STOKR — is a blockchain platform for tokenizing real-world assets and conducting Security Token Offerings (STO), providing companies and startups with access to capital, and investors — with a transparent and regulated way to invest. Built on Ethereum and compliant with European legislation, STOKR combines technological reliability, legal integrity, and a convenient user experience. The platform has already undergone an independent audit, attracted significant partners, and reached impressive volumes of tokenized assets. As a result, it has become an important tool for companies seeking alternative sources of financing and aiming to reach a new level of engagement with investors. STOKR merges blockchain flexibility with strict legal standards, opening opportunities for the democratization of financial markets.

- STOKR Concept and Mission

- Technological Architecture and Security Audit

- Key STO Features

- Platform Achievements and Updates

- Market Outlook and Significance

STOKR Concept and Mission

STOKR was created to democratize access to investments and simplify the process of raising capital for small and medium-sized businesses. The platform acts as an intermediary between projects and investors, enabling the issuance of tokenized securities in full compliance with EU regulations. Special emphasis is placed on projects with social or technological impact, attracting a target audience of conscious investors. Beyond the financial aspect, STOKR strives to increase transparency and trust in a market traditionally dominated by large institutional players. It allows small companies to raise capital without complex intermediaries, reducing costs and accelerating the process. An important part of its mission is supporting projects that can contribute to sustainable development, environmental initiatives, and socially significant technologies.

Technological Architecture and Security Audit

At its core, STOKR is built on Ethereum smart contracts that automate key STO processes: token issuance, investment acceptance, fund refunds if the goal is not met, and profit distribution. Each project receives its own crowdsale contract with individual parameters — timelines, limits, and whitelist settings. To ensure reliability, the platform underwent a security audit by ChainSecurity Ltd. Experts conducted automated code analysis and manual review, identified and fixed minor issues, and confirmed the absence of critical vulnerabilities. 100% of functionalities are covered by tests, minimizing risks for investors and issuers. Additionally, STOKR's architecture includes integration with payment gateways, allowing the acceptance of both cryptocurrencies and fiat currencies. This enables the platform to serve an international client base and adapt to different jurisdictions. Security and transparency are ensured not only by the code but also by built-in KYC/AML compliance procedures.

Key STO Features

Launching an STO via STOKR is not just a technical process but a comprehensive operation covering legal, financial, and marketing aspects of the project. The platform handles essential steps — from preparing smart contracts to ensuring regulatory compliance and managing investor relations. This approach allows companies to focus on developing their product rather than dealing with infrastructure complexities. Below are the key features that make STOs on STOKR a convenient and secure capital-raising tool:

- Turnkey solution — from campaign launch to profit distribution.

- EU regulatory compliance — reducing legal risks for all participants.

- Two types of tokens — revenue-sharing or profit-sharing models.

- KYC/AML and whitelist — access granted only to verified investors.

- Automated refunds — if the campaign fails, funds are returned.

- Fiat and crypto acceptance — flexibility for various investor categories.

- User-friendly interface — tools for investor management and analytics for issuers.

Each of these features aims to simplify interaction between issuers and investors while lowering barriers to entry into the digital securities market. Combining legal rigor with technological innovation attracts both retail and institutional participants. This makes STOs on STOKR not only an effective fundraising tool but also a competitive advantage for companies.

Platform Achievements and Updates

Over its existence, STOKR has achieved a number of significant milestones that have strengthened its position in the tokenization market. These accomplishments reflect not only the platform's technological advancements but also its ability to attract strategic partners, expand functionality, and increase operational scale. Regular product updates, the growth in successful STOs, and integrations with key financial industry players demonstrate steady progress. The table below highlights the main stages and indicators illustrating STOKR's development:

| Event / Metric | Date / Value |

|---|---|

| ChainSecurity security audit | 2019 |

| Launch of two types of security tokens | 2019 |

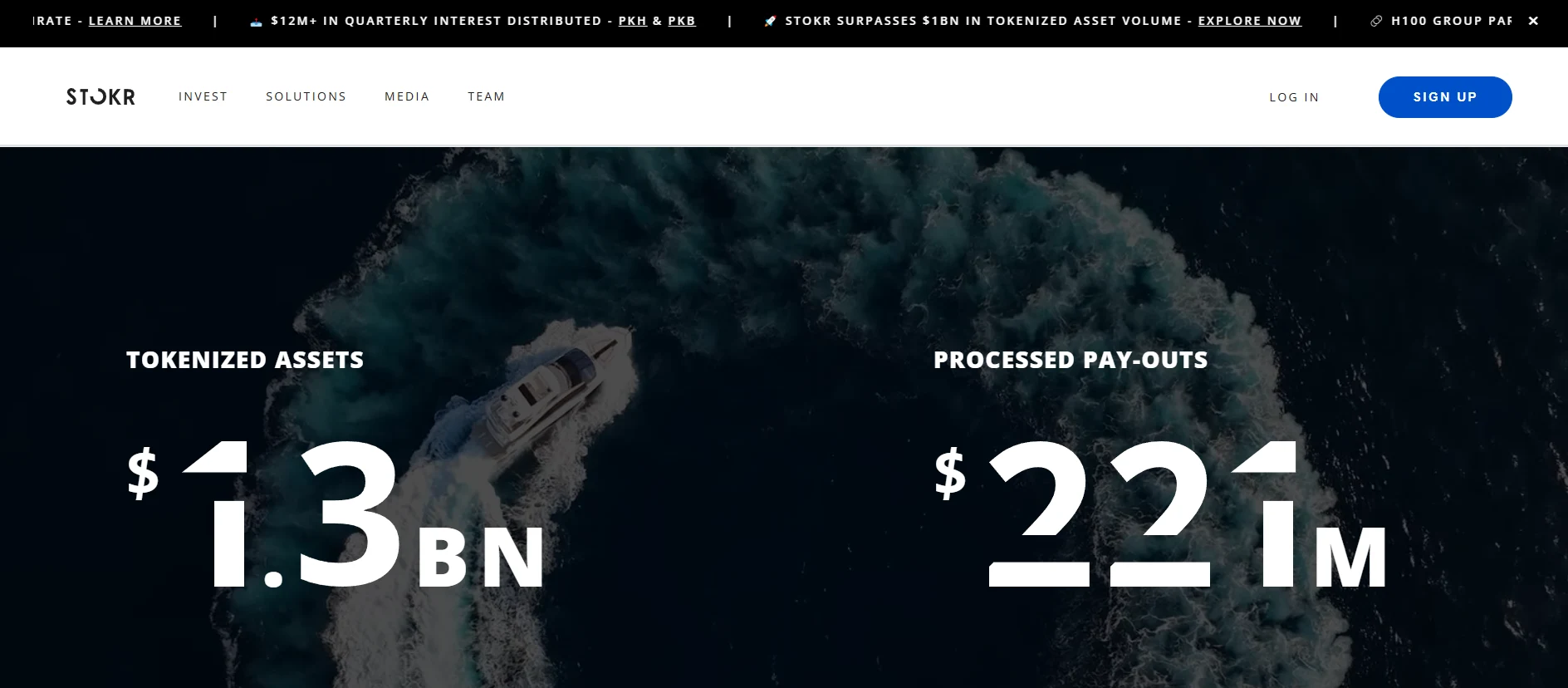

| Tokenized asset volume | $1 billion+ |

| Partnership with Medad Holding | 2025 |

| UX/UI update | December 2024 |

These results demonstrate not only technical growth but also STOKR’s ability to build long-term partnerships and expand its market scale. Surpassing $1 billion in tokenized assets confirms strong investor trust. Partnerships with major companies and regular product improvements reflect a strategic approach to development. The conducted audit and improved interface further enhance the platform’s appeal to new clients.

Market Outlook and Significance

STOKR has already established itself as one of the leaders in asset tokenization in Europe. With the growing interest in digital securities, the platform could become a key tool for companies entering the global capital market. The combination of legal compliance, technological flexibility, and support for socially impactful projects forms a foundation for sustainable growth. In the future, STOKR may expand its influence beyond the EU, integrating with global infrastructures for secondary trading of security tokens. This step could make tokenization a standard method for raising capital worldwide. Given its achievements, the platform has all the chances to become a benchmark example of the successful synergy between blockchain technology and financial regulation.