The European Union's financial markets and securities regulator does not yet see Decentralized finance (DeFi) as a significant threat to overall financial stability, although they believe it warrants close observation.

On October 11, the European Securities and Markets Authority (ESMA) published a study named "Decentralized Finance in the EU: Developments and Risks." The report delves into the emerging ecosystem's advantages and potential hazards, determining that DeFi doesn't currently present a major risk to financial stability.

The overall crypto market value stands slightly above $1 trillion, with DeFi's total value pegged at around $40 billion as per DefiLlama's data. In contrast, the European Commission states that financial institutions in the EU held assets totaling approximately $90 trillion in 2021.

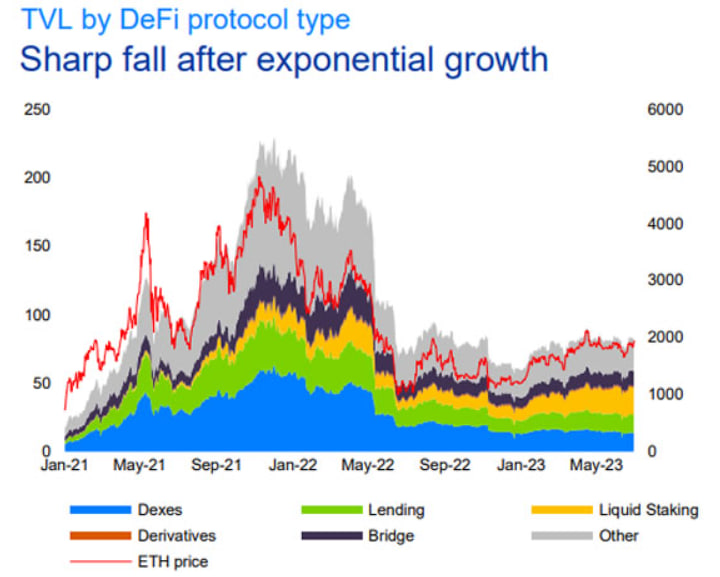

Source: ESMA

The study indicated that the overall cryptocurrency market is comparable in size to the twelfth largest bank in the EU, accounting for roughly 3.2% of the assets of EU banks.

ESMA also reviewed various crypto-related incidents from 2022, including the downfall of the Terra ecosystem and FTX. Despite these events being likened to the crypto equivalent of the "Lehman moment," they didn't notably affect the conventional markets.

However, the authority pointed out that DeFi shares some characteristics and susceptibilities with mainstream finance, like liquidity and maturity disparities, the use of leverage, and extensive interconnectedness.

The report emphasized that while the general investment in DeFi is still relatively minimal, there are substantial risks associated with investor protection. This is due to the highly speculative aspect of numerous DeFi projects, significant operational and security flaws, and the absence of a distinct accountable entity.

The regulator warned that these issues could lead to systemic risks if DeFi becomes more widespread or if its ties with traditional financial systems become more pronounced.

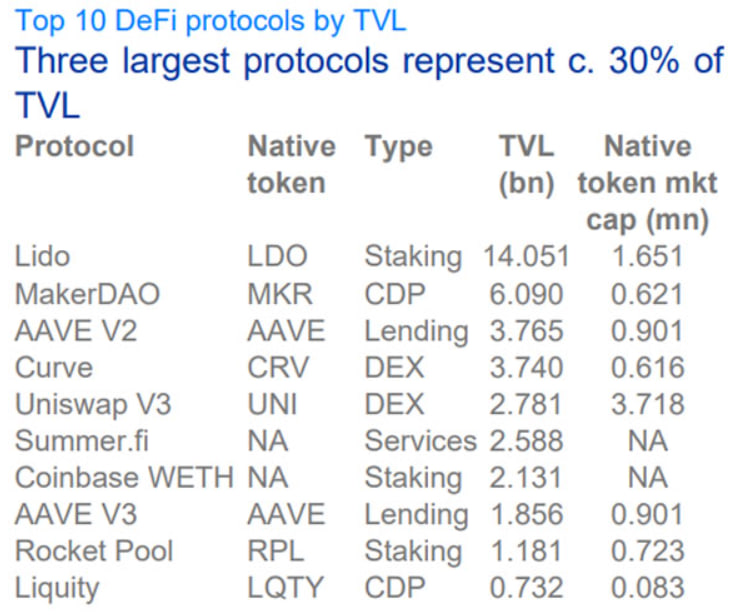

"Most DeFi activities are focused on a handful of protocols," the report highlighted, pointing out that the top three protocols account for 30% of the total value locked (TVL).

Top ten DeFi protocols by TVL. Source: ESMA

"If any of these major protocols or blockchains were to collapse, the entire system could feel the effects," the report stated.

Following the release of its second consultation paper on the Markets in Crypto Assets (MiCA) regulations this month, the regulator has intensified its focus on DeFi and cryptocurrency markets.