STON.fi — an innovative platform functioning as a decentralized automated market maker (AMM) on the TON blockchain. It offers users zero fees, minimal slippage, a user-friendly interface, and full integration with TON wallets.

- What is STON.fi?

- Token Exchange on STON.fi

- Liquidity Pools and Token Staking on Dex

- Tokenomics and Use Cases

- Conclusion

What is STON.fi?

STON.fi is an AMM DEX developed within the TON ecosystem, operating on a Request for Quote (RFQ) model and using Hash Time-Locked Contracts (HTLC). By eliminating third-party involvement, the platform increases transaction reliability and security.

The STON.fi protocol does not rely on assumptions. It performs sequential and precise verification steps to address issues of compatibility, security, risk reduction, and transaction costs in the DeFi sector. Additionally, STON.fi integrates various services into Telegram, allowing users to manage and conduct asset transactions directly.

Token Exchange on STON.fi

The main product of STON.fi is exchange, enabling users to swap any tokens of their choice. When performing a swap on STON.fi, a 0.3% fee is charged, which is distributed as follows:

- 0.2% goes to liquidity providers as compensation, increasing the pool size.

- 0.1% goes to the StonFi protocol.

The process of using STON.fi for a standard user includes the following steps, similar to any DEX:

1. Users connect their wallet to STON.fi to authorize transactions and access their token balance.

2. Then users select the desired trading pair for exchange.

3. After entering the amount of token A to be exchanged for token B, the protocol calculates the exchange rate and displays the estimated amount of token B to be received.

4. Users review the transaction details, including the exchange rate, fees, and the estimated amount to be received. If everything is satisfactory, they confirm the transaction through their wallet.

Notably, STON.fi offers gas-free transactions by deducting the fee from the amount of token A. This requires supporting infrastructure such as wallet integration. The STON.fi routing mechanism then processes the transaction. Upon completion, users receive a confirmation and can view updated balances in their connected wallets.

Liquidity Pools and Token Staking on Dex

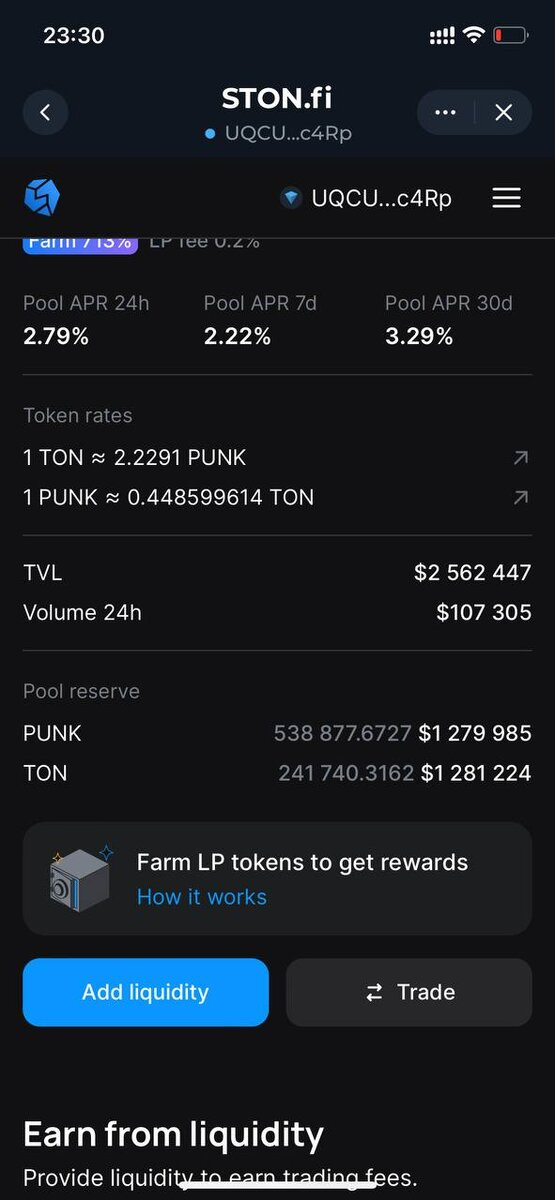

Providing Liquidity: Users can add liquidity using two different currency pairs and earn commission at a very attractive APR rate.

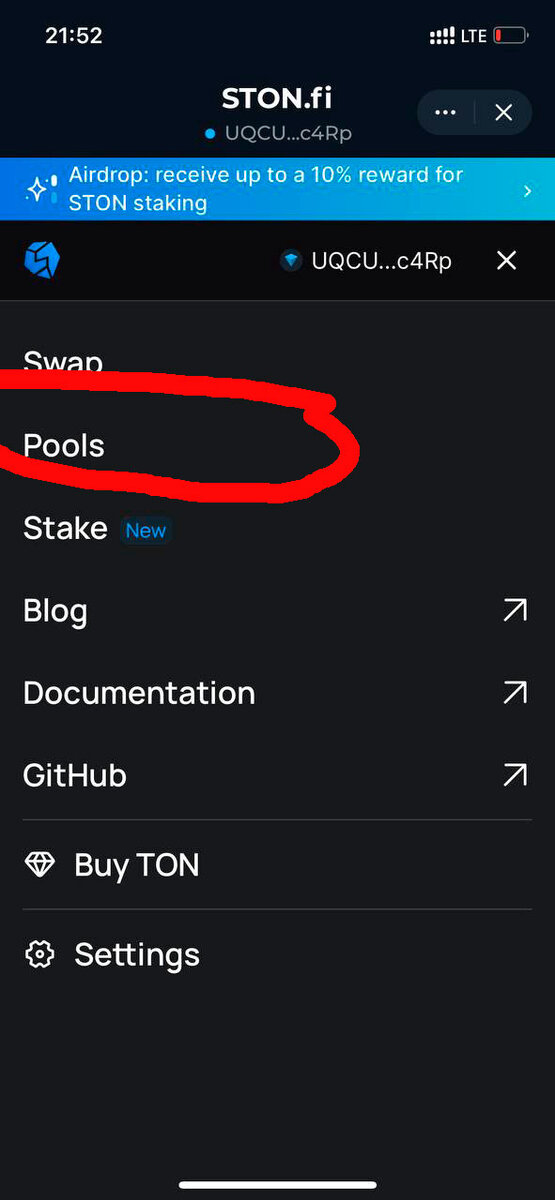

Step-by-step guide to adding liquidity on STON.fi:

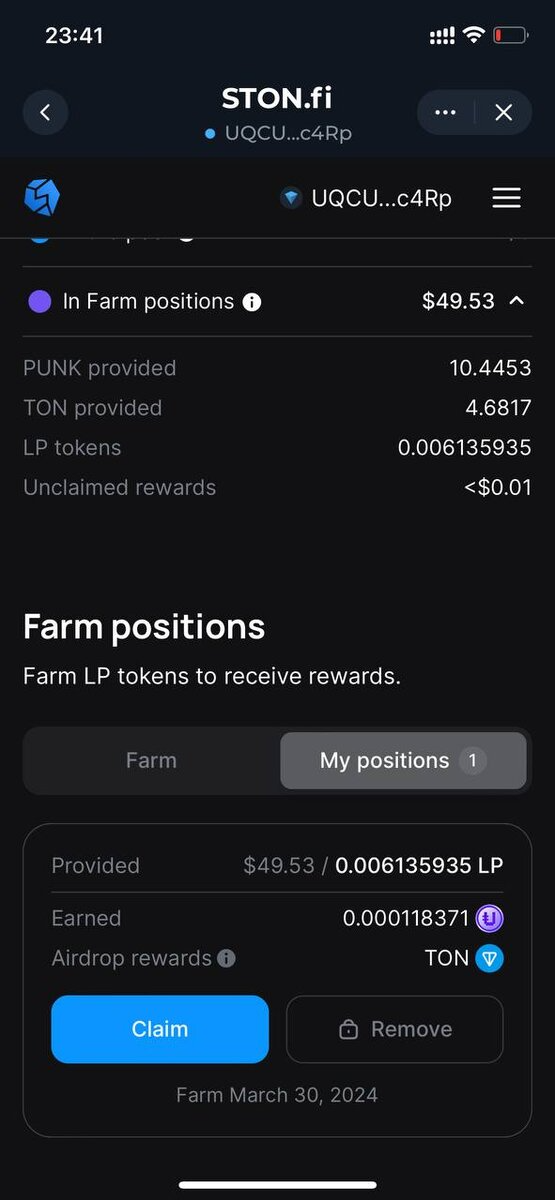

- Go to the "Pools" tab. Find and open the PUNK/TON pair. The tabs are located in the upper right corner, next to the wallet address.

- Click "Add Liquidity", specify the desired amount of tokens.

- Click "Provide Liquidity".

- Sign the transaction.

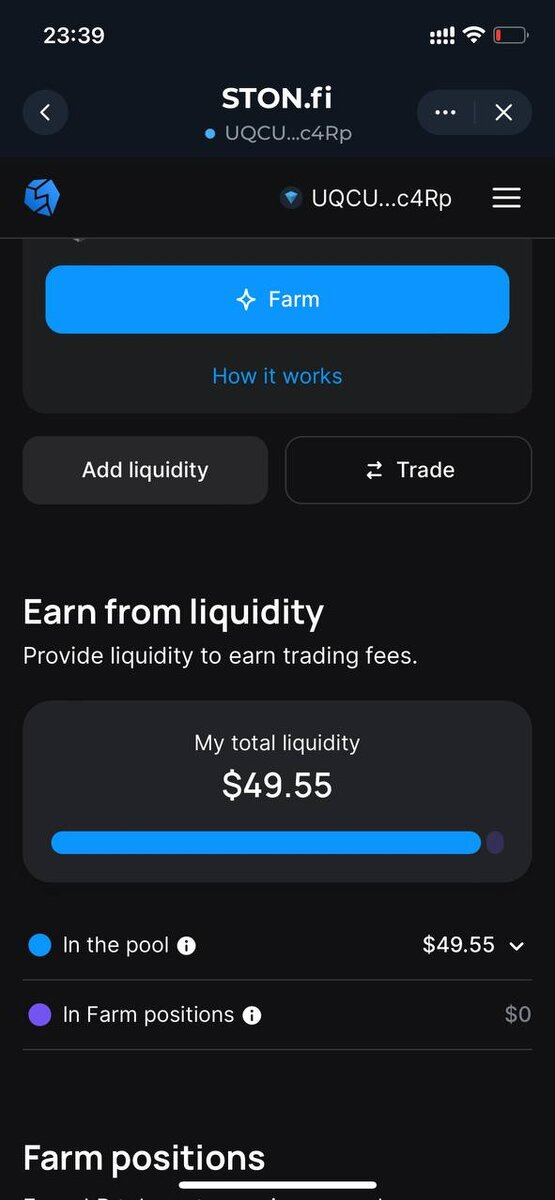

- Go to your pool and view the details of your position.

- Check the current liquidity (e.g., 49.55).

- Click "Farm" to add to farming.

- Enter the amount of LP tokens for staking and click "Farm" again. Sign the transaction.

- Go to "My positions" to view your tokens and their earnings.

Staking: Users can stake $STON to earn additional profit and participate in distributions.

Tokenomics and Use Cases

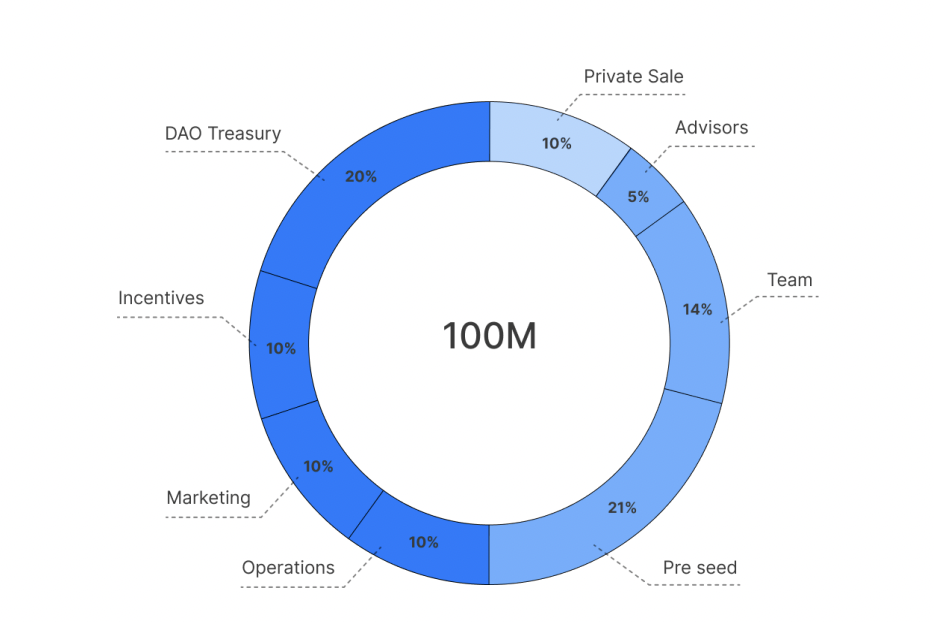

Token Characteristics

Ticker: STON

Total supply: 100,000,000 STON

Token Distribution

The STON token is distributed as follows:

| Category | Percentage | Description |

|---|---|---|

| DAO Treasury | 20% | Locked for 24 months, then available for DAO use. |

| Incentives | 10% | Distributed linearly over five years to encourage user participation. |

| Marketing | 10% | 2 million tokens unlocked at TGE, the remaining 8 million distributed over 3 years for marketing activities like giveaways and campaigns. |

| Operations | 10% | 4 million tokens unlocked at TGE, the remaining 6 million distributed over five years for operational activities including protocol development and liquidity provision. |

| Pre-seed | 21% | Locked for 12 months, then gradually released over 2 years. |

| Team | 14% | Locked for 2 years, then distributed over 3 years. |

| Private Sale | 10% | Locked for 1 year, then released over 2 years. |

| Advisors | 5% | Locked for 1 year, then released over 2 years. |

Conclusion

STON.fi represents an advanced AMM DEX platform built on the TON ecosystem, offering users a secure and reliable way to exchange assets across different blockchains. Utilizing a Request for Quote (RFQ) model and Hash Time-Locked Contracts (HTLC), it eliminates third-party involvement, enhancing transaction security and efficiency.

The STON.fi protocol addresses critical issues related to compatibility, security, and transaction costs in the DeFi sector, providing users with convenient and gas-free transactions. Integration with Telegram adds further convenience, enabling users to manage and conduct asset transactions effortlessly.

The tokenomics of STON.fi are structured to support the ecosystem's development and growth. Thoughtful distribution and release schedules promote long-term project sustainability, encouraging user participation, marketing activities, and operational efforts.

STON.fi is an innovative project that offers simple, secure, and cost-effective solutions for users looking to engage in decentralized financial operations, ensuring sustainable development and integration into the modern DeFi landscape.