The share price of Nvidia, a leading chip maker and one of the leaders in artificial intelligence, has plummeted after hitting record highs earlier this year. The company, which once had a market capitalization of $2 trillion and even briefly surpassed the $3 trillion mark, now faces high volatility in the market.

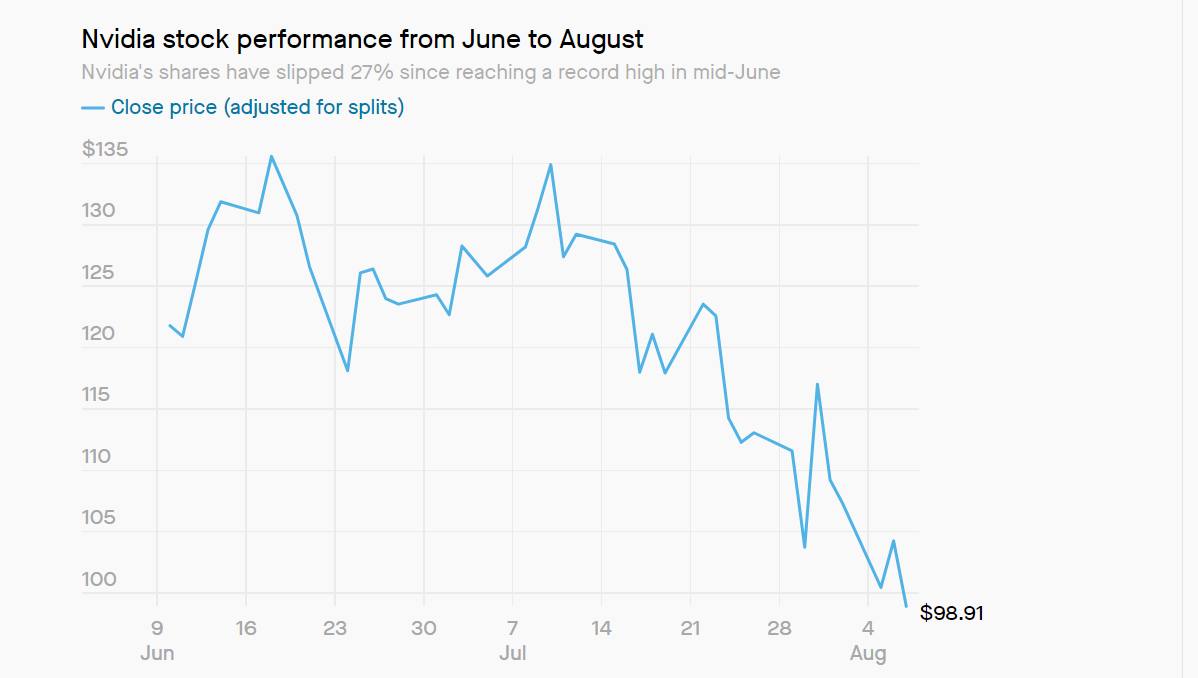

Nvidia's market value has shrunk by a significant $900 billion, a tangible blow to the company's position. On June 18, following a 10-to-1 stock split and impressive financial results, Nvidia's stock price surpassed the $135.58 mark. However, this rapid rise was short-lived, and the subsequent 27% drop from the high was a cause of concern for investors.

Nvidia reported revenue of $26 billion in the first quarter of fiscal 2025, up 262% from a year earlier. This result was driven by strong demand for the company's chips, but the surge was followed by a significant pullback. In the short period after the peak, Nvidia's market capitalization also declined, losing more than $500 billion in three trading days. This decline affected not only the U.S. market, but also affected the quotations of European and Asian chip makers.

In recent months, Nvidia has faced a number of challenges from regulators concerned about the company's dominant position in the artificial intelligence chip market. Nvidia currently controls about 90% of that market, raising concerns about the competitive landscape and the need for further regulation.

The recent drop in Nvidia's share price is also linked to geopolitical tensions. In July, the company's shares, along with other global chip makers, declined after reports of possible export restrictions by the U.S. against China. In particular, the Biden administration's plans to restrict supplies of advanced chip manufacturing equipment to China were discussed. This news caused concern in the markets, which led to a further decline in Nvidia shares.

An additional factor of pressure on the shares was the statements of former US President Donald Trump regarding Taiwan, which increased investors' fears. However, analysts at Jefferies and Bank of America believe the market overestimated these geopolitical risks, which may have led to an overreaction.

Nvidia shares fell again this week when it was revealed that shipments of its new Blackwell artificial intelligence platform could be delayed by at least three months due to design issues. That came after Nvidia CEO Jensen Huang said in May that Blackwell revenue was expected to grow significantly this year.

Nvidia is expected to release its earnings report for the second quarter of fiscal 2025 on Aug. 28, which could shed more light on the company's current financial health and future plans. This report will be scrutinized by analysts and investors as it could be an important indicator of Nvidia's future prospects in a volatile market and increasing regulation.