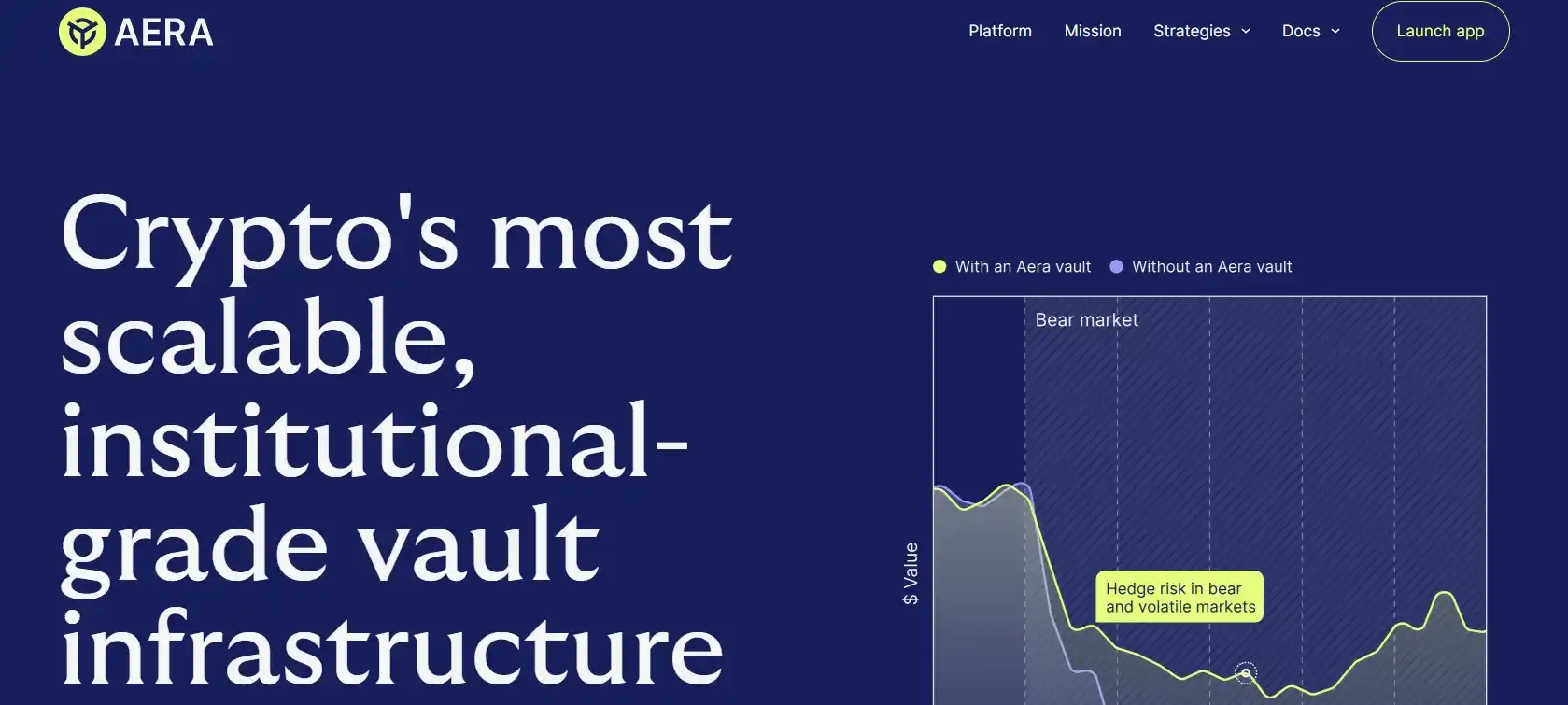

In the rapidly evolving field of decentralized finance, organizations are acutely facing the challenge of efficient and secure digital asset management. The Aera Finance project presents a modern solution, offering an infrastructure for creating automated and customizable on-chain vaults. The platform combines the reliability of smart contracts with the flexibility of external analytics to implement complex strategies. Its goal is to shape a future where capital management becomes fully autonomous and transparent.

Contents:

- Fundamental Principles of Aera Finance

- Platform Architecture and Key Features

- Strategies and Use Cases

- Aera Finance Security and Fund Control

- Conclusion

Fundamental Principles of Aera Finance

Aera Finance is building the foundation for a new generation of digital asset management tools by bridging two worlds. The platform utilizes the immutability and transparency of the blockchain to record operations but moves complex analytical calculations and strategy optimization off-chain. This approach enables the implementation of dynamic, adaptive financial models while maintaining full security and control for asset owners.

The project's core idea is to provide scalable and reliable infrastructure upon which diverse strategies can be built. From managing corporate treasuries to complex yield-generation mechanisms, Aera offers a flexible and modular protocol. Its development involves leading DeFi researchers, aiming to create a long-term, evolving solution for the market.

Platform Architecture and Key Features

The ecosystem is built around programmable smart contract vaults. Their operation is managed by special participants—"guardians"—who propose optimized off-chain operations, but every action is strictly checked for compliance with predefined rules. The technical implementation provides users with several key advantages:

- Flexibility and Modularity: Owners can configure integrations with other protocols via call restrictions (hooks) without requiring programming skills.

- Efficiency: The use of Merkle trees allows for imposing strict constraints on transactions without a significant increase in fees.

- Transparency and Accountability: All operations are recorded on the blockchain and are available for public audit via a dashboard.

- Adaptability: Vault components can be upgraded, allowing strategies to leverage new market opportunities.

This architecture creates an environment where the execution of complex strategies is both trust-based and fully verifiable. The platform is capable of interacting with a vast universe of DeFi assets, providing a tool for secure and automated capital management.

Strategies and Use Cases

The project offers a range of ready-made financial solutions that automate key digital asset management tasks. These pre-configured mechanisms address the core needs of organizations and private managers in the decentralized finance space.

The following table demonstrates the central strategies available in the system:

| Strategy | Primary Goal | Mechanism |

|---|---|---|

| Volatility Targeting | Reducing portfolio value fluctuations | Dynamic redistribution of assets in response to changing market conditions. |

| Working with Stablecoins | Generating income with minimal risk | Placing stablecoins across several approved lending protocols with their automatic rebalancing. |

| Generating Yield on ETH | Generating yield above the standard rate | Placing ETH in proven and reliable lending protocols to increase profitability. |

| Protocol-Owned Liquidity | Stimulating activity in decentralized finance | Using the protocol's own funds to create liquidity and reduce trading costs. |

| Grants Distribution | Conducting efficient and transparent payments | Flexible distribution of funds in native tokens or stablecoins with minimal price impact. |

In addition, the platform includes tools for optimal incentive distribution, helping to avoid wasteful spending. Thanks to this set of capabilities, the infrastructure serves as a universal solution for both secure fund storage and their effective growth. It allows turning passive assets into working capital with clear management rules.

Aera Finance Security and Fund Control

Security is a fundamental principle of the platform, confirmed by its architecture and development team. The protocol was created by specialists from Gauntlet and Auditless, and its code has undergone independent verification by auditors Spearbit and OpenZeppelin. To continuously improve resilience, a bug bounty program is in place, attracting a broad community to security testing.

The system's architecture ensures full control over assets by following a non-custodial model. Funds are always under the control of their owner, who solely makes decisions about depositing or withdrawing capital. An additional layer of protection is created by the ability to configure allowlists, strictly defining which protocols and assets a specific vault can interact with. This approach minimizes operational risks, forming a reliable foundation for the automated execution of financial strategies.

Conclusion

The Aera Finance project represents a comprehensive and thoughtful response to key challenges in digital asset management. It successfully combines the automation of complex strategies with institutional-grade security and provides organizations with a tool for effective capital control. This allows turning treasury management from an operational task into a strategic asset.

A clear development path focused on full decentralization underscores the initiative's long-term ambitions. Aera does not merely automate existing processes but lays the groundwork for a new paradigm where intelligent smart contracts ensure transparent and adaptive fund management. The platform sets a high standard and has all the prerequisites to become a benchmark solution for treasuries in the Web3 ecosystem.