the collateral, the collateral is liquidated at auction and the auction price cannot be lower than the total owed amount. Thus, the main creditor will not be lost.

More about defi app

BEND Airdrop will be the first stage of the BEND Fair Launch. 500,000,000 BEND (5% of the total BEND supply) will be allocated to the entire NFT community as part of the Airdrop. BEND holders can vote on which NFTs the Bend protocol can support as collateral to borrow ETH and provide liquidity. This will benefit all NFT holders if the supported liquidity of the NFT improves. To avoid unnecessary GAS costs, eligible users can claim BEND for a specified period of time.