In this comprehensive analysis, an in-depth prediction has been provided for Amazon's stock price in 2030. Various factors influencing the company's performance, such as financial indicators, market dynamics, technology advancements, consumer behavior, and competitive landscape, are closely examined to offer insights into Amazon's potential stock price trajectory in the next decade.

Financial Performance and Growth Potential

Amazon's strong financial performance indicates future growth prospects. The company's consistent revenue growth attributed to diversified product offerings and a growing customer base positions it well for expansion. With a strong e-commerce platform, AWS dominance, and ventures into emerging sectors, Amazon is poised to leverage evolving market trends for significant stock price growth by 2030.

Market Dominance and Competitive Advantage

Amazon's stronghold in the e-commerce industry is unmatched. The company's innovation focus and extensive logistical infrastructure give it a competitive edge over rivals. By continuous product category expansion, fulfillment network enhancements, and delivery efficiency improvements, Amazon maintains market leadership. This dominance positions Amazon to capture more market share, driving its stock price higher in the coming years.

Technological Innovation and Disruption

Technological innovations are pivotal to Amazon's success. Investments in AI, machine learning, and automation lead to operational efficiencies and enhanced customer experiences. Early adoption of voice assistants, smart home devices, and AWS cloud services transformed industries. Amazon's focus on technological advancements sets the stage for market disruption and growth opportunities, positively impacting the stock price by 2030.

Expansion into New Markets and Revenue Streams

Amazon's diversification through services like AWS cloud computing, Prime Video, healthcare investments, and smart home ecosystems broadens revenue streams. Strategic expansion into emerging markets strengthens Amazon's position and outlook, contributing to a positive stock price forecast for 2030.

Consumer Behavior and Market Trends

Consumer behavior shifts support Amazon's business model, with preferences for online shopping, mobile reliance, and personalized experiences. Leveraging consumer data enables Amazon to deliver tailored services and drive loyalty, influencing stock growth over the coming decade.

Risk Assessment and Mitigation

Despite promising growth prospects, Amazon faces regulatory, geopolitical, and competitive risks that could impact its stock price outlook. Implementing effective risk mitigation strategies is essential for sustained growth and investor confidence.

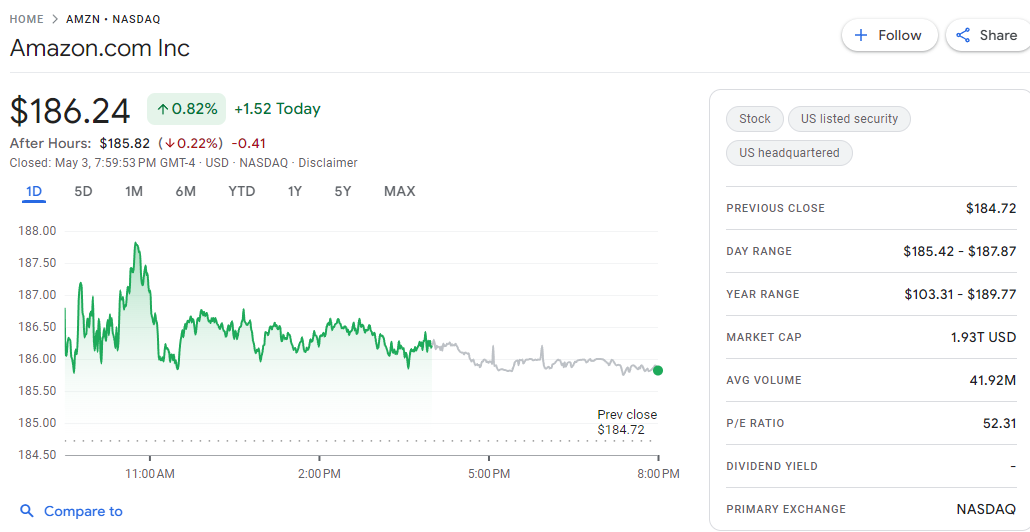

Amazon Stock Projections

The predicted stock price for Amazon in 2024 is $300, representing a significant increase from current levels. A further rise to $270 in 2025 is anticipated, with a projected price of $567.36 per share by 2030, indicating substantial growth potential.

Conclusion

In conclusion, Amazon's financial strength, market dominance, technological innovations, diversification, and consumer insights point towards significant stock price growth by 2030.

FAQ

Factors Influencing Amazon's Stock Price Predictions for 2030

Financial performance, market dominance, technology advancements, consumer behavior, competition, and risk assessments are essential factors considered for Amazon's stock price outlook.

Impact of Amazon's Financial Performance on Future Predictions

Robust financial performance with steady revenue growth and diversified offerings underpins Amazon's growth potential, influencing favorable stock price projections for 2030.

Significance of Market Dominance in Stock Price Forecasts

Unmatched market leadership in e-commerce and logistics positions Amazon for growth, suggesting an upward trajectory for its stock price over the next decade.

Role of Technological Innovations in Stock Price Outlook

Investments in AI, machine learning, and automation drive operational efficiencies, customer experiences, and potential for market disruption, contributing to a positive stock price forecast.

Effect of Diversification on Stock Price

Expansion into new markets diversifies revenue streams, enhancing Amazon's market position and overall stock price projection for 2030.

Influence of Consumer Behavior on Stock Projections

Alignment with consumer behavior trends, personalized experiences, and targeted services enhance loyalty and revenue growth, reflecting positively on Amazon's stock performance.

Potential Risks Affecting Amazon's Stock Price

Regulatory challenges, geopolitical factors, supply chain disruptions, and rising competition pose risks that could impact Amazon's future stock price outlook, necessitating effective risk management strategies.

Stock Price Predictions for Amazon

Projected stock prices for Amazon indicate significant growth potential, with forecasts reaching $567.36 per share by 2030 based on historical growth trends.