Uniswap is a leading platform in the field of Automated Market Making (AMM) and holds a dominant position in the decentralized exchange (DEX) market. Its success has been particularly evident with the release of version V3, which introduced the concept of Concentrated Liquidity Market Making (CLMM). CLMM reduces slippage across various ranges and improves liquidity efficiency by minimizing losses. However, Uniswap is not stopping there, as recently announced by Uniswap Labs on their Twitter account. The upcoming release of version V4 is already planned for the near future.

Contents:

- About Uniswap V4

- Hooks in Uniswap V4

- Singleton Contract

- Introduction of New Governance and Administration Mechanism

- The Importance of DeFi

About Uniswap V4

The Uniswap team has announced the release of their new version, Uniswap V4, which was developed in collaboration with some members of Paradigm. The main goals of Uniswap V4 are to reduce transaction fees, optimize liquidity, and increase profitability for liquidity providers.

In the V4 version, Uniswap continues to employ the Concentrated Liquidity Model (CLMM). However, the vision of Uniswap V4 is to provide people with the ability to develop ideas and create products using "hooks." Hooks are contracts that execute at various points during transaction execution in the pool. The team could choose the same trade-offs as in version 3 or add completely new functionality.

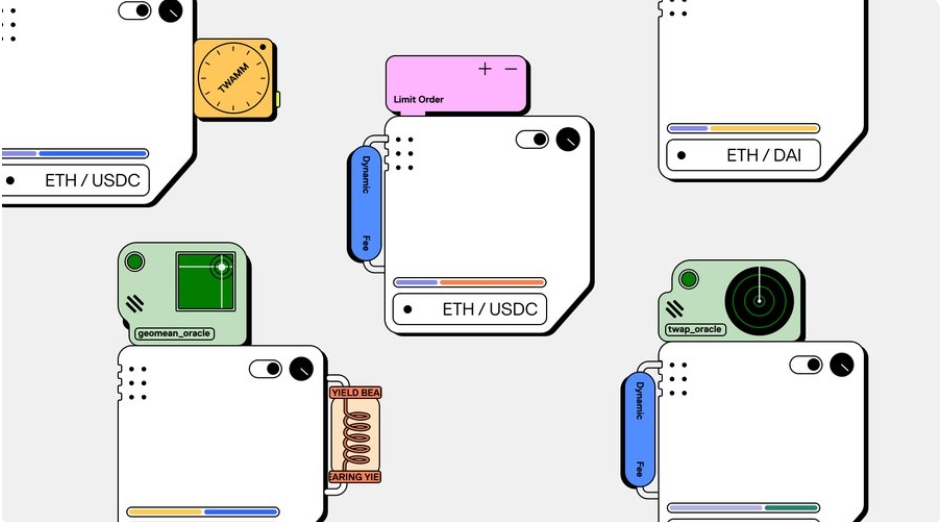

The new products being tested by the team include:

- Time-weighted average market maker (TWAMM)

- Dynamic fees based on volatility or other parameters

- On-chain limit orders

- Liquidity provision to lending protocols if it falls outside a specified range

- On-chain oracles, such as geometric oracles

- Automatic compounding of fees back into liquidity positions

- Internalization of profits from minor extractor value (MEV) distributed to liquidity providers (LPs)

Hooks in Uniswap V4

One of the important features of Uniswap V4 is hooks. Hooks are snippets of code that are executed at specific points in the pool's lifecycle, regardless of whether they are created after liquidity is added or removed by pool participants, or before or after a swap is conducted. Hooks play a crucial role as they provide the team with much more customization and control options compared to previous versions of Uniswap.

For example, hooks can be used to develop pools with a variable dynamic swap fee that adjusts based on market conditions, as opposed to a fixed and pre-determined fee.

Hooks also provide traders with the ability to use more complex order types, such as limit orders or TWAP (Time-Weighted Average Price) orders. They allow traders to buy or sell a specific amount of tokens over a designated time interval.

In addition, the hook provides the opportunity to utilize Uniswap liquidity in various ways. Similar to Balancer's booster pool, liquidity outside the pool can be allocated in other protocols, such as lending, to generate additional profits.

Hooks in Uniswap V4 enable aggregators to create more flexible and customizable centralized liquidity pools. These hooks allow for changing pool parameters or adding new features and capabilities, including things like Time-Weighted Average Market Maker (TWAMM), limit orders, dynamic fees, internal MEV mechanism, and surplus bar deposit in a credit agreement. Custom functions, such as an oracle, can flexibly manage the contract's hook and make their own modifications as needed. These capabilities make Uniswap V4 a more flexible and customizable tool for liquidity aggregators.

Here is a table describing some advantages and potential risks of using a DApp based on Uniswap hooks:

| Advantages | Potential Risks |

|---|---|

| Expansion of Uniswap functionality | Possibility of new vulnerabilities |

| Potential for fee generation | Risks of contract-level attacks |

| Additional opportunities for developers | Unpredictability of DApp behavior |

| Flexibility in creating innovative applications | Inadequate contract security auditing |

| Increased appeal to users | High gas costs when using the DApp |

Singleton Contract

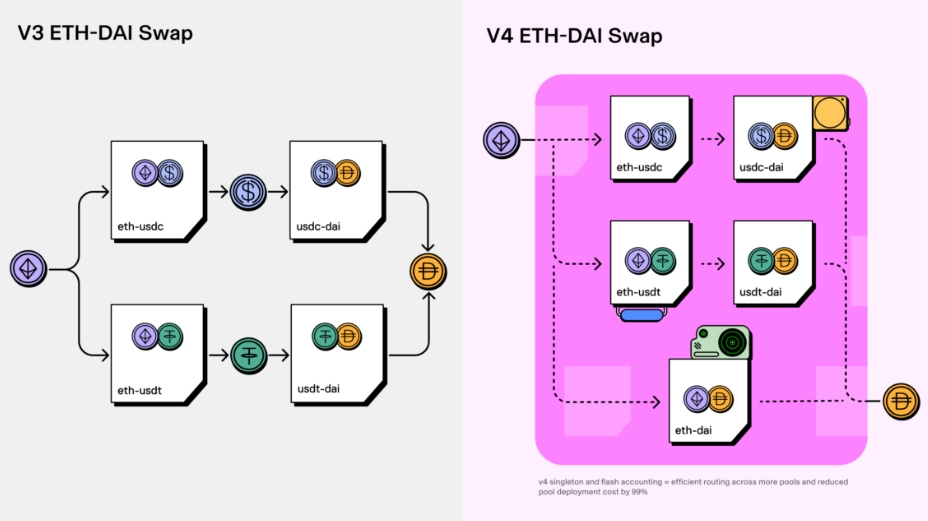

Uniswap V4 made significant changes to its architecture, replacing the Factory/Pool mode with the Singleton mode. In the original version, each liquidity pool was created independently through the Factory contract, which meant that multiple contracts had to be passed in a multi-step transaction. For example, if you needed to convert ETH to DAI, it might require using two liquidity pools (e.g., ETH-USDC and USDC-DAI). With the new Singleton mode, all liquidity pools are consolidated into a single contract, simplifying the exchange process.

In the latest Singleton contract, all liquidity pools were combined into a unified contract. Additionally, it introduced the functionality of multi-step transactions that can be completed by interacting with the contract. This helps reduce the required gas fee when executing a transaction.

This will lead to significant gas savings as there will no longer be a need to transfer tokens between pools stored in different contracts. Initial estimates show that gas costs for working with the pool decrease by 99% in the v4 version. Hooks open up a multitude of new possibilities, and Singleton efficiently utilizes all of them.

The new "fast accounting" system complements this Singleton. Unlike the previous approach in v3, which moved assets into and out of the pool at the end of each swap, this system only works with the net balance. This results in a much more efficient system that saves additional gas costs in Uniswap v4.

Singleton also applies the concept of "flash accounting" proposed by Uniswap Labs. This mechanism further reduces gas costs when trading on decentralized exchanges (DEXs) by transferring the net token balance from the pool only after the exchange is completed. This is in contrast to Uniswap V3, where all assets participating in the trade are transferred into or out of the pool during the exchange process.

In Uniswap V4, each operation updates only one "internal net balance" and does not perform external transfers until the end, making it easier to execute complex transactions, increase liquidity, and make atomic operations more robust, while reducing gas fees.

It has been officially confirmed that the upcoming Ethereum update in Cancun will include EIP-1153. This protocol will introduce new functionality in the form of a "temporary" storage that does not require temporary memory updates to the account balance every time it changes. This significant improvement will significantly reduce gas fees on the Ethereum network.

Introduction of New Governance and Administration Mechanism

Uniswap V4 introduces a new governance mechanism that allows for the collection of transaction fees and withdrawal fees from liquidity pools. Additionally, this mechanism enables the governance system to allocate the collected fees to reward users and developers contributing to Uniswap.

This feature can be useful in contracts with hooks, for example, allowing a contract developer with hooks to charge a certain fee for using the liquidity pool (LP). However, considering Uniswap's current slow implementation regarding transaction fees, if the agreement requires a fee to be charged from the pool, the developer's income must be calculated first. This portion of the fee is relatively low compared to the value of the UNI token owned by the user.

The Importance of DeFi

The Uniswap V4 update can significantly enhance the competitiveness of Uniswap, enabling features such as TWAMM, limit orders, dynamic fees, liquidity provisioning to credit agreements, and automatic extension processing fees.V4 will have wide-ranging implications for Uniswap itself and the DeFi ecosystem as a whole. For liquidity providers and traders, the gas fees required can also be significantly reduced due to the new architecture.

Ultimately, Uniswap V4 will contribute to simplifying the protocol and expanding its utility. Unlike Uniswap V3, which has limited capabilities and faces challenges in managing centralized liquidity positions, Uniswap V4 offers more convenient hooks and singletons for liquidity development and utilization. This opens the doors to a multitude of new and exciting applications and stimulates a wave of innovation in the DeFi space, which is crucial for the industry's development.

Overall, Uniswap V4 represents an exciting new upgrade for DeFi that will help accelerate its advancement. While its launch may take some time, DeFi is once again anticipating positive changes.