ETH Strategy is an on-chain protocol that provides DeFi participants with access to leveraged Ethereum exposure without liquidation risks or debt pressure. Inspired by MicroStrategy’s approach, the project translates the idea of corporate ETH accumulation into smart contracts, offering a next-generation treasury mechanism. Through a combination of convertible bonds, options, and the STRAT token, ETH Strategy builds a decentralized financial infrastructure where users can invest in the growth of Ethereum under more favorable and secure conditions.

- ETH Strategy Concept and Objectives

- Protocol Mechanics

- STRAT Token Economy and Benefits

- Tokenomics and Funding

- Advantages, Risks, and Future Outlook

ETH Strategy Concept and Objectives

ETH Strategy creates an autonomous treasury that accumulates ETH and enables users to gain exposure to Ethereum via structured financial instruments. Unlike traditional derivatives or leveraged strategies, the protocol eliminates key risks such as liquidation, high fees, and collateral instability. Its main goal is accelerated ETH accumulation, where STRAT supply grows more slowly than ETH reserves, creating a favorable model for token holders.

The project is designed as a decentralized Web3 analogue of MicroStrategy, accumulating ETH through bond issuance but doing so on-chain without centralized control. Every step of the protocol—from debt issuance to STRAT minting—is transparent and managed by smart contracts. Users receive either protected debt with an option or an equity stake in the protocol, depending on their strategy.

Protocol Mechanics

ETH Strategy implements a unique on-chain ETH accumulation mechanism that combines debt instruments and options into an autonomous system, removing the need for trust in centralized operators. The protocol is designed for safe capital raising and asset management, ensuring transparency and efficiency.

The system involves two main roles:

1. Investors who purchase bonds;

2. STRAT holders with a stake in the ETH treasury.

When issuing bonds, the protocol follows this mechanism:

-

The user deposits stablecoins (e.g., USDC) to purchase a bond.

-

In return, they receive two tokens:

– CDT (Convertible Debt Token), representing debt redeemable or convertible;

– An NFT option, giving the right to convert CDT into STRAT at a fixed price before expiration. -

The protocol uses the stablecoins to purchase ETH, increasing treasury reserves.

-

Upon expiry, the investor may:

– Redeem their stablecoins if ETH has not appreciated;

– Or convert their CDT + NFT into STRAT tokens if ETH has surpassed the target price.

It’s important to note that STRAT is minted only upon debt conversion. This gives the protocol full control over token supply and prevents inflation. The circulating STRAT is directly tied to market activity and demand for equity participation.

Additionally, a portion of the ETH treasury is deployed in DeFi platforms like Morpho to generate returns. STRAT may be used as collateral in such pools, providing additional yield.

As a result, the system remains resilient to volatility and external shocks. All processes—from bond issuance to STRAT minting—are managed by smart contracts, removing the need for intermediaries. ETH Strategy offers a transparent, secure, and adaptive approach to leveraged ETH exposure with risk control.

STRAT Token Economy and Benefits

STRAT's operation is tightly coupled with the protocol’s debt model. It is never minted arbitrarily but only when a bond is voluntarily converted. This ensures that STRAT remains a scarce and value-backed asset. The model promotes a stable token economy in which each minted STRAT is tied to accumulated ETH in the treasury.

Users benefit from multiple advantages that differentiate ETH Strategy from typical DeFi platforms:

-

Leverage without liquidation risk — users gain ETH exposure without margin or forced liquidation risks.

-

Downside protection for bonds — if ETH falls below a set level, investors get their stablecoins back.

-

Full transparency — smart contracts handle issuance of tokens, debt, and options automatically.

-

Participation in ETH treasury growth — each funding round increases ETH per STRAT ratio.

-

Strategic flexibility via options — NFT options can be used for conversion timing or arbitrage.

This structure gives investors both risk control tools and mechanisms for predictable, performance-based returns. STRAT’s economy is attractive to both long-term holders and active market participants. Its balance of debt and equity components makes ETH Strategy a sustainable and forward-looking project in the evolving DeFi space.

Tokenomics and Funding

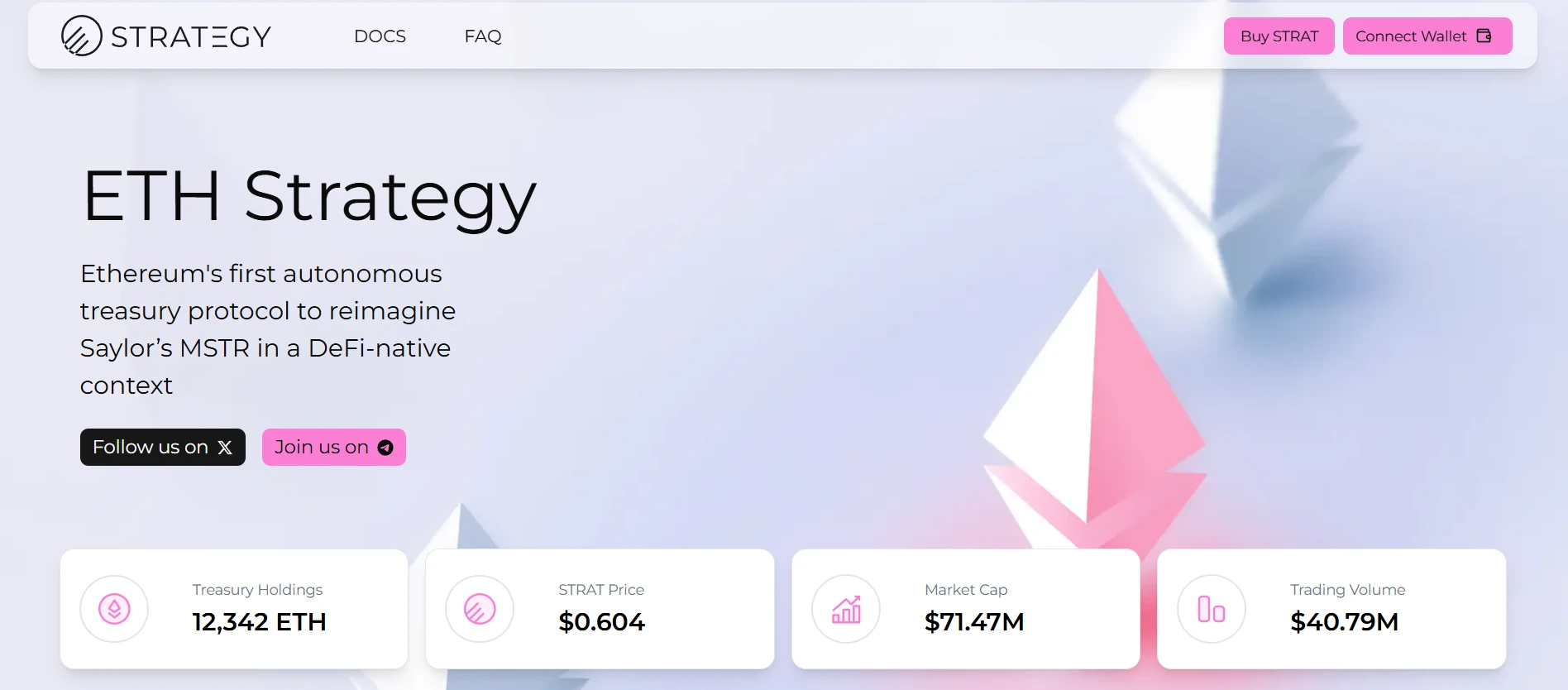

ETH Strategy raised 12,342 ETH (~$46.5 million) during its launch round. The majority—11,817 ETH—was allocated to the treasury to purchase ETH and support STRAT liquidity. The rest was split between operations and team reserves.

The project’s token model is built around three assets: STRAT (equity token), CDT (debt token), and an NFT option. STRAT is only minted when CDT is burned and the option exercised, making issuance tightly controlled and backed by real ETH growth.

To stabilize the market, early investors agreed to a 4-month lock-up followed by a 2-month linear vesting period. This prevented post-launch sell pressure and promoted a healthier market.

| Category | ETH Amount | Purpose |

|---|---|---|

| Treasury | 11,817 ETH | ETH purchases, STRAT liquidity support |

| Operational Expenses | 150 ETH | Audits, development, marketing |

| Team & Advisor Reserve | 375 ETH | Incentives, consulting, legal support |

This issuance and distribution model ensures STRAT remains a sound token, directly linked to protocol asset growth.

Advantages, Risks, and Future Outlook

ETH Strategy provides Ethereum exposure without margin or liquidation risks — a major advantage. Investors are protected: if ETH drops, they can reclaim their stablecoins. Smart contracts govern all operations, and STRAT issuance is strictly tied to debt conversion, keeping supply disciplined. Each new bond round increases the ETH-per-STRAT value, reinforcing the token’s position. Risks include regulatory attention, smart contract vulnerabilities, and ETH volatility possibly causing short-term deviations from NAV. Future plans include launching permissionless bonding, integrating with Morpho, enabling STRAT staking, and deploying gamma-scalping strategies. If ETH continues to rise, ETH Strategy is well-positioned to become a core DeFi tool for managed leverage and decentralized ETH accumulation.