The cryptocurrency market continues to develop rapidly, offering new opportunities for investors and users. One of these innovations is cryptocurrency restaking. This process is based on the concept of reusing staked assets to generate additional income. Restaking opens new horizons in managing cryptocurrency assets, providing investors with increased profitability and flexibility.

What is Restaking?

Restaking is a method that allows coins to be staked simultaneously in the main cryptocurrency network and in other protocols. Don't be intimidated by the complex terms—it's actually much simpler than it seems.

To understand restaking, it is first necessary to understand staking. Staking means locking up assets in a cryptocurrency network to earn passive income. This is done by community members who want their coins to generate profits.

Staking is only possible in networks with a Proof-of-Stake (PoS) consensus, such as Ethereum (ETH). Staking participants receive rewards in the form of coins from the same network. For example, Ethereum stakers earn rewards in ETH.

The staking process is carried out by validators—network participants responsible for processing and confirming transactions. They connect their coins and computing equipment to the network and receive rewards in the form of coins for their work.

The prefix "re" in the word restaking indicates the reuse of already staked coins.

For community members, restaking is a way to increase staking profitability. For developers, it is an opportunity to quickly and cost-effectively ensure the security of other elements of the main network, such as protocols, oracle networks, and Layer 2 (L2) solutions. Instead of creating their own validator network, developers can offer existing validators participation in restaking for a small fee.

History of Restaking

The principle of restaking was proposed by the creators of the EigenLayer protocol. This mechanism allows Ethereum validators to reuse their staked coins for an additional fee.

The restaking process is carried out within the EigenLayer ecosystem through Actively Validated Services (AVS). These services use staked ETH to enhance their functionality. EigenLayer users can choose which decentralized services they want to collaborate with.

In EigenLayer, you can restake both ETH and liquid staking tokens (LST) such as stETH, rETH, cbETH, and LsETH, which are issued to community members for staking cryptocurrency on a PoS blockchain.

These tokens are issued to community members for staking cryptocurrency on a PoS blockchain. The advantages of using liquid staking tokens include:

- High liquidity: The ability to trade and use LST tokens on various platforms.

- Flexibility: The ability to switch between different protocols without the need to unstake.

- Additional income: The potential to earn extra rewards.

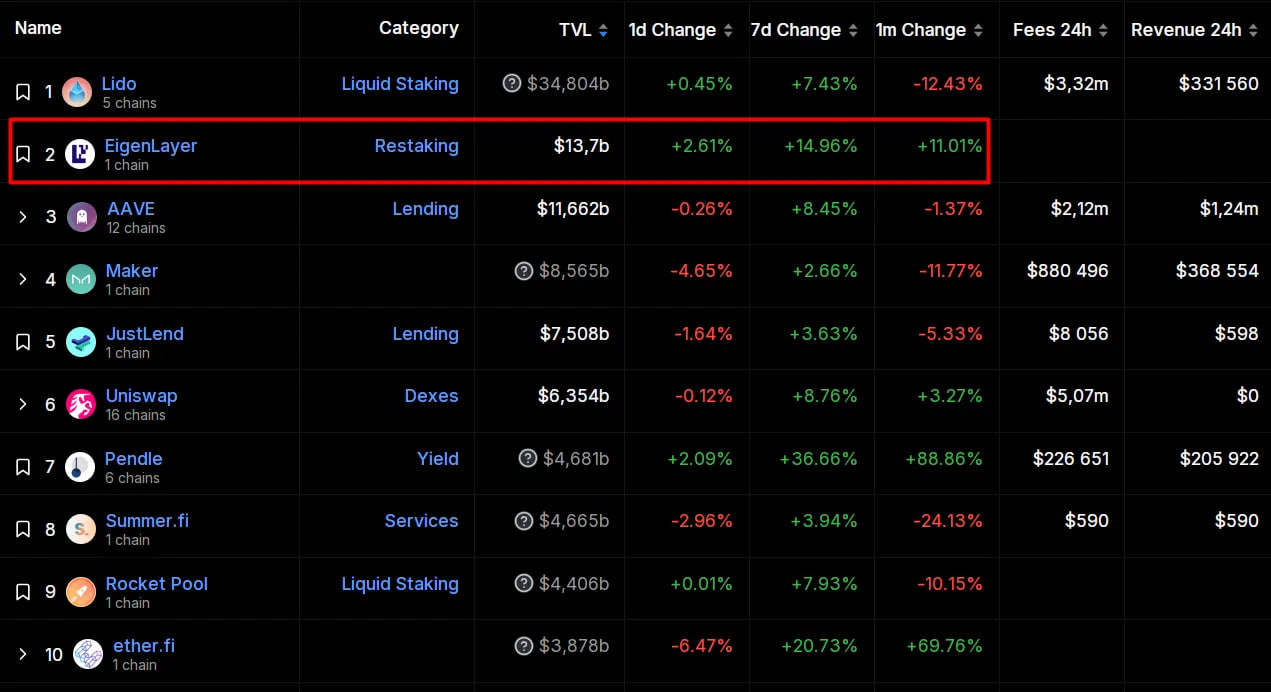

The mainnet of the protocol was launched in June 2023. As of April 2024, EigenLayer ranks second among all DeFi protocols by total value locked (TVL).

In addition to EigenLayer, there are two other restaking protocols on the market:

-

Repl:

- Focuses on integration with multiple blockchain networks.

- Offers a high degree of flexibility and adaptability.

- Supports a wide range of cryptocurrencies.

-

Octopus Network:

- Specializes in ensuring the security of parachains in the Polkadot ecosystem.

- Offers the possibility of staking in multiple networks simultaneously.

- Supports various reward mechanisms for validators.

These protocols also provide users with the opportunity to increase their returns and improve the security of their crypto assets, expanding the potential uses of staked coins.

Pros and Cons

Restaking, like any other financial strategy, has its advantages and disadvantages. Let's look at the main ones.

Pros of Restaking

Firstly, restaking allows you to earn additional income from already staked coins, which significantly increases the overall profitability of staking. Secondly, the ability to stake coins in multiple protocols simultaneously gives users more freedom in managing their crypto assets. Thirdly, participation in restaking helps to strengthen the decentralization and security of blockchain networks, as more validators are involved. Finally, users can receive liquid staking tokens (LST), such as stETH, rETH, cbETH, and LsETH, which can be used to further increase income.

Liquid staking tokens (LST) have their own advantages. Firstly, they provide high liquidity, allowing LST tokens to be traded and used on various platforms. Secondly, LSTs offer flexibility, allowing switching between different protocols without the need to unstake. Thirdly, such tokens have the potential to earn additional rewards.

Cons of Restaking

However, restaking also has its drawbacks. Firstly, it can increase the risk of losses, especially on less stable platforms or with improper asset management. Secondly, the restaking process requires more careful monitoring and management of assets, which can be challenging for inexperienced users. Thirdly, there may be additional fees for transactions and the use of restaking platforms, which can reduce overall profitability. Finally, users depend on the reliability and security of the platforms offering restaking, which adds an element of trust in third parties.

| Advantages | Disadvantages |

|---|---|

| Increased profitability | Increased risks |

| Flexibility in asset management | Complexity of management |

| Enhanced network security | Fees and expenses |

| Additional rewards | Dependence on platforms |

Restaking provides unique opportunities to increase profitability and flexibility in managing crypto assets, but it also carries additional risks and requires a more careful approach to asset management. Understanding all aspects of restaking will help users effectively utilize this strategy and maximize their returns.