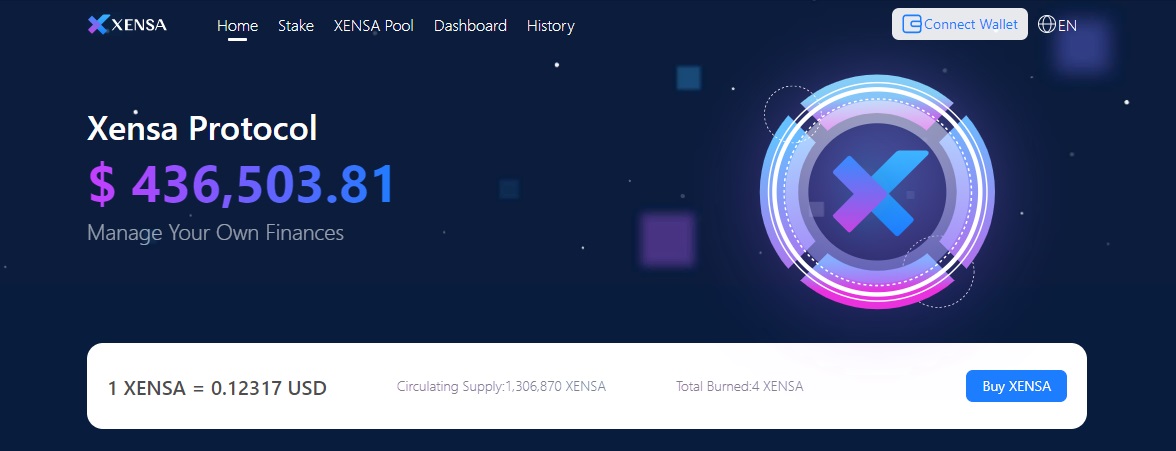

Xensa — a non-custody, decentralized liquidity marketplace protocol, where users can participate as savers or borrowers. Investors provide liquidity to the market to generate passive income, while borrowers can borrow overcollateralized (indefinitely) or undercollateralized (liquidity per block).

Contents:

Description of the Xensa crypto exchange

It is an OEC lending and borrowing marketplace, based on one of the largest DeFi protocols AAVE. AAVE has grown to be one of the most respected and secure protocols in the world, but this platform wants to do it differently. The project protocol lacks governance and venture capital investments, instead offering a lucrative fee for exchanging tokens between token holders and liquidity providers. The protocol will always be banned from everyone on the same basis.

Since the project has no management or ownership, there is no protocol treasury. Instead, 100% of the income, generated from loans, go directly to users who stake on Xensa. Both lenders and borrowers receive Xensa fees to incentivize the use of the protocol.

The maximum Xensa stock will be 200 million (200,000,000):

| 1. | 39% - as incentives for lenders and borrowers, issued within 4 years. |

| 2. | 30% - as an incentive for USDT / Xensa liquidity providers. |

| 3. | 25% - to the team, blocking for 1 year, then continuous eligibility for the second year, graduation to be completed in 3 years. |

| 4. | 6% of initial liquidity / marketing / rewards: set aside for initial liquidity and other marketing / promotion needs. |

Users can receive $ XENSA as a reward by making a deposit and borrowing, using the Xensa protocol. The project rewards are available for 30 days but can be claimed immediately for a 50% penalty. This mechanism provides a stable reward for those actively adhering to the protocol by blocking their tokens. XENSA for stakers will be blocked for 30 days. During this time, stakers will not be able to withdraw XENSA, but will be able to receive protocol income at any time.

Dapp on social media

At the moment, White Paper and RoadMap are not available on the site. Instead, the developers provide an introductory document. It contains all necessary information.