Frex is a fintech platform for international money transfers that uses blockchain infrastructure and regulated stablecoins to accelerate cross-border settlements. The project is designed for users who need to send money abroad quickly, with minimal fees and without hidden FX markups. Unlike traditional bank transfers, Frex focuses on transparent exchange rates, predictable processing times, and a convenient user experience, while remaining fully compliant with regulatory and compliance requirements. The platform does not position itself as a crypto service for traders, but rather as a clear and accessible fintech tool where blockchain acts as an internal settlement layer.

- FrexPay — concept and target audience

- Stablecoins and blockchain as the foundation of Frex’s payment model

- How Frex Payments works: user journey and transfer logic

- Frex vs traditional international transfers: comparative analysis

- Infrastructure, regulation, and future outlook of Frex

FrexPay — concept and target audience

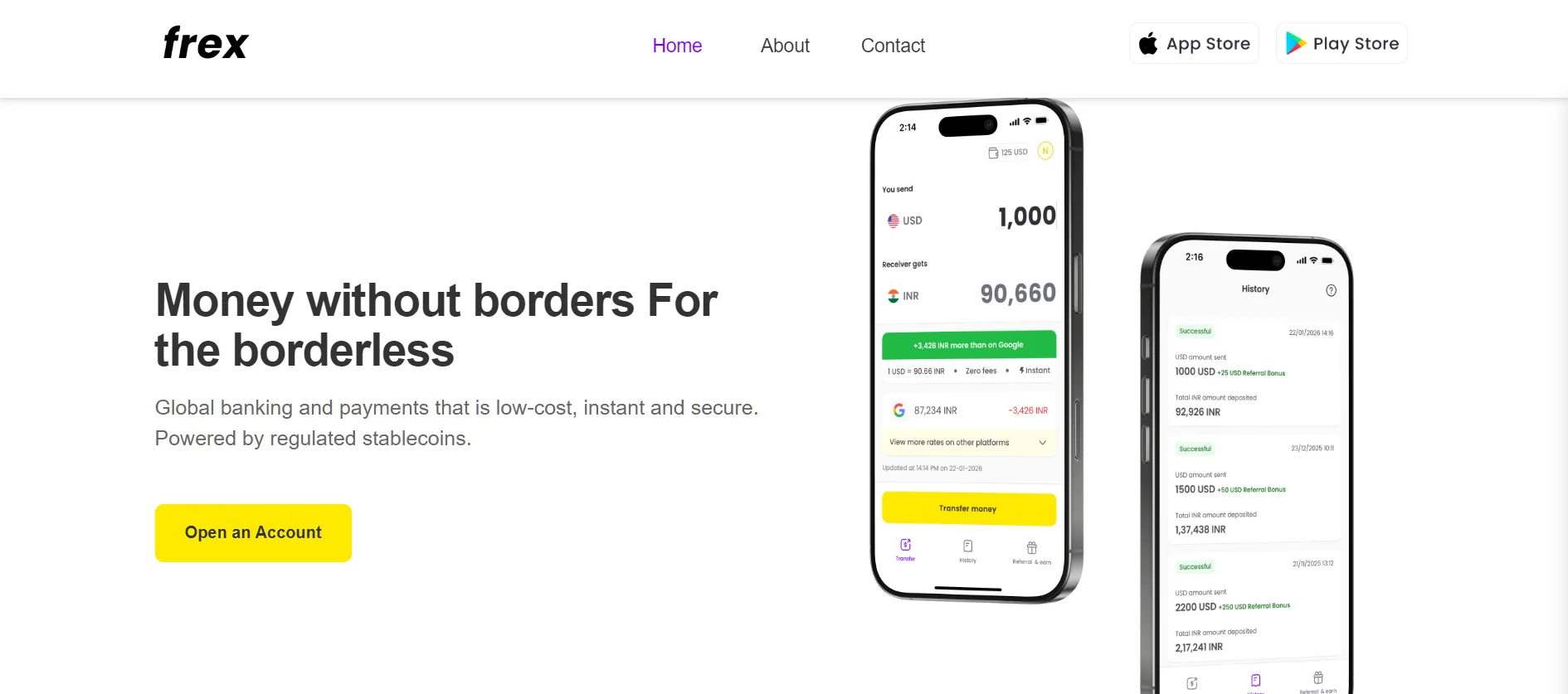

Frex is a technology platform designed to facilitate international money transfers using modern digital payment rails. The project primarily targets individual users who regularly send funds abroad, including migrants, freelancers, remote workers, and people supporting family members in other countries. Frex’s core value proposition lies in the combination of low fees, competitive exchange rates, and fast settlement times.

At the same time, Frex does not operate as a bank or a crypto exchange. Instead, the platform acts as a connective layer between the traditional financial system and blockchain infrastructure, providing users with a single interface to manage transfers. Users interact with familiar fiat currencies, while the internal settlement logic may rely on digital assets. This approach lowers the entry barrier and makes the service accessible even to those with no prior experience in cryptocurrencies.

Stablecoins and blockchain as the foundation of Frex’s payment model

The technological foundation of Frex is built around the use of stablecoins — digital tokens pegged to the value of fiat currencies. Unlike volatile crypto assets, stablecoins are designed for payments and value storage, making them a practical tool for settlements and transfers. Within the Frex model, they serve as an intermediate settlement layer between the sender and the recipient.

Blockchain infrastructure enables these settlements to be processed almost around the clock, without relying on long chains of correspondent banks. This is especially important for cross-border payments, where traditional channels often lead to delays and additional fees. Combining stablecoins with blockchain technology makes transfers faster and final amounts more predictable. At the same time, users are not required to hold or manage digital assets directly — all operations take place within the Frex ecosystem.

How Frex Payments works: user journey and transfer logic

The practical value of Frex becomes clear through its user journey. The platform is designed so that users without technical or crypto-related experience can send international transfers as easily as a standard bank payment. All complex processes related to blockchain and stablecoin settlements are handled in the background and do not require user involvement.

Frex structures the transfer process as a clear sequence of steps where exchange rates, fees, and the final credited amount are known in advance. This reduces uncertainty and makes the service suitable for regular use.

The main steps of a Frex transfer are as follows:

-

User registration and verification — account creation and completion of mandatory KYC/AML checks.

-

Bank account connection — linking a bank account through payment and banking API integrations.

-

Transfer creation — selecting the amount, destination, and recipient currency.

-

Terms confirmation — displaying the exchange rate and final amount before confirmation.

-

Transfer execution — converting funds into stablecoins, transmitting them via the blockchain network, and settling back into fiat.

After completing these steps, users receive their transfers without having to track complex interbank processes. This workflow allows Frex to combine a familiar fintech experience with the advantages of blockchain-based settlement. As a result, international transfers become faster, more transparent, and less dependent on traditional banking constraints.

Frex vs traditional international transfers: comparative analysis

To understand Frex’s competitive positioning, it is important to compare it with traditional international transfer methods. Bank-based SWIFT payments and classic remittance services remain widely used, but they are often associated with high fees, unfavorable exchange rates, and long processing times.

Using stablecoins as a settlement layer allows Frex to optimize these processes and reduce the number of intermediaries involved. Below is a comparison of key characteristics between traditional transfers and the model applied by Frex.

| Parameter | Traditional transfers | Frex / stablecoin-based model |

|---|---|---|

| Speed | 1–5 business days | From minutes to hours |

| Fees | High and opaque | Low and predefined |

| Exchange rate | Includes bank markup | Close to market rate |

| Availability | Limited to banking hours | 24/7 |

| Transparency | Limited | Enhanced |

This table clearly illustrates why stablecoin-based solutions are gaining traction in the cross-border payments sector. Frex uses this model not as an experiment, but as the foundation of its payment architecture. This makes the service particularly attractive for users who value speed, clear terms, and minimal losses during currency conversion.

Infrastructure, regulation, and future outlook of Frex

Frex builds its ecosystem with a strong focus on regulatory compliance and financial security standards. The platform implements user identification procedures and transaction monitoring, while relying on licensed third-party providers for banking and payment infrastructure. This approach allows Frex to operate within existing legal_