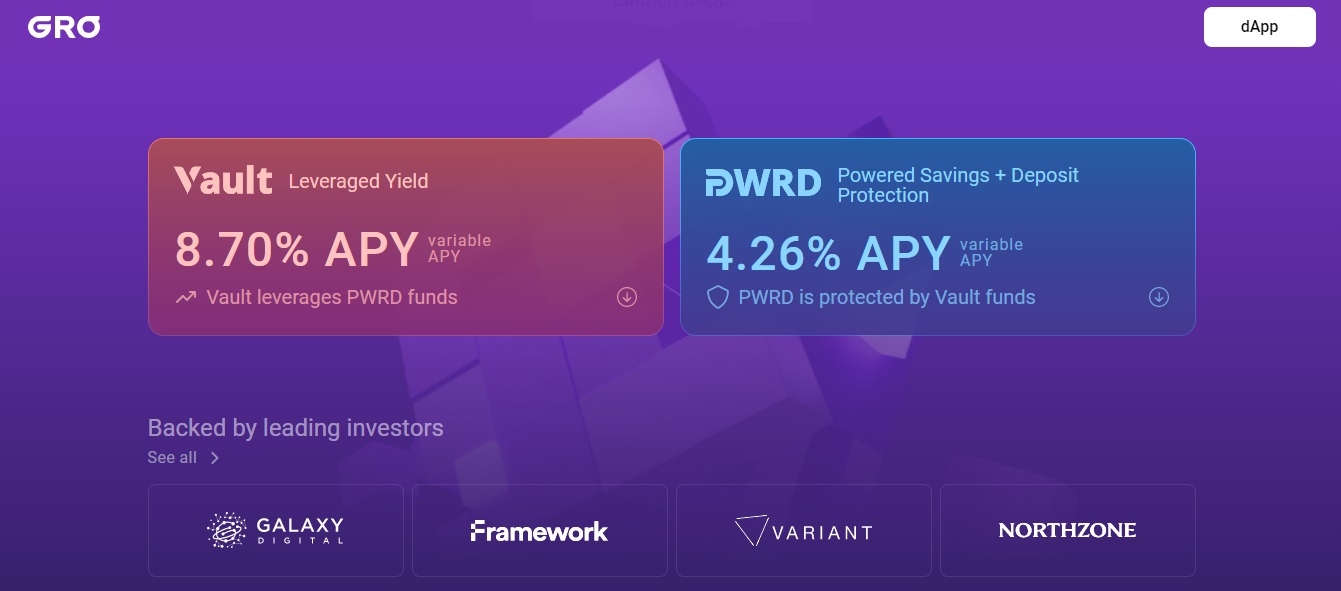

Gro Protocol — a stablecoin yield aggregator that separates risk and return. The first two products, built on top of it, are the PWRD stablecoin with deposit protection and returns, and the Vault with leveraged stablecoin returns.

About the Gro Protocol project

Gro Protocol delivers the best DeFi yields by constantly optimizing a range of market-neutral yield strategies, including lending revenue, trading fees from automated market makers and protocol rewards. What makes it unique is the Gro Risk Balancer, a new risk module that purposefully allocates the risks of smart contracts and stablecoins.

Initially, the protocol launches two products with risk and return tranches:

| 1. | PWRD. |

| 2. | Vault. |

All deposits are algorithmically and non-custodially distributed over a set of strategies. Contributors to the vault receive a higher share of the system's revenue, but also take on the additional risk of the smart contract and stablecoin.

Risk Balancer integrates with the deposit and withdrawal mechanisms of the Gro protocol to enable decentralized and user-driven portfolio rebalancing. This allows the protocol to maintain a balanced exposure autonomously, spreading risk across proven and verified stablecoins and protocols.

PWRD — a low risk savings product, designed to provide more secure access to DeFi yield, tokenized as a stablecoin with built-in yield and security. Its value is supported by the three most traded stablecoins on the market — DAI, USDC and USDT.

Because the Gro Risk Balancer distributes risk across stablecoins, it helps to protect PWRD in case one of the DAI, USDC or USDT fails or is censored. It offers deposit protection, as the risk tranche mechanism means that any loss of capital from stablecoins or yield strategies is first absorbed by the vault, allowing PWRD to generate income more securely.

Site storage

Vault (also, called Gro Vault Token, i.e. GVT) is the second of the child assets, supported by the Gro Risk Balancer. It is designed to be the highest yielding stablecoin store on the market. The key is in its connection to the super-powerful stablecoin PWRD. PWRD users effectively buy deposit protection from vault holders through a profit-sharing mechanism. This means storage owners absorb market disruptions but also get a higher rate of return.

The Gro Risk Balancer and association with PWRD means vault owners can leverage their capital in battle-hardened, popular and time-tested stablecoins and protocols without increasing exposure to high-risk DeFi products with similar returns. The only additional impact is the Gro protocol itself.