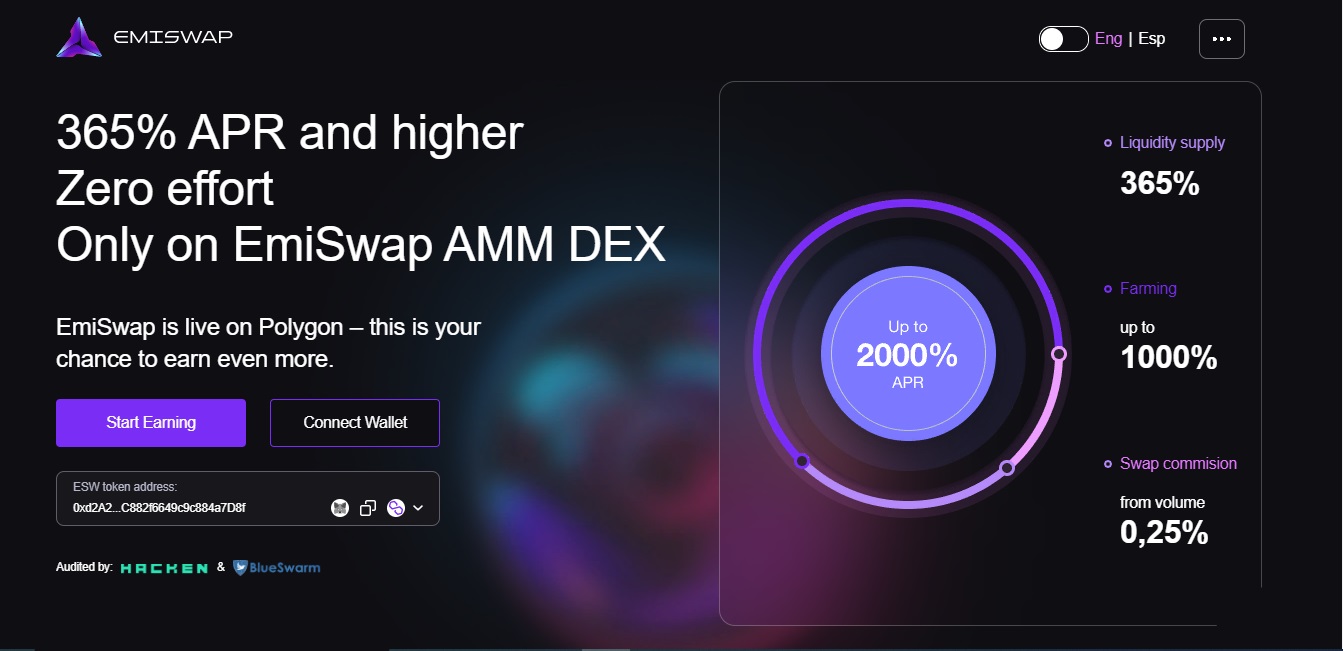

EmiSwap — a proven, high APR cross-chain AMM DEX that offers users a secure environment for daily high returns from liquidity mining and farming.

How does DeFi EmiSwap work?

EmiSwap — an AMM DEX, a project in the EmiDAO ecosystem and the world's first truly standalone DAO. 100% of the trading commission on the DEX is shared between liquidity providers and ESW token holders. Liquidity providers receive 0.25% from any transaction on the DEX and ESW - 0.05%. This makes ESW a governance token that incentivizes the community and allows the owner to vote on the development of the coin defi project.

How does DeFi work:

| 1 | Swap tokens for EmiSwap or add liquidity to pools to earn a share of trading fees. |

| 2 | The amount does not matter: even if you exchanged tokens for $5, you will receive a 100% refund of the gas you paid. The refund will be added to your native ESW token balance. |

| 3 | These ESWs make you eligible for more rewards. |

The developers of EmiSwap took the AMM Mooniswap protocol as a basis. This protocol was developed, based on the Uniswap V2 AMM, which the Mooniswap team has enhanced with an anti-lead protection solution to prevent liquidity providers from losing profits due to temporary price slippage.

Thus, EmiSwap — an open source decentralized fork of Uniswap V2 and Mooniswap, with increased performance and additional features such as scalability, DAO management, cross- and multi-block support, real revenue sharing, gamified NFT mechanics, fair minting, interoperability, ESW farming and staking, as well as generous rewards for early trades and LP.

Commissions and dividends in DeFi

EmiSwap charges a 0.3% fee on every exchange, just like Uniswap. 0.25% is automatically distributed to liquidity providers and the remaining 0.05% is distributed to ESW holders.

Dividends are awarded to all ESW holders. Already accrued dividends are not transferred along with the transfer of ESW to another user, they are considered to belong to the original owner and can be received by him after the implementation of the withdrawal functionality.