In the ever-evolving world of cryptocurrency trading, having a solid grasp of fundamental metrics like open interest can significantly improve decision-making processes. Whether someone is an experienced trader or a newcomer to crypto trading, understanding open interest is crucial for effectively navigating the volatile markets.

Understanding Open Interest:

Open interest (OI) is a critical metric that monitors the total number of outstanding derivative contracts in the crypto space, such as Bitcoin Perpetual Futures or Ethereum call or put options, which have not yet been settled or closed. It provides insights into market activity levels and trader engagement by reflecting the total count of active positions within a specific contract. Essentially, open interest tracks the cumulative number of contracts held by traders, offering valuable information on market sentiment and potential future price movements. Traders often analyze open interest along with other indicators to assess the strength of a price trend and make well-informed trading decisions.

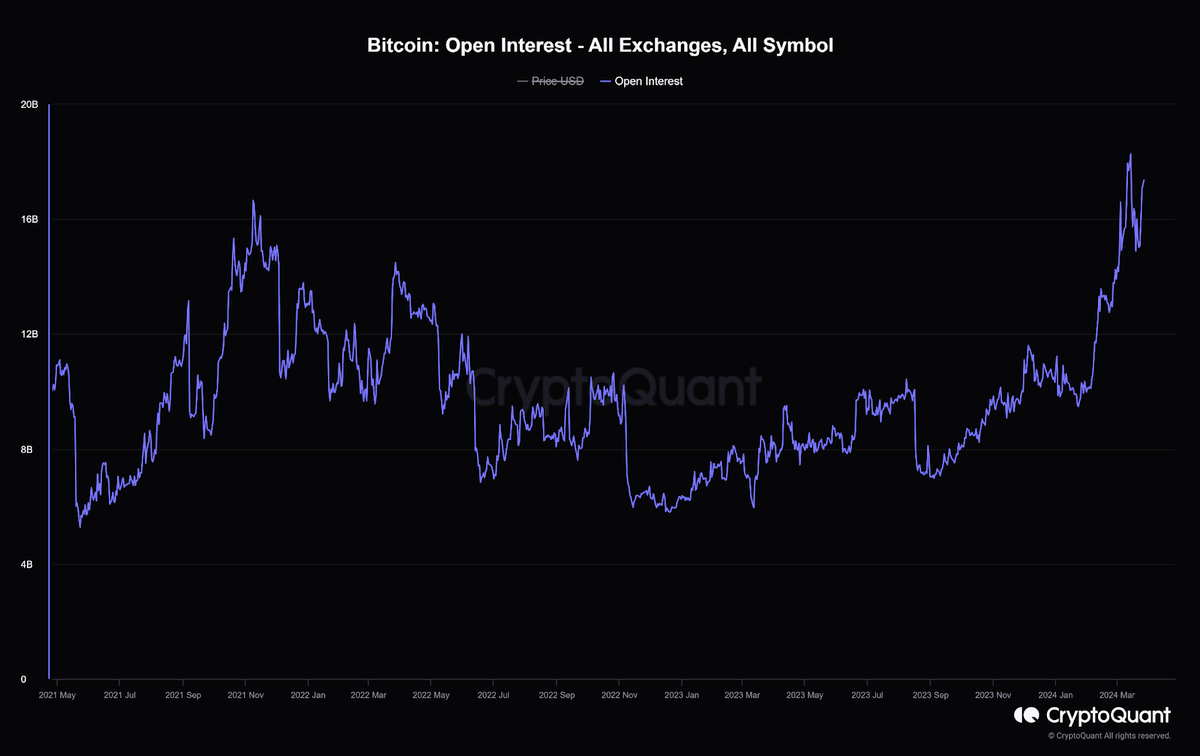

The graph illustrates the value tied up in Bitcoin futures contracts on various exchanges since May 2021. While there have been fluctuations in activity levels in September 2021, March 2022, and November 2023, the overall trend indicates a decline in the utilization of futures for speculating on Bitcoin's price. It provides valuable insights into the Bitcoin futures market's activity levels, although other factors should also be taken into consideration.

Exploring Open Interest with Litecoin Futures:

Suppose the open interest for Litecoin futures contracts starts at 12. A trader named Emily enters the market and purchases 20 contracts, increasing the open interest to 32. Another trader, Alex, then closes 8 contracts, reducing the open interest to 24. However, Emily buys an additional 10 contracts, resulting in a 10-unit increase in open interest, raising it to 34.

In this scenario, Alex's closure of positions leads to a decrease in open interest, while Emily's additional purchases contribute to its increase. This dynamic nature of open interest showcases its responsiveness to trading activity.

Open interest plays a crucial role for traders and analysts in futures trading, as it indicates market participation and activity levels. An increase in open interest signals heightened market engagement, confirming the existing trend, whereas a decrease may indicate a potential trend reversal or weakening.

Significance of Open Interest:

- Market Sentiment: High open interest reflects increased activity and interest in a contract, suggesting higher liquidity and potential price volatility. Low open interest may indicate reduced market sentiment or trading activity.

- Price Trend Confirmation: Changes in open interest often accompany shifts in price trends. Rising open interest, alongside price increases, can confirm the strength of a trend, while declining open interest may suggest a possible reversal.

- Liquidity Evaluation: Market liquidity can be evaluated by analyzing open interest. Higher open interest implies more participants, making it easier to enter or exit positions without significant price impact.

- Market Turning Points: Open interest assists in identifying potential market peaks and troughs when used in conjunction with other indicators. Peaks in open interest may align with market highs, indicating potential trend reversals.

Differentiating Open Interest and Trading Volume:

While both metrics provide insights into market activity, they serve different purposes:

- Trading Volume: Reflects the total number of contracts traded within a specific period, indicating market immediacy and liquidity.

- Open Interest: Tracks outstanding contracts yet to be closed or settled, revealing ongoing market participation and interest.

Limitations of Open Interest:

Despite its significance, open interest has limitations:

- Interpretation Challenges: Fluctuations in open interest may not differentiate between new positions and closures, making interpretation challenging.

- Volatility Impact: In highly volatile markets, open interest may fluctuate rapidly, making it challenging to identify meaningful trends.

- Incomplete Market Picture: Open interest may not provide a comprehensive view of market dynamics, especially without data on institutional positions.

Concluding Thoughts:

In the dynamic crypto trading landscape, open interest is vital for understanding market sentiment and potential trends. By analyzing changes in open interest alongside other indicators, traders can make more informed decisions. However, it's essential to consider open interest within the broader context of market analysis and combine it with other technical indicators for comprehensive insights. Leveraging open interest empowers traders to navigate the crypto landscape with confidence and precision.