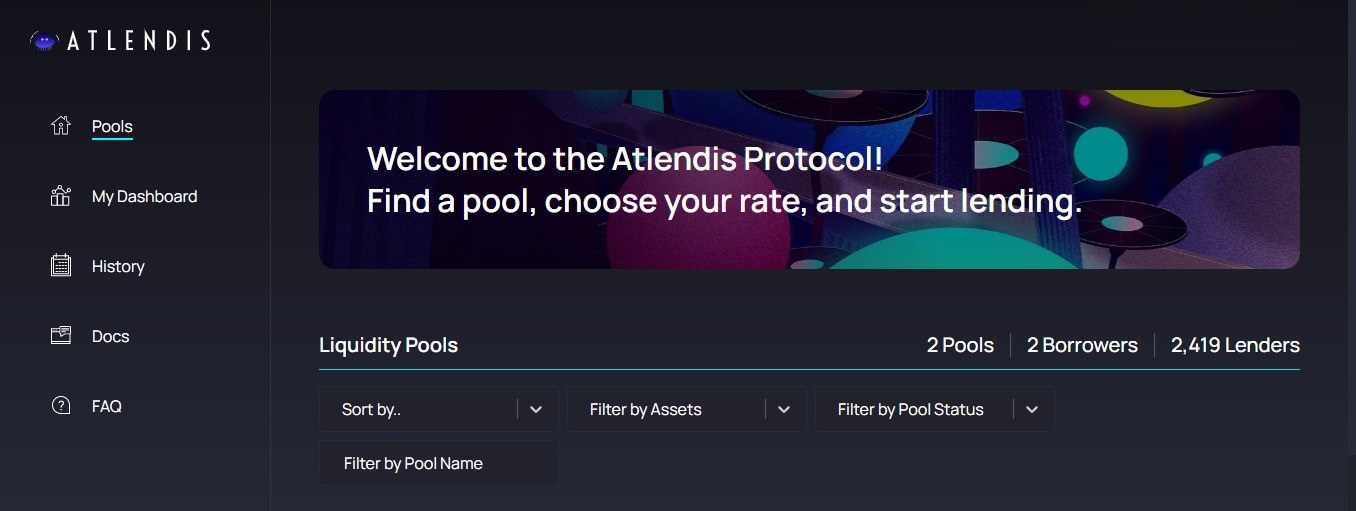

Atlendis — a capital-efficient, non-custodial, decentralized DeFi lending protocol that allows liquidity providers (LPs) to lend digital assets to whitelisted counterparties. The protocol consists of a set of fully autonomous smart contracts, located on the Polygon network.

About Atlendis project

Unlike other lending protocols that require the borrower to post collateral, Atlendis allows whitelisted borrowers to borrow without collateral upfront. The unsecured nature of the loan exposes the lender to credit risk, which is rewarded with returns, determined by market demand/supply dynamics. From the borrower's point of view, unsecured borrowing provides greater capital efficiency as well as greater flexibility to optimize the capital structure.

Other features:

| 1. | The Atlendis protocol uses a ticket book to determine the rate. The liquidity pools of the Atlendis protocol are divided into multiple ticks. |

| 2. | A tick — a subpool of funds in a borrower's pool that corresponds to a specific lending rate. |

| 3. | When adding liquidity to the pool, liquidity providers can choose their lending rate from a predefined set of available lending rates, and then their funds are placed on the appropriate tick and made available to the borrower. |

Offer prices are derived from the selected loan interest rate and pool maturity. Borrowing always starts from the lowest rate to the highest rate, which allows the market to discover the borrowing rate.

Liquidity providers should be able to set their own lending rate, i.e. they should be able to choose the amount of risk they are willing to take, depending on the desired level of potential profit. The buy order book is built around the concept of determining the market rate.

Benefits of NFT protocol positions

Liquidity providers do not dilute: if new liquidity providers make deposits to the pool during the life of the loan, this will not affect the number of bonds, held by existing liquidity providers. New depositors will be able to purchase the bonds at the next bond issue.

APY is predictable: looking at NFT parameters, one can easily predict future returns. NFT positions comply with the ERC-721 standard and have all features inherent in this standard. Liquidity providers may sell their positions to exit the pool.

Liquidity providers are only exposed to the risk of default on their positions, meaning that if they do not hold any bonds of the insolvent borrower (because they did not select that particular borrower, they set the lending rate above market or made a deposit while borrowing was going on) , then they will not be subject to losses.